Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In January 2020, suppose a Quick Copy franchise in Regina purchased a building, paying $107.000 cash and signing a $153,000 note payable. The franchise paid

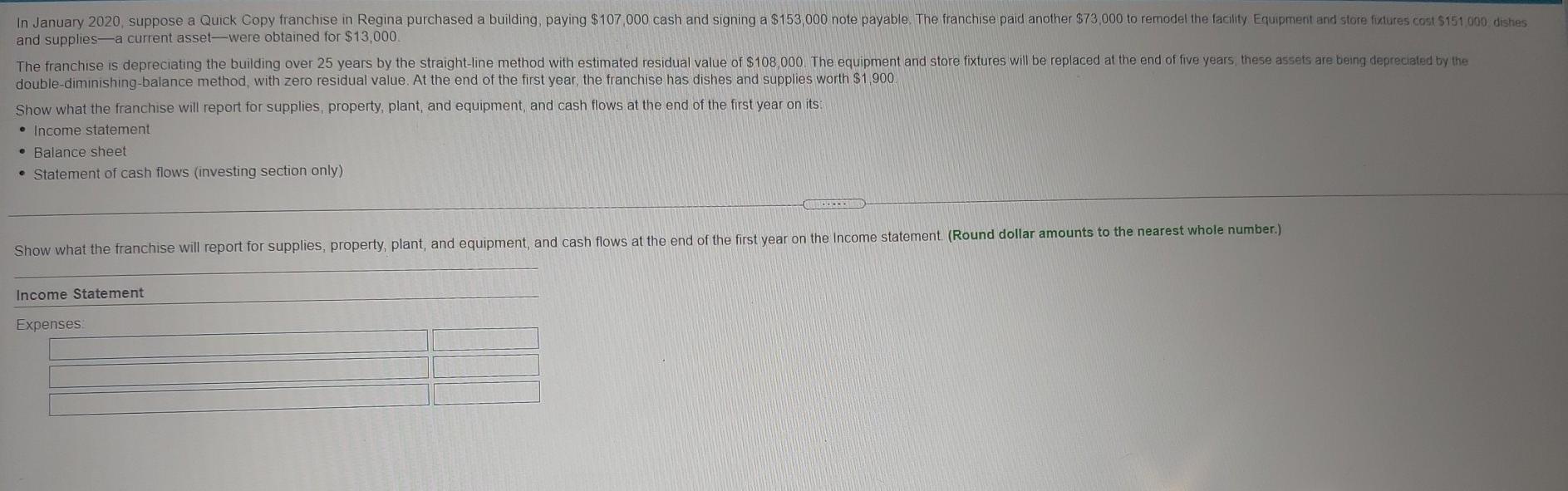

In January 2020, suppose a Quick Copy franchise in Regina purchased a building, paying $107.000 cash and signing a $153,000 note payable. The franchise paid another $73.000 to remodel the facility Equipment and store fixtures cost $151,000 dishes and supplies-a current asset-were obtained for $13,000 The franchise is depreciating the building over 25 years by the straight-line method with estimated residual value of $108,000. The equipment and store fixtures will be replaced at the end of five years these assets are being depreciated by the double-diminishing-balance method, with zero residual value. At the end of the first year, the franchise has dishes and supplies worth $1,900 Show what the franchise will report for supplies, property, plant, and equipment, and cash flows at the end of the first year on its Income statement Balance sheet Statement of cash flows (investing section only) Show what the franchise will report for supplies, property, plant, and equipment, and cash flows at the end of the first year on the Income statement (Round dollar amounts to the nearest whole number.) Income Statement Expenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started