Question

In January 2014, Google Inc. was considering the acquisition of Nest Labs Inc. for $3,200 million. Nest Labs manufactures and distributes smart thermostats and smoke

In January 2014, Google Inc. was considering the acquisition of Nest Labs Inc. for $3,200 million. Nest Labs manufactures and distributes smart thermostats and smoke alarms, with auto-programming and detection capabilities that allow users to control remotely. Nest sold about 40k devices monthly for $119 million in annual revenue for 2013. Overall, the home hardware industry is expected to grow 3.2% annually. The transaction allows Google to deliver products in smart home applications, which is expected to grow more rapidly than the general home industry. In the first year under its ownership, Google is anticipating cash flows of $22.4 million. Googles cost of capital is estimated at 6.5%

- Based on the information above, what growth rate in cash flows is required to cover the cost of acquiring Nest? Would you have bought Nest Labs? Please describe.

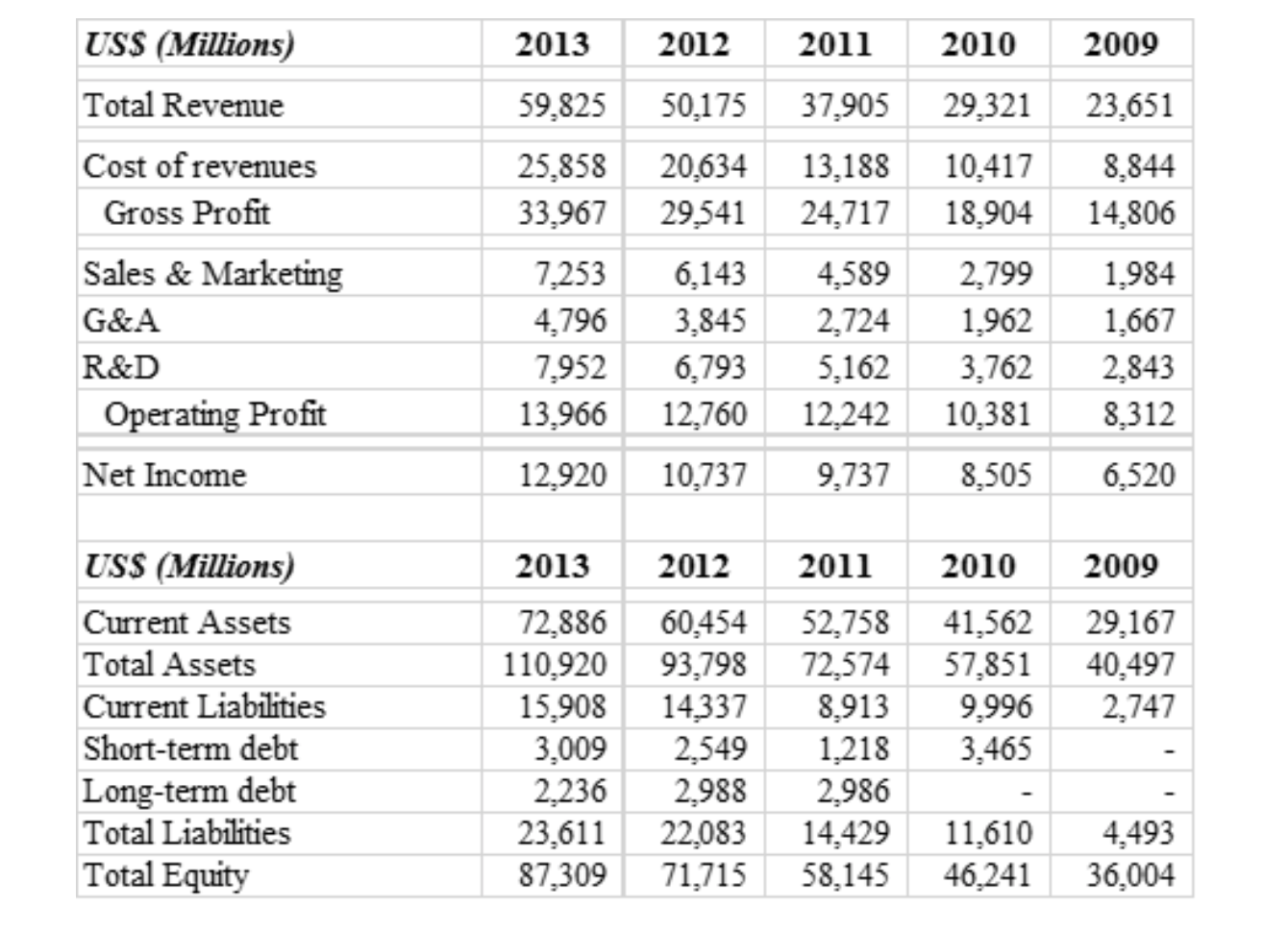

- Did Google have the financial capacity to acquire Nest Labs in 2014? Use the data below to assess this question. Hint = calculate financial ratios, specifically illustrating leverage and liquidity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started