Question

In its proposed 2020 income statement, Hrabik Corporation reports income before income taxes $493,000, income taxes $1/2,55 (not including unusual items), loss on operation

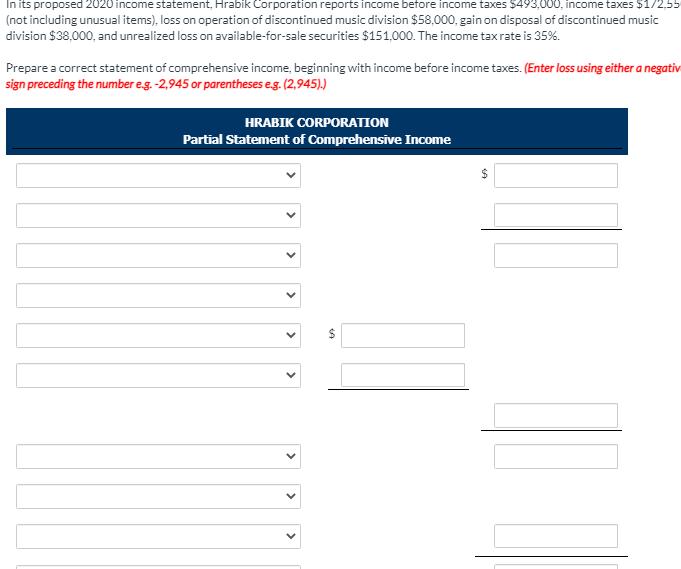

In its proposed 2020 income statement, Hrabik Corporation reports income before income taxes $493,000, income taxes $1/2,55 (not including unusual items), loss on operation of discontinued music division $58,000, gain on disposal of discontinued music division $38,000, and unrealized loss on available-for-sale securities $151,000. The income taxrate is 35%. Prepare a correct statement of comprehensive income, beginning with income before income taxes. (Enter loss using either a negativ sign preceding the number eg. -2,945 or parentheses eg. (2,945).) HRABIK CORPORATION Partial Statement of Comprehensive Income %24 > > > > > >

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Income statement is helpful in the financial calculation of a company The results of finances invol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

9th Edition

1118334329, 978-1118334324

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App