Question

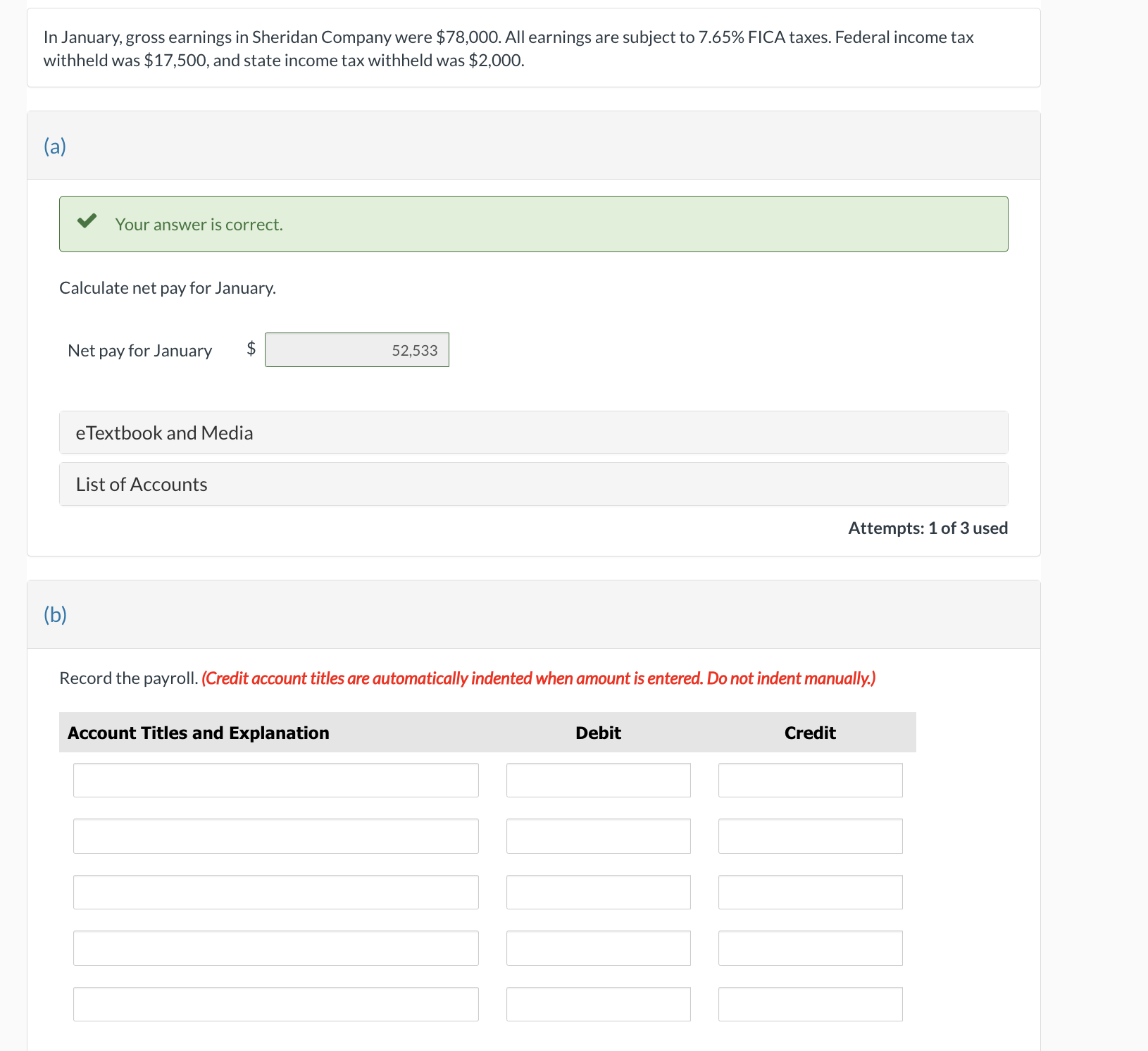

In January, gross earnings in Sheridan Company were $78,000. All earnings are subject to 7.65% FICA taxes. Federal income tax withheld was $17,500, and

In January, gross earnings in Sheridan Company were $78,000. All earnings are subject to 7.65% FICA taxes. Federal income tax withheld was $17,500, and state income tax withheld was $2,000. (a) Your answer is correct. Calculate net pay for January. Net pay for January $ 52,533 eTextbook and Media List of Accounts Attempts: 1 of 3 used (b) Record the payroll. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Jerry Weygandt, Paul Kimmel, Donald Kieso

11th Edition

111856667X, 978-1118566671

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App