1. If assets are $40,000 and stockholders equity is $10,000, how much are liabilities? a. $30,000 b. $50,000 c. $20,000 d. $60,000 e. $10,000 2.

1. If assets are $40,000 and stockholders’ equity is $10,000, how much are liabilities?

- a. $30,000

- b. $50,000

- c. $20,000

- d. $60,000

- e. $10,000

- 2. To which account in the Balance Sheet is the net income or net loss transferred to at the end of the accounting period?

- a. Cash

- b. Account Receivable

- c. Retained Earnings

- d. Dividends

- e. Inventory

- 3. The proper entry to record the inventory write-off:

- a. DR Inventory

CR Income from Sale of fixed asset

b. DR Inventory

CR Inventory write-off expense

c. DR Inventory write-off expense

CR Retained Earnings

d. DR Depreciation Expense

CR Accumulated Depreciation

e. DR Inventory write-off expense

CR Inventory

- 4. Which of the following is a type of audit opinion that a firm would usually prefer?

- a. Unqualified opinion

- b. Qualified opinion

- c. Adverse opinion

- d. Clear opinion

- e. None of the above

- 5. The following are selected accounts of Laura Gibson Company on December 31:

Normal Balance (Dr.) or (Cr.)

Cash

Accounts Receivable

Loans Issued

Accounts Payable

Common Stock

Rent Expense

Utility Expense

Commission Income

Indicate the normal balance in terms of debit (Dr.) or credit (Cr.).

- 6. A company prepares financial statements in order to summarize financial information.

Below are a list of financial statements and a list of descriptions. Name the financial statements and describe.

Financial Statements

a.

b.

c.

d.

Descriptions

1.

2.

3.

4.

- 7. The Current Liabilities section of the balance sheet should include

- a. Land.

- b. Life Insurance.

- c. accounts payable.

- d. bonds payable.

- e. preferred stock.

- 7. The Current Liabilities section of the balance sheet should include

- 8. Which of the following accounts would not be classified as intangible?

- a. Goodwill

- b. Patent

- c. accounts receivable

- d. Trademarks

- e. Franchises

- 8. Which of the following accounts would not be classified as intangible?

- 9. Please describe your main achievements and your suitability for the role of financial reporting specialist in Russian.

- 10. On January 1, 2017, the Freedom Finance purchased a machinery at a cost of $55,000. The machinery was expected to have a service life of 10 years and no residual value. The straight-line depreciation method was used. Which of the following journal entries should be recorded?

a. Depreciation Expense 10,000

Intangible Asset 10,000

b. Accumulated Depreciation 5,000

Depreciation Expense 5,000

c. Depreciation Expense 5,500

Accumulated Depreciation 5,500

d. Cash and cash equivalent 10,000

Operating Expense 10,000

e. Depreciation Expense 5,000

Accumulated Depreciation 5,000

- 11. Which of the following cost methods was excluded from IFRS:

- a. Retail

- b. LIFO

- c. FIFO

- d. Weighted-average

- e. (c) and (d)

- 12. A company has made a material change to an accounting policy in preparing its current financial statements. Which of the following disclosures are required by IAS 8 Accounting policies, changes in accounting estimates and errors in the financial statements?

1 The reasons for the change.

2 The amount of the adjustment in the current period and in comparative information for prior periods.

3 An estimate of the effect of the change on the next five accounting periods.

- a. 1 and 2 only

- b. 1 and 3 only

- c. 2 and 3 only

- d. 1, 2 and 3

- e. None of the above

- 13. Tracey’s business sells three products – A, B, and C. The following information was available at the year-end:

The value of inventory at the year-end should be:

- a. $675

- b. $670

- c. $795

- d. $550

- 14. At 31 August 2005 the balance on the company’s cash in bank was $3,600. Examination of the bank statements revealed the following:

– Received payment amounting to $180 had not been recorded in the cash in bank account.

– Cheques paid to suppliers of $1,420 did not appear in the cash in bank account.

What was the balance of the cash in bank account at 31 August 2005?

- a. $5,200

- b. $5,020

- c. $2,360

- d. $3,780

- 15. George started a business by investing $10,000 into a business bank account. At the end of his first year’s trading he had earned a profit of $5,000 and had the following assets and liabilities:

Noncurrent assets $20,000

Current assets $15,000

Current liabilities $8,000

During the year he had withdrawn $2,000 from the business

How much further capital had he introduced in the year?

- a. $20,000

- b. $24,000

- c. $10,000

- d. $14,000

- 16. Molly starts up in business as a florist on 1 April 2004. For the first six months, she has a draft profit of $12,355.

On investigation you discover the following:

– Rent paid for the 12 months ending 31 March 2005 of $800 has not been recorded in the accounts.

– Closing inventory in the accounts at a cost of $1,000 has a net realisable value of $800.

What is the adjusted profit for the period?

