Question

In January 2015, the management of Kinzie Company concludes that it has sufficient cash to permit some short-term investments in debt and stock securities. During

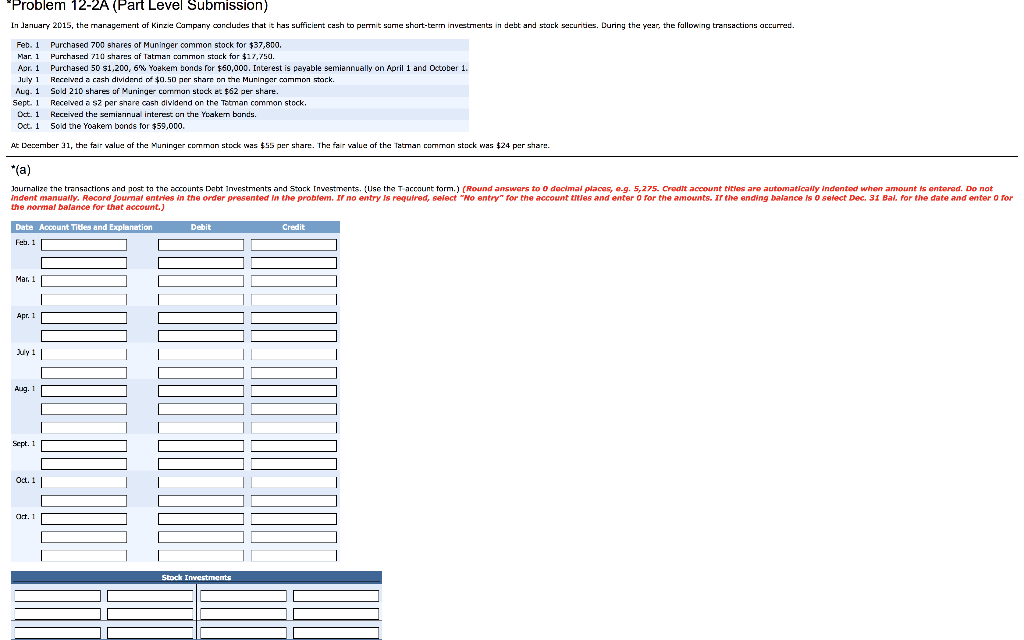

In January 2015, the management of Kinzie Company concludes that it has sufficient cash to permit some short-term investments in debt and stock securities. During the year, the following transactions occurred.

In January 2015, the management of Kinzie Company concludes that it has sufficient cash to permit some short-term investments in debt and stock securities. During the year, the following transactions occurred.

| Feb. 1 | Purchased 700 shares of Muninger common stock for $37,800. | |

| Mar. 1 | Purchased 710 shares of Tatman common stock for $17,750. | |

| Apr. 1 | Purchased 50 $1,200, 6% Yoakem bonds for $60,000. Interest is payable semiannually on April 1 and October 1. | |

| July 1 | Received a cash dividend of $0.50 per share on the Muninger common stock. | |

| Aug. 1 | Sold 210 shares of Muninger common stock at $62 per share. | |

| Sept. 1 | Received a $2 per share cash dividend on the Tatman common stock. | |

| Oct. 1 | Received the semiannual interest on the Yoakem bonds. | |

| Oct. 1 | Sold the Yoakem bonds for $59,000. |

At December 31, the fair value of the Muninger common stock was $55 per share. The fair value of the Tatman common stock was $24 per share.

Journalize the transactions and post to the accounts Debt Investments and Stock Investments. (Use the T-account form.) (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. If the ending balance is 0 select Dec. 31 Bal. for the date and enter 0 for the normal balance for that account.)

Problem 12-2A (Part Level Submission) In January 2015, the managemernt af Kinzie Campany concludes that it has sufficient cash to pemit ame shart-term invetments in debt and stok seurities. During the year, the fallowing transactions occurre Feb. 1 Purchased 700 shares of Muninger common stock for $37,800, Mar. 1 Purchased 110 shares af Tatr lan Dammon stack for 7,75a. Aor. 1 Purchased 50 s1,200, 6% Yoakem bonds ror $60,000. Interest is payable 9emiannually on April 1 and October 1. lty 1 Recevd cash dividcnn of $0.50 per sharr nn the Muningar common tock. Aug. 1 Sod 210 share uf Muninger currrron stuck e:62 per share. Sept Rece vad a S2 par snare cash dividend on the Totman common stock Oct. 1 Receved the seriiannual interest an the Yeakern bands Oct. 1 Sod e Yoakem bonds for $59,000. At December 31, th fair value af the Muringer comman stock was5 per share. The fer value of the Tatmar comman stack was $24 per share. Jaurralize tne transactions and post to the accounts D bt investments and Stock rnw stments use the T account or n. ndent manually. Record ournal entries in the order presented the problem. Ir no entry is required Select teormal balance for that ccount.) Round answers to O dacimal p acas e g. 5 275 edit aco unt t as are automatica" and nted when amount nterad. Do n No entry for thaccount titles and enter o ror the 0unts. Ir the ending Dalance s 0 select Dec. 31 Bal for the date nd enter o r or Date Account Titdes and Explanation Debit Credit Fes. 1 Mar. 1 Apr. 1 Aug. 1 Sept. 1 Ost. 1 Ot. 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started