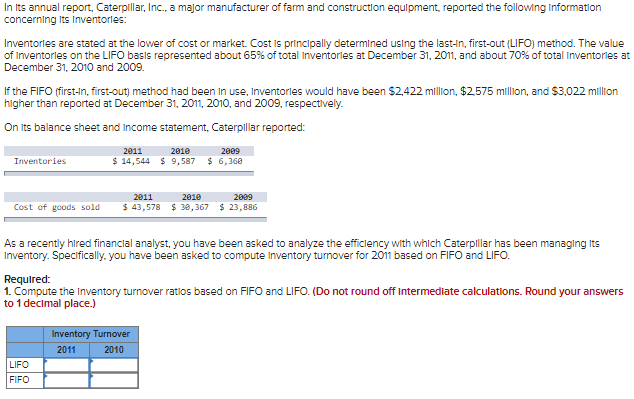

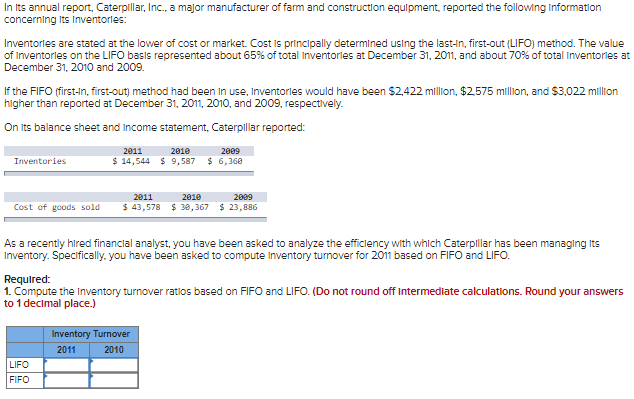

In its annual report, Caterpillar, Inc., a major manufacturer of farm and construction equipment, reported the following Information concerning its Inventorles: Inventorles are stated at the lower of cost or market. Cost is principally determined using the last-In, first-out (LIFO) method. The value of Inventorles on the LIFO basis represented about 65% of total Inventorles at December 31,2011 , and about 70% of total Inventorles at: December 31, 2010 and 2009. If the FIFO (first-In, first-out) method had been in use, Inventorles would have been $2,422 million, $2,575 million, and $3,022 million higher than reported at December 31,2011,2010, and 2009 , respectively. On its balance sheet and income statement, Caterpillar reported: As a recently hired financlal analyst, you have been asked to analyze the efficlency with which Caterpillar has been managing its Inventory. Speclfically. you have been asked to compute Inventory turnover for 2011 based on FIFO and LIFO. Required: 1. Compute the Inventory turnover ratios based on FIFO and LIFO. (Do not round off Intermediate calculations. Round your answers to 1 decimal place.) In its annual report, Caterpillar, Inc., a major manufacturer of farm and construction equipment, reported the following Information concerning its Inventorles: Inventorles are stated at the lower of cost or market. Cost is principally determined using the last-In, first-out (LIFO) method. The value of Inventorles on the LIFO basis represented about 65% of total Inventorles at December 31,2011 , and about 70% of total Inventorles at: December 31, 2010 and 2009. If the FIFO (first-In, first-out) method had been in use, Inventorles would have been $2,422 million, $2,575 million, and $3,022 million higher than reported at December 31,2011,2010, and 2009 , respectively. On its balance sheet and income statement, Caterpillar reported: As a recently hired financlal analyst, you have been asked to analyze the efficlency with which Caterpillar has been managing its Inventory. Speclfically. you have been asked to compute Inventory turnover for 2011 based on FIFO and LIFO. Required: 1. Compute the Inventory turnover ratios based on FIFO and LIFO. (Do not round off Intermediate calculations. Round your answers to 1 decimal place.)