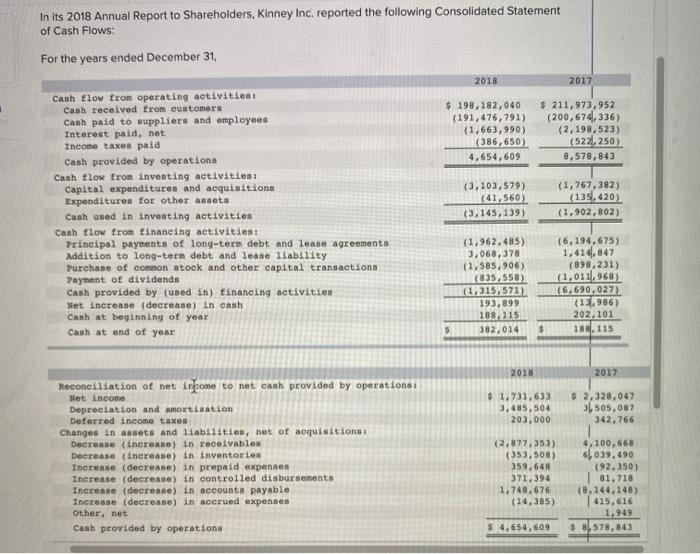

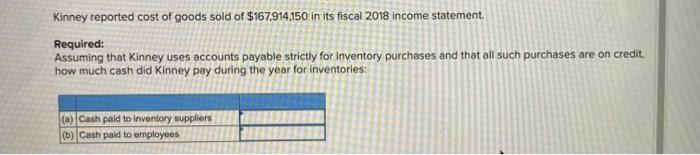

In its 2018 Annual Report to Shareholders, Kinney Inc. reported the following Consolidated Statement of Cash Flows: For the years ended December 31, 2018 2017 $ 198, 182,040 (191,476,791) (1,663,990) 386,650) 4,654,609 $ 211,973,952 (200,674,336) (2,198,523) (522,250) 8,578,843 Cash flow from operating activities: Cash received from customers Cash paid to wappliers and employees Interest paid, net Income taxes paid Cash provided by operations Cash flow from investing activities Capital expenditures and acquisitions Expenditures for other assets Cash used in investing activities Cash flow from financing activities: Principal payments of long-term debt and lease agreements Addition to long-term debt and lease liability Purchase of common stock and other capital transactions Payment of dividends Cash provided by (oped in) financing activities Bet increase (decrease in cash Cash at beginning of year Cash at end of year (3,103,579) (41,560) (3,145,139) (1,767,382) (135,420) (1,902,802) (1,962,485) 3.068,378 (1,585,906) (35,558) (1,315,571) 193,899 188. 115 382,014 (6,194,675) 1,414,847 (898,231) (1.011.968) (6,690,027) (15,986) 202,101 188, 115 $ 2018 2017 $ 1,731,633 3,485,504 203,000 $ 2,328,047 3,505,087 342,766 Reconciliation of net irbome to net cash provided by operations Net Income Depreciation and amortisation Deferred income taxes Changes in assets and liabilities, net of acquisitions i Decrease (increase) in receivables Decrease (increase) in inventories Increase (decrease in prepaid expenses Increase (decrease) in controlled disbursements Increase (decreane) in accounts payable Increase (decrease) in accrued expenses Other, net Cash provided by operations (2,877,353) (353.508) 359.648 371,394 1,748.676 (14,385) 4,100,668 6,039, 490 (92,350) | 81.718 (8,144,148) 415,616 1,949 $ 8,578,843 $ 4.654,609 Required: Assuming the decrease in accrued expenses during fiscal year 2018 included a $14,000 reduction due to taxes. compute the income tax expense for Kinney in that year. Income tax expense Required: Kinney reported cost of goods sold of $167.914,150 in its fiscal 2018 incorre statement. Compute Kinney's net inventory purchases during the year. Net purchases Required: Assuming the decrease in accrued expenses during fiscal year 2018 included a $13.800 reduction due to interest on debt, compute the interest expense (net) for Kinney in that year. Interest experte Kinney reported cost of goods sold of $167.914,150 in its fiscal 2018 income statement Required: Assuming that Kinney uses accounts payable strictly for inventory purchases and that all such purchases are on credit, how much cash did Kinney pay during the year for inventories: (a) Cash paid to inventory suppliers (6) Cash paid to employees