- a. $11,355

- b. $11,755

- c. $12,155

- d. $12,555

- 17. A company has the following share capital:

Authorised

Issued

$000

$000

25c ordinary shares

8,000

4,000

6% 50c preference shares

2,000

1,000

In addition to providing for the year’s preference dividend, an ordinary dividend of 2c per share is to be paid.

What are total dividends for the year?

- a. $140,000

- b. $380,000

- c. $440,000

- d. $760,000

- 18. On 1 April 2004 the balance on B’s accumulated profit account was $50,000 credit. The balance on 31 March 2005 was $100,000 credit. On 10 March 2005 dividends of $50,000 were declared in respect of the year ended 31 March 2005, payable on 31 May 2005.

Based on this information, profit after tax (but before dividends) for the year ended 31 March 2005 was:

- a. Nil

- b. $50,000

- c. $100,000

- d. $150,000

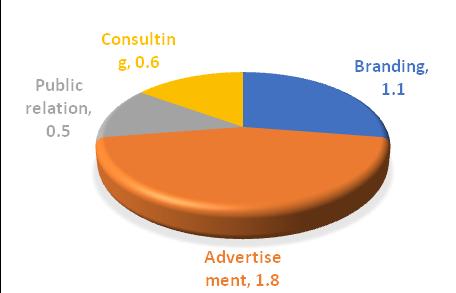

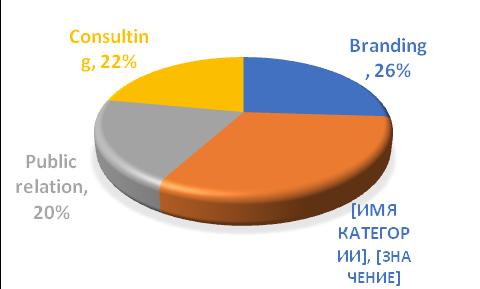

- 19. In how much the advertising revenue has changed from year 1 to year 2 in percentage terms compared to the year 1

Year 1 (In $ mln)

Year 2 (total revenue – $5 mln)

- a. -11%

- b. -13%

- c. 13%

- d. -15%

- e. 20%

- 20. The value of what currency experienced the least change in relation to the British pound sterling in the period from year 1 to year 2

Currency

1 Year

2 Year

EUR

1.52

1.64

USD

1.6

1.45

JPY

158

190

AUD

2.55

2.71

CHF

2.6

2.4

HKD

12.3

11.2

MYR

7.6

5.45

- a. AUD

- b. JPY

- c. EUR

- d. CHF

- e. None of the above

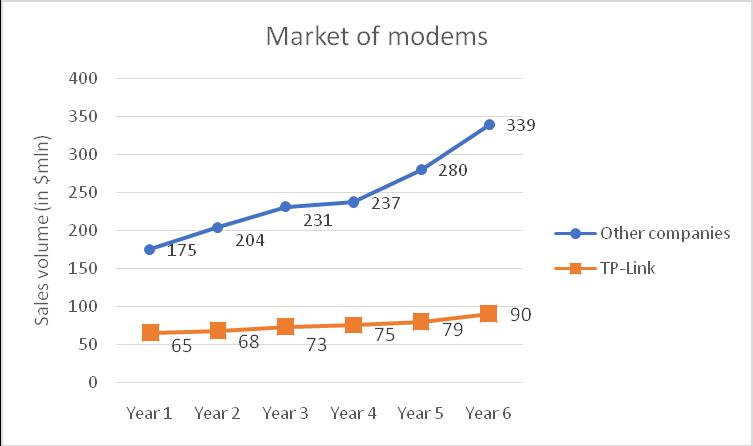

- 21. What were the TP-Link’s competitors' total sales volume in the period from year 1 to year 6 inclusive:

- a. 339 mln

- b. 514 mln

- c. 848 mln

- d. 1128 mln

- e. 1466 mln

- 22. In the last year, the amount of permanent staff in a region of Europe consisted of only four-fifths of the current level and consisted of only three-fourths of the amount of the temporary staff working now. What was the total number of permanent and temporary staff in the region last year?

Alpha South Construction. Amount and costs on staff by the regions.

Region

Number of staffs

Overall cost (In $ mln)

permanent staff

temporary staff

permanent staff

temporary staff

USA

2000

130

47

2.5

South-Eastern Asia

650

62

14.4

0.7

Great Britany

840

55

7.2

0.4

Europe

250

24

6.6

0.3

China

1500

95

4.8

0.2

Middle East

135

12

2

0.1

- a. 200

- b. 208

- c. 212

- d. 218

- e. 224

| Description | A $ per Unit | B per unit | C per unit |

Original cost | 7 | 10 | 19 |

Estimated selling price | 15 | 13 | 20 |

Selling and distribution costs | 2 | 5 | 6 |

Units of inventory | 20 | 25 | 15 |

Public relation, 0.5 Consultin g, 0.6 Advertise ment, 1.8 Branding, 1.1

Step by Step Solution

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 10000 Liability Assets Stockholders equity Therefore liability 4000010000 30000 Therefore liability 30000 2 c Retained Earnings The balance in the I...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started