Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In January 2 0 2 4 , Don and Steve each invested $ 1 0 0 , 0 0 0 cash to form a corporation

In January Don and Steve each invested $ cash to form a corporation to conduct business as a retail golf equipment store.

On January they paid Bill, an attorney, to draft the corporate charter, file the necessary forms with the state, and write the bylaws. They leased store building and began to acquire inventory, furniture, display equipment, and office equipment in February. They hired a sales staff and clerical personnel in March and conducted training sessions during the month. They had a successful opening on April and sales increased steadily throughout the summer.

The weather turned cold in October, and all local golf courses closed by October which resulted in a drastic decline in sales. Don and Steve expect business to be very good during the Christmas season and then to taper off significantly from January through the end of February. The corporation accrued bonuses to Don and Steve on December payable on April of the following year. The corporation made timely estimated tax payments throughout the year. The corporation hired a bookkeeper in February, but he does not know much about taxation.

As their tax consultant, identify for Don and Steve the relevant tax issues by completing each item below.

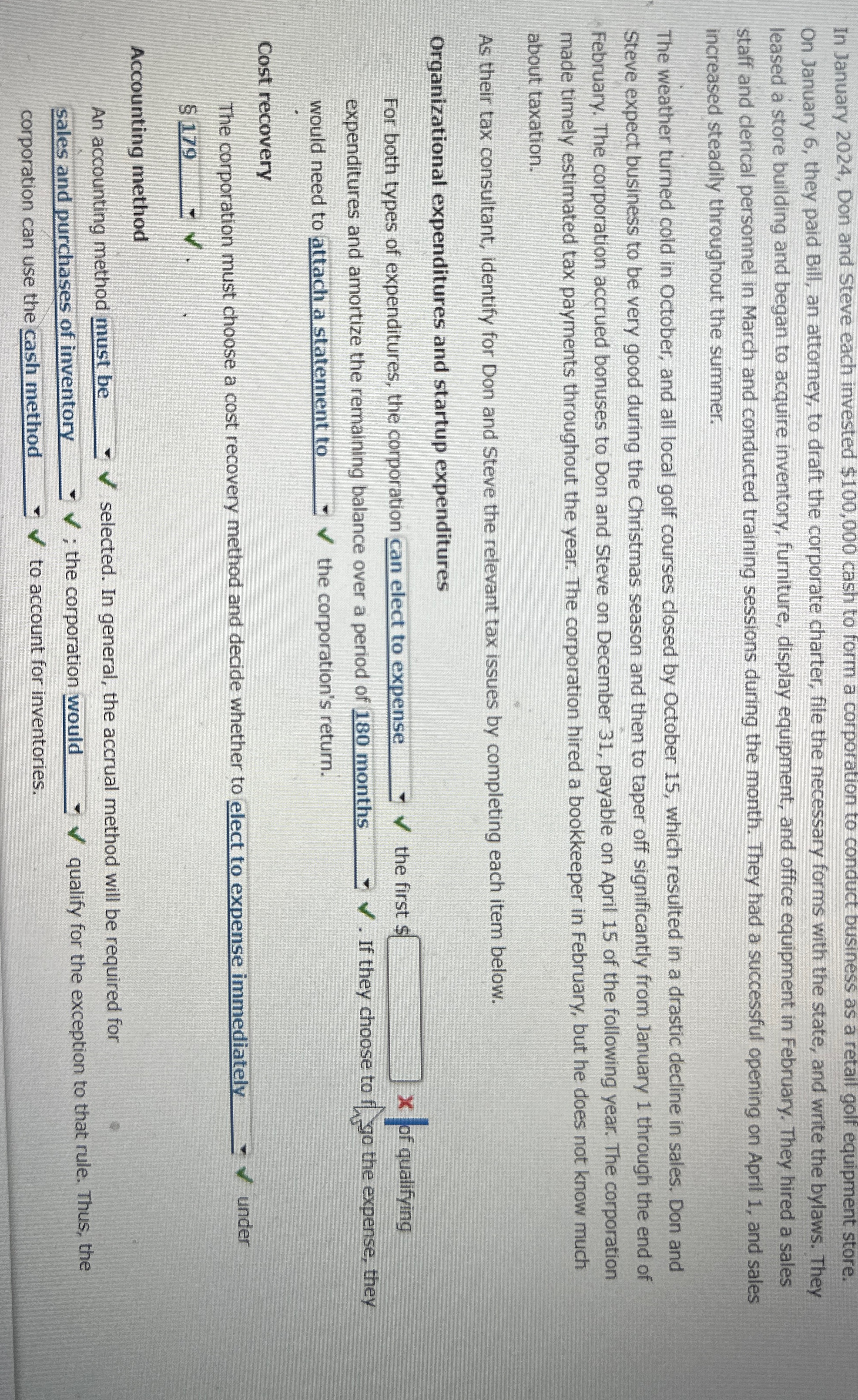

Organizational expenditures and startup expenditures

For both types of expenditures, the corporation can elect to expense the first $ of qualifying expenditures and amortize the remaining balance over a period of montl If they choose to fyo the expense, they would need to attach a statement to the corporation's return.

Cost recovery

The corporation must choose a cost recovery method and decide whether to elect to expense immediately under

Accounting method

An accounting method must be selected. In general, the accrual method will be required for

sales and purchases of inventory ; the corporation would qualify for the exception to that rule. Thus, the corporation can use the cash method to account for inventories.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started