Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In its first year of operations, Martha Enterprises Corp. reported the following information: a. Income before income taxes was $640,000. b. The company acquired

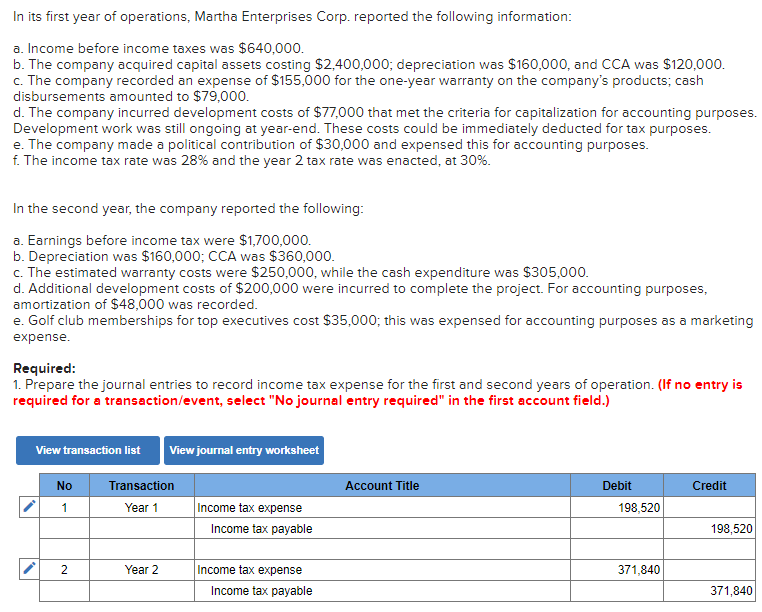

In its first year of operations, Martha Enterprises Corp. reported the following information: a. Income before income taxes was $640,000. b. The company acquired capital assets costing $2,400,000; depreciation was $160,000, and CCA was $120,000. c. The company recorded an expense of $155,000 for the one-year warranty on the company's products; cash disbursements amounted to $79,000. d. The company incurred development costs of $77,000 that met the criteria for capitalization for accounting purposes. Development work was still ongoing at year-end. These costs could be immediately deducted for tax purposes. e. The company made a political contribution of $30,000 and expensed this for accounting purposes. f. The income tax rate was 28% and the year 2 tax rate was enacted, at 30%. In the second year, the company reported the following: a. Earnings before income tax were $1,700,000. b. Depreciation was $160,000; CCA was $360,000. c. The estimated warranty costs were $250,000, while the cash expenditure was $305,000. d. Additional development costs of $200,000 were incurred to complete the project. For accounting purposes, amortization of $48,000 was recorded. e. Golf club memberships for top executives cost $35,000; this was expensed for accounting purposes as a marketing expense. Required: 1. Prepare the journal entries to record income tax expense for the first and second years of operation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet No Transaction Account Title 1 Year 1 Income tax expense Income tax payable 2 Year 2 Income tax expense Income tax payable Debit Credit 198,520 198,520 371,840 371,840

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Prepare the journal entries to record income tax expense for the first and second years of operati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663deb69c1644_961043.pdf

180 KBs PDF File

663deb69c1644_961043.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started