Answered step by step

Verified Expert Solution

Question

1 Approved Answer

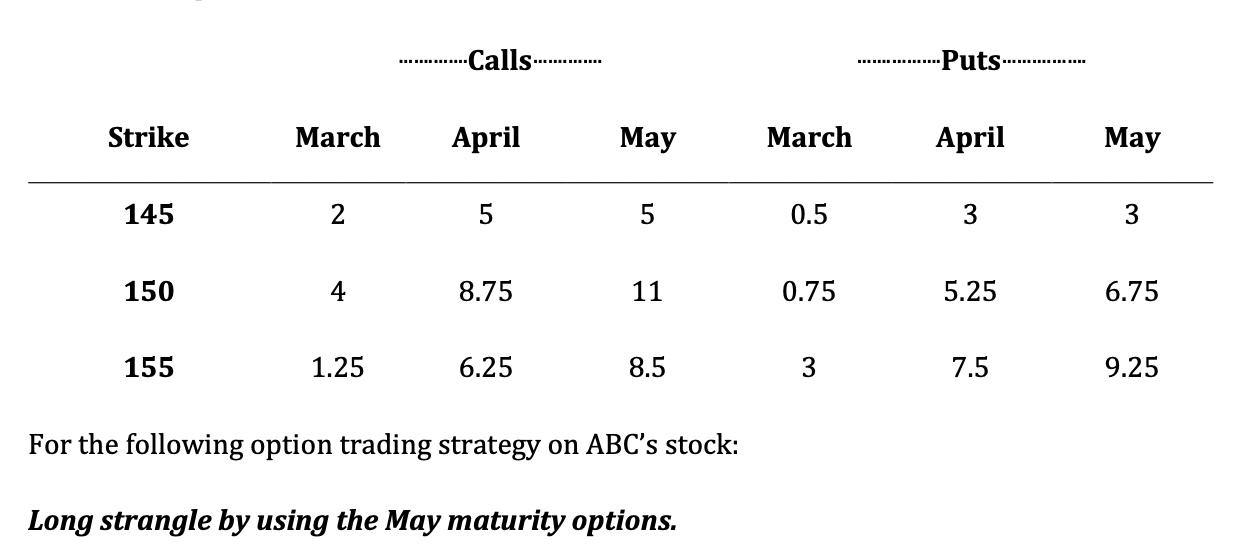

In Jan 2018, company ABC's stock price is traded at $150. The following table concerns information of the March, April, and May maturity option contracts

In Jan 2018, company ABC's stock price is traded at $150. The following table concerns information of the March, April, and May maturity option contracts on ABC's stock. The contract size of each option contract is 1000 shares.

(a) Describe how the trading strategy is constructed. Which call and/or put is (are) used to construct the trading strategy?

(b) What is the net payoff function for the trading strategy?

(c) Draw the profit and loss diagram of the trading strategy. Show the breakeven point(s), the strike price(s), and the maximal profit or loss of the trading strategy.

(d) What is your expectation of ABC's stock when you construct the trading strategy?

Strike 145 150 155 March 2 4 1.25 Calls April 5 8.75 6.25 May 5 11 8.5 For the following option trading strategy on ABC's stock: Long strangle by using the May maturity options. March 0.5 0.75 3 Puts. April 3 5.25 7.5 May 3 6.75 9.25

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a A long strangle is a strategy that involves buying a call option and a put option with the same expiration date but different strike prices The call ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started