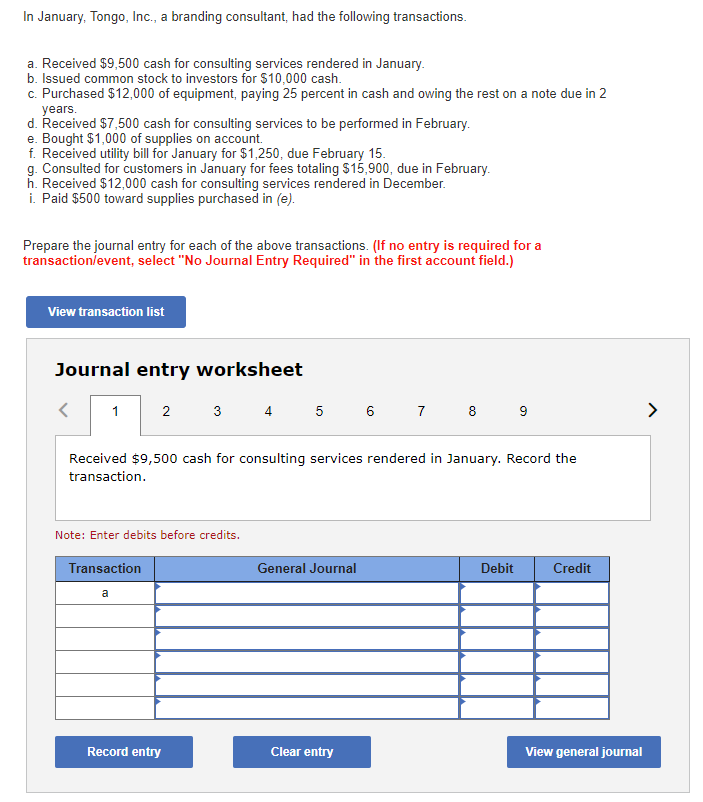

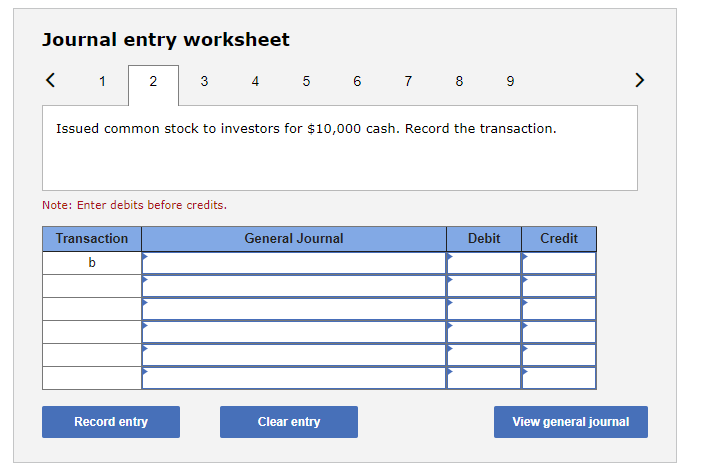

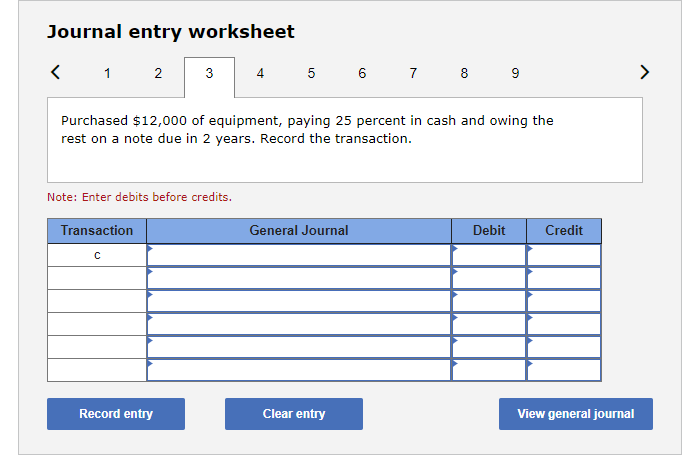

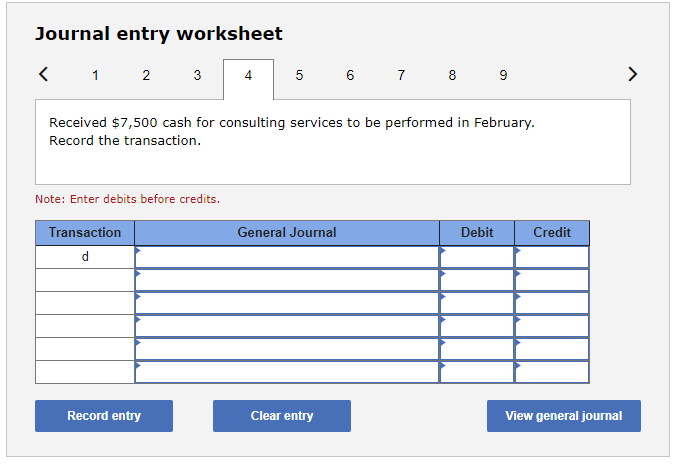

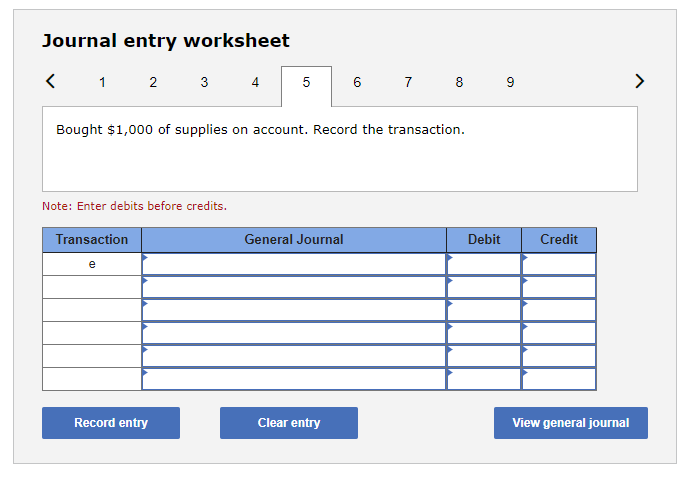

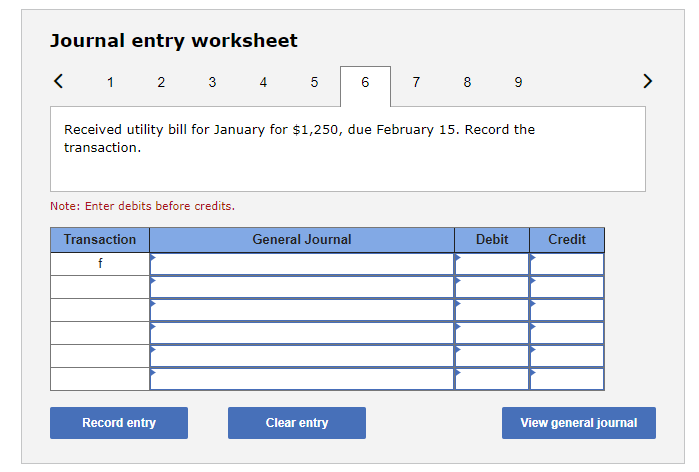

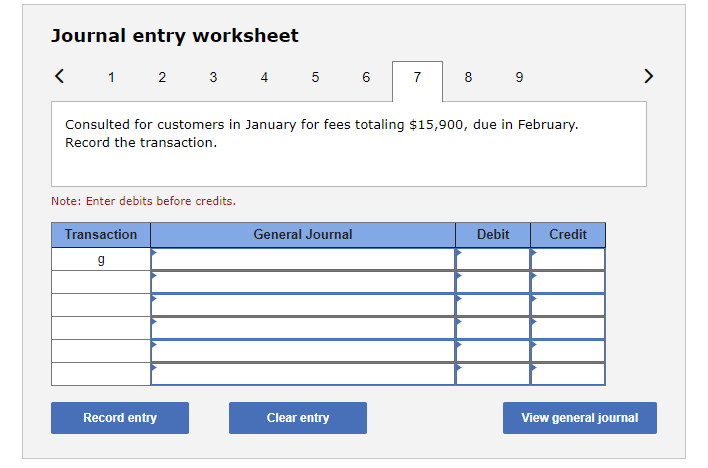

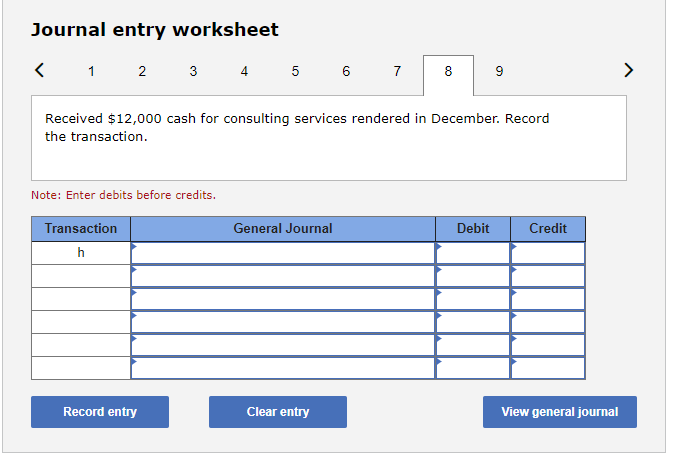

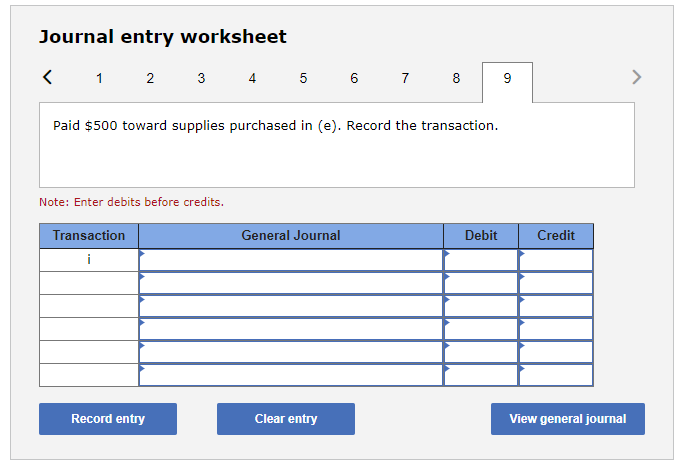

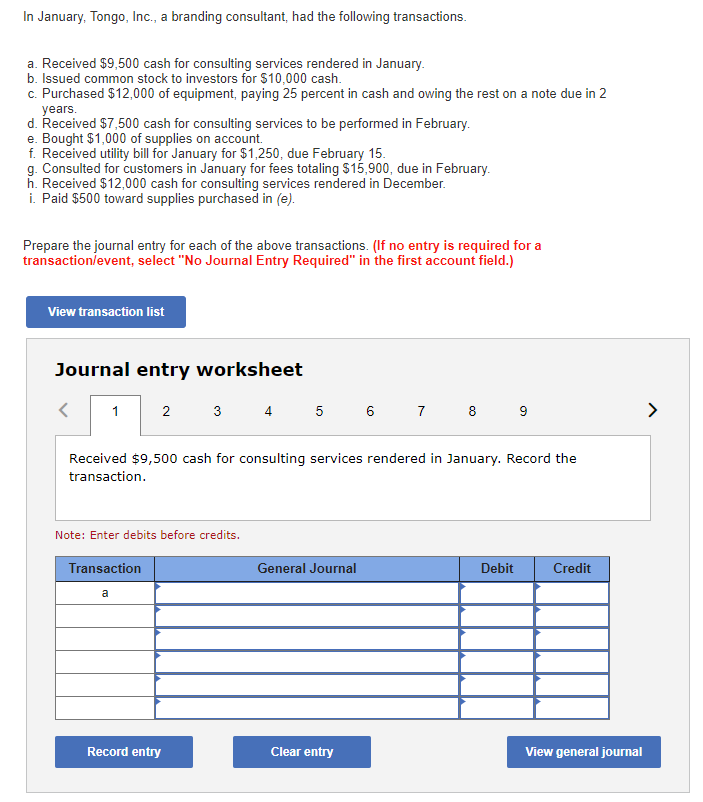

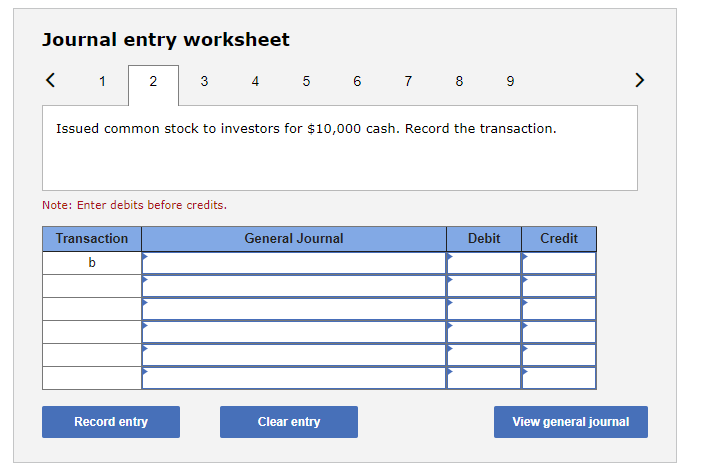

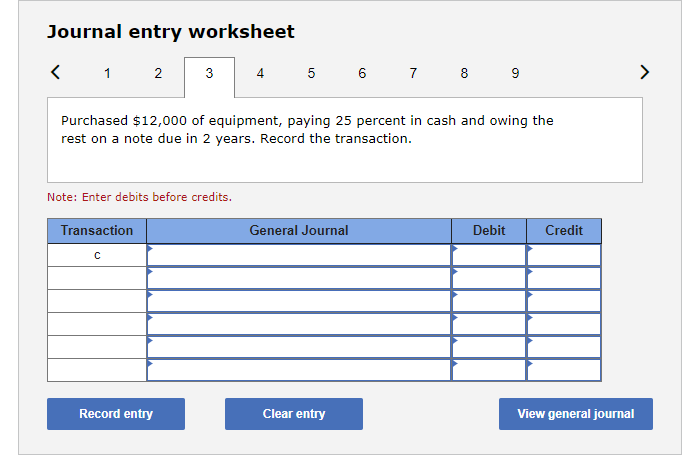

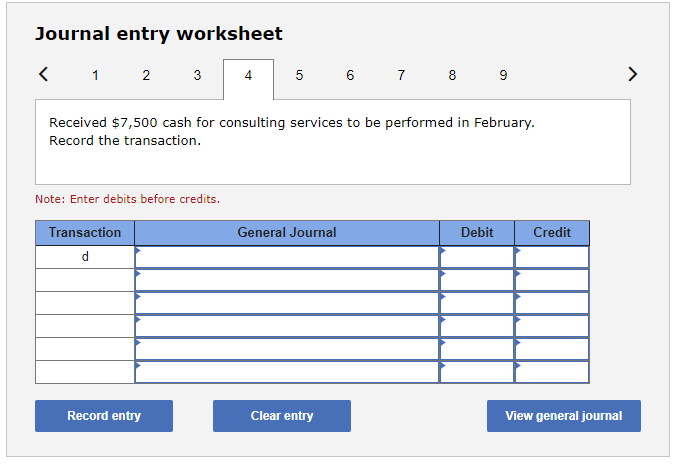

