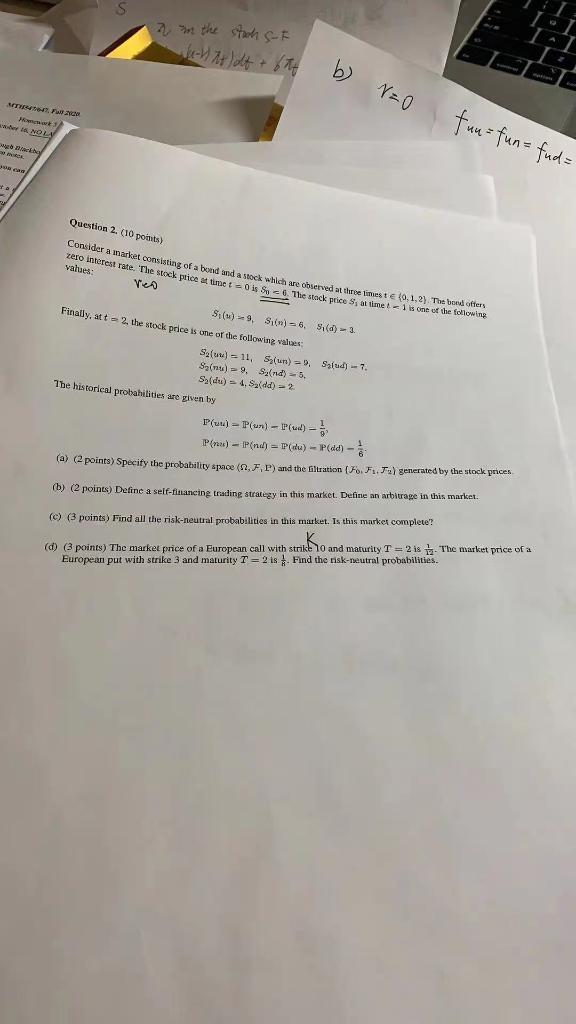

in in the stoch SF b) N=0 ww wer der is NOL fun= fun= fud= Question 2. (10 points) Consider a market consisting of a bond and a stock whileh are observed at tre times 0,1,2). The word offers zero interest rate. The stock price at trots is S. The stack price S, ottimet 1 is one of the following values: Ten S. (u) 9. S) 6. S.(d) - 3. Finally, att 2. the stock price is one of the following values Saluw) 11, Sz(ut) =). Salud) - 7 Sa(n) = 9, Sz(nd) = 5. Sz(du) = 4, Sa(dd) - 2 The historical probabilities are given by P(uu) (u) -(w) P(a) P(and= P(alu) P(dd) (a) (2 points) Specify the probability space (FP) and the filtration (Fo. F.. Ja) generated by the stock prices (b) (2 points) Define a self-financing trading strategy in this market. Define an arbitrage in this market (e) (3 points) Find all the risk-neutral probabilities in this market. Is this market complete? (0) 3 points) The market price of a European call with strike 10 and maturity T = 2 is The market price of a European put with strike 3 and maturity T = 2 is. Find the nisk-neutral probabilities. in in the stoch SF b) N=0 ww wer der is NOL fun= fun= fud= Question 2. (10 points) Consider a market consisting of a bond and a stock whileh are observed at tre times 0,1,2). The word offers zero interest rate. The stock price at trots is S. The stack price S, ottimet 1 is one of the following values: Ten S. (u) 9. S) 6. S.(d) - 3. Finally, att 2. the stock price is one of the following values Saluw) 11, Sz(ut) =). Salud) - 7 Sa(n) = 9, Sz(nd) = 5. Sz(du) = 4, Sa(dd) - 2 The historical probabilities are given by P(uu) (u) -(w) P(a) P(and= P(alu) P(dd) (a) (2 points) Specify the probability space (FP) and the filtration (Fo. F.. Ja) generated by the stock prices (b) (2 points) Define a self-financing trading strategy in this market. Define an arbitrage in this market (e) (3 points) Find all the risk-neutral probabilities in this market. Is this market complete? (0) 3 points) The market price of a European call with strike 10 and maturity T = 2 is The market price of a European put with strike 3 and maturity T = 2 is. Find the nisk-neutral probabilities