Answered step by step

Verified Expert Solution

Question

1 Approved Answer

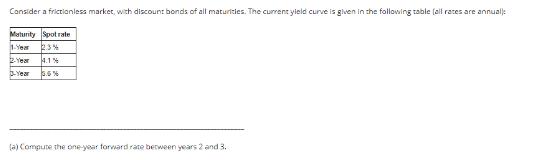

Consider a frictionless market, with discount bonds of all maturities. The current yield curve is given in the following table (all rates are annuall

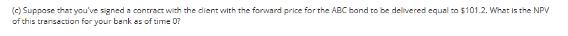

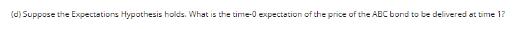

Consider a frictionless market, with discount bonds of all maturities. The current yield curve is given in the following table (all rates are annuall Maturity Spotrate 1-Year 23% 4.1% Year 5.6% (a) Compute the one-year forward rate between years 2 and 3. (b) Suppose that your bank was able to enter into a forward contract with a client. According to the contract, you will sell the client a two-year bond ADC with the annual coupons paid at the rate of 696, a year from now. Note that the client receives the bond immediately after the coupon payment a year from now, so the first coupon the client collects is two years from now. The principal payment of the bond is $100. What is the arbitrage-free forward price for this contract? (c) Suppose that you ve signed a contract with the client with the forward price for the ABC bond to be delivered equal to $101.2. What is the NPV of this transaction for your bank as of time 07 (d) Suppose the Expectations Hypothesis holds. What is the time-0 expectation of the price of the ABC bond to be delivered at time 1?

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started