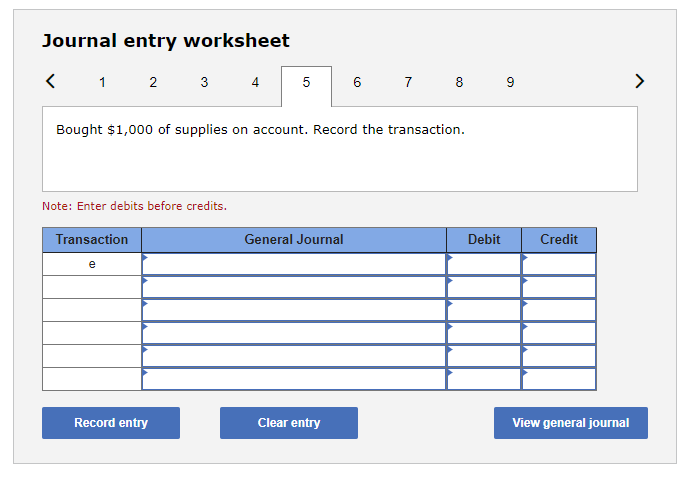

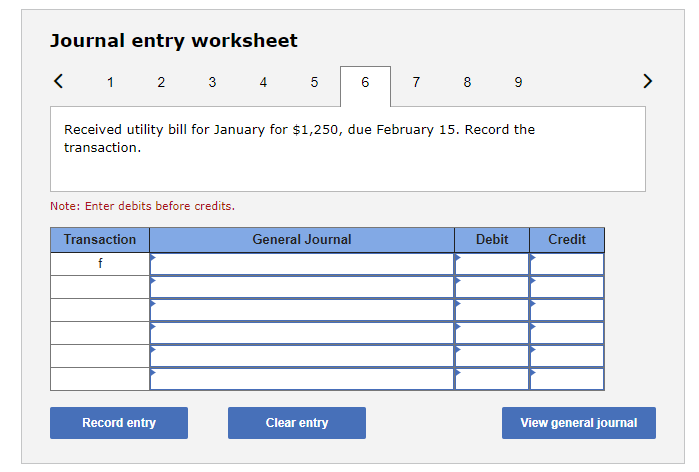

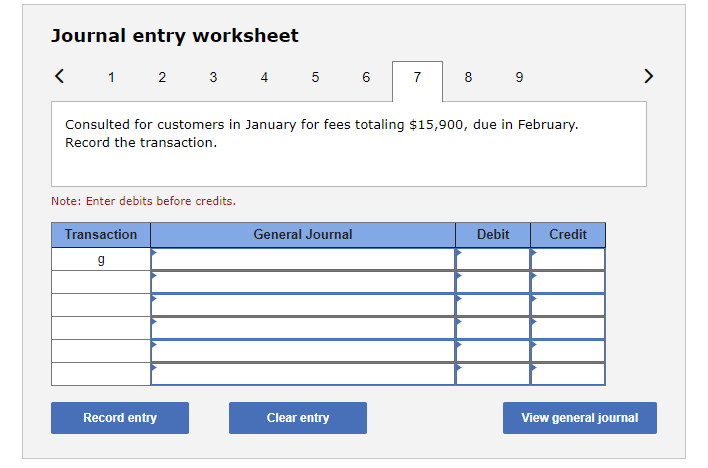

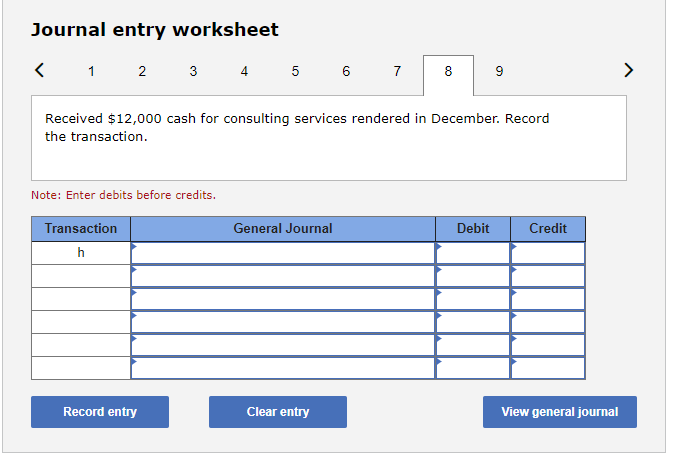

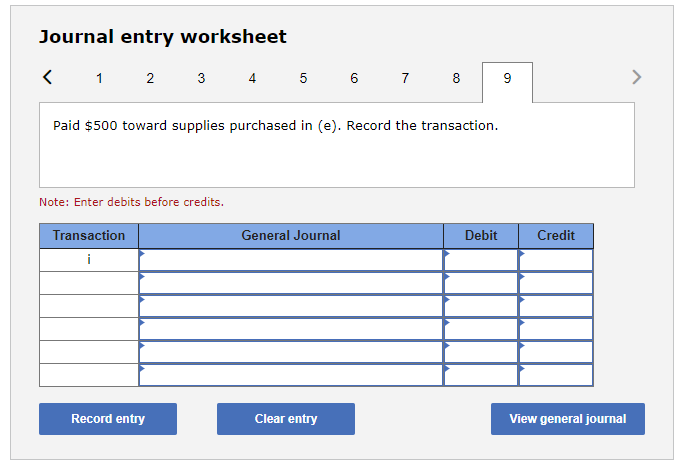

In January, Tongo, Inc., a branding consultant, had the following transactions. a. Received $9,500 cash for consulting services rendered in January b. Issued common stock to investors for $10,000 cash. c. Purchased $12,000 of equipment, paying 25 percent in cash and owing the rest on a note due in 2 years. d. Received $7,500 cash for consulting services to be performed in February e. Bought $1,000 of supplies on account. f. Received utility bill for January for $1,250, due February 15. g. Consulted for customers in January for fees totaling $15,900, due in February h. Received $12,000 cash for consulting services rendered in December i. Paid $500 toward supplies purchased in (e). Prepare the journal entry for each of the above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 9 > Received $9,500 cash for consulting services rendered in January. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit a Record entry Clear entry View general journal Journal entry worksheet 1 2 3 4 5 6 7 8 9 N Issued common stock to investors for $10,000 cash. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Journal entry worksheet 1 2 3 4 5 6 7 8 9 > Purchased $12,000 of equipment, paying 25 percent in cash and owing the rest on a note due in 2 years. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Journal entry worksheet Received utility bill for January for $1,250, due February 15. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit f Record entry Clear entry View general journal Journal entry worksheet Consulted for customers in January for fees totaling $15,900, due in February. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit 9 Record entry Clear entry View general journal Journal entry worksheet Received $12,000 cash for consulting services rendered in December. Record the transaction. Note: Enter debits before credits. General Journal Debit Credit Transaction h Record entry Clear entry View general journal Journal entry worksheet