Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In his spare time, the CEO, Charles plays for an elite beach volleyball team in an interstate competition. During the 2021/22 income year, Charles

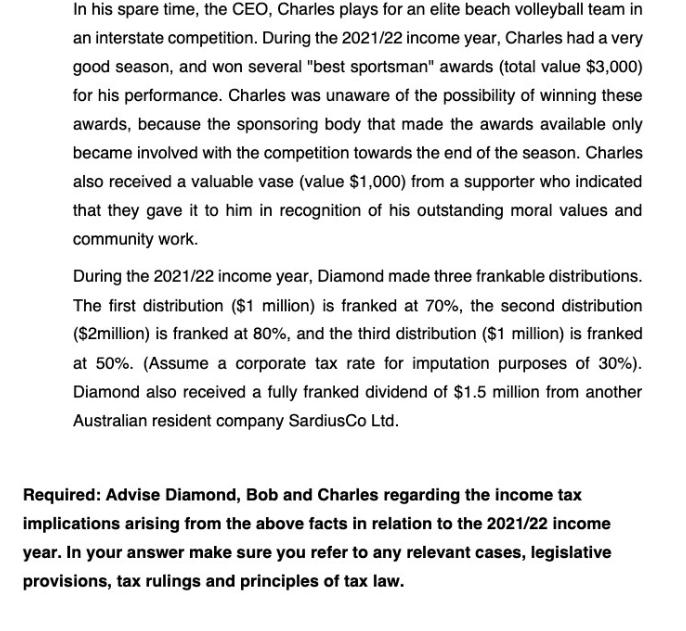

In his spare time, the CEO, Charles plays for an elite beach volleyball team in an interstate competition. During the 2021/22 income year, Charles had a very good season, and won several "best sportsman" awards (total value $3,000) for his performance. Charles was unaware of the possibility of winning these awards, because the sponsoring body that made the awards available only became involved with the competition towards the end of the season. Charles also received a valuable vase (value $1,000) from a supporter who indicated that they gave it to him in recognition of his outstanding moral values and community work. During the 2021/22 income year, Diamond made three frankable distributions. The first distribution ($1 million) is franked at 70%, the second distribution ($2million) is franked at 80%, and the third distribution ($1 million) is franked at 50%. (Assume a corporate tax rate for imputation purposes of 30%). Diamond also received a fully franked dividend of $1.5 million from another Australian resident company SardiusCo Ltd. Required: Advise Diamond, Bob and Charles regarding the income tax implications arising from the above facts in relation to the 2021/22 income year. In your answer make sure you refer to any relevant cases, legislative provisions, tax rulings and principles of tax law.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Income Tax Implications for Diamond Bob and Charles Diamond Frankable Distributions The franking cre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started