Question

In January of 2020 Jack Daniels invested $ 200 000 from his private savings account into his business bank account. At the end of

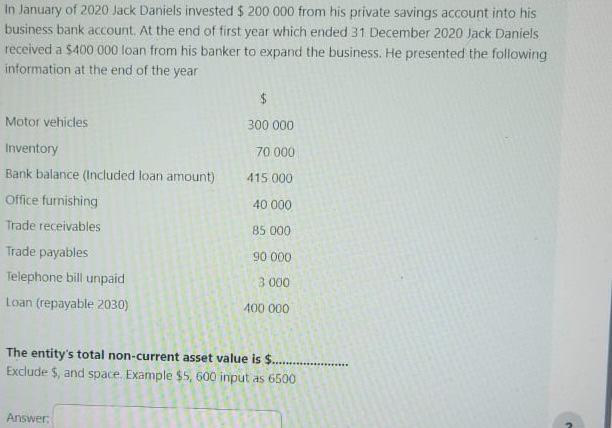

In January of 2020 Jack Daniels invested $ 200 000 from his private savings account into his business bank account. At the end of first year which ended 31 December 2020 Jack Daniels received a $400 000 loan from his banker to expand the business. He presented the following information at the end of the year Motor vehicles Inventory Bank balance (Included loan amount) Office furnishing Trade receivables Trade payables Telephone bill unpaid Loan (repayable 2030) $ 300 000 Answer: 70 000 415.000 40 000 85 000 90 000 3.000 400 000 The entity's total non-current asset value is $.................. Exclude $, and space. Example $5, 600 input as 6500

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the entitys total noncurrent asset value we need to sum up the values of m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App