Answered step by step

Verified Expert Solution

Question

1 Approved Answer

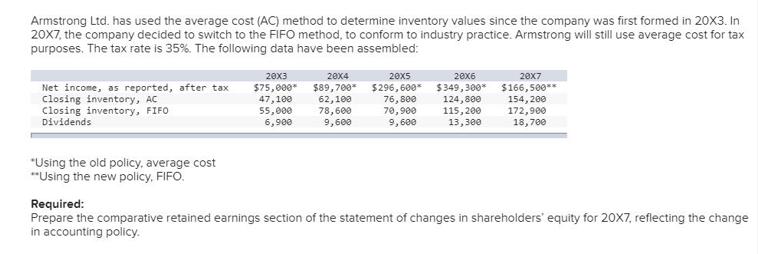

Armstrong Ltd. has used the average cost (AC) method to determine inventory values since the company was first formed in 20X3. In 20X7, the

Armstrong Ltd. has used the average cost (AC) method to determine inventory values since the company was first formed in 20X3. In 20X7, the company decided to switch to the FIFO method, to conform to industry practice. Armstrong will still use average cost for tax purposes. The tax rate is 35%. The following data have been assembled: Net income, as reported, after tax Closing inventory, AC Closing inventory, FIFO Dividends "Using the old policy, average cost **Using the new policy, FIFO. 20x3 $75,000* 47,100 55,000 6,900 20x4 20x5 20x6 $89,700* $296,600* $349,300* 62,100 76,800 124,800 78,600 70,900 9,600 9,600 115,200 13,300 20x7 $166,500** 154,200 172,900 18,700 Required: Prepare the comparative retained earnings section of the statement of changes in shareholders' equity for 20X7, reflecting the change in accounting policy.

Step by Step Solution

★★★★★

3.31 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Prepare the comparative retained earnings section of the statement of changes in shareholders equity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started