Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In January, Tongo, Incorporated, a branding consultant, had the following transactions. Received $14,200 cash for consulting services rendered in January. Issued common stock to investors

In January, Tongo, Incorporated, a branding consultant, had the following transactions.

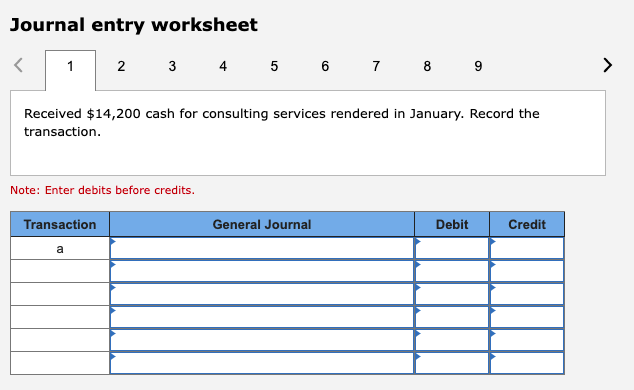

- Received $14,200 cash for consulting services rendered in January.

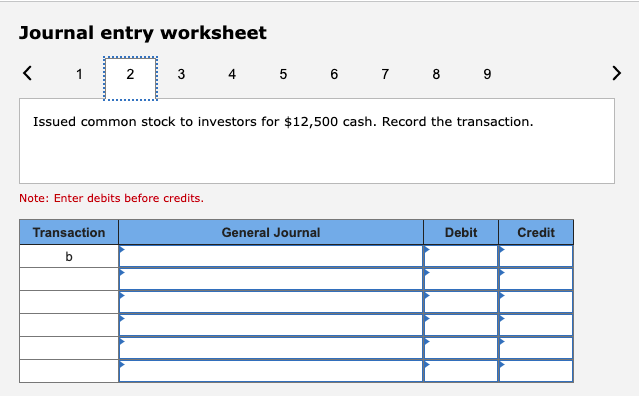

- Issued common stock to investors for $12,500 cash.

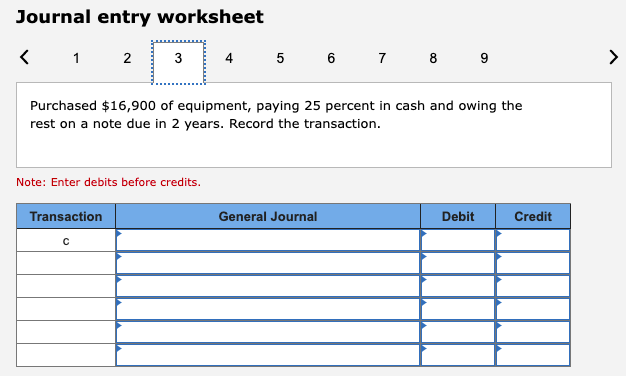

- Purchased $16,900 of equipment, paying 25 percent in cash and owing the rest on a note due in 2 years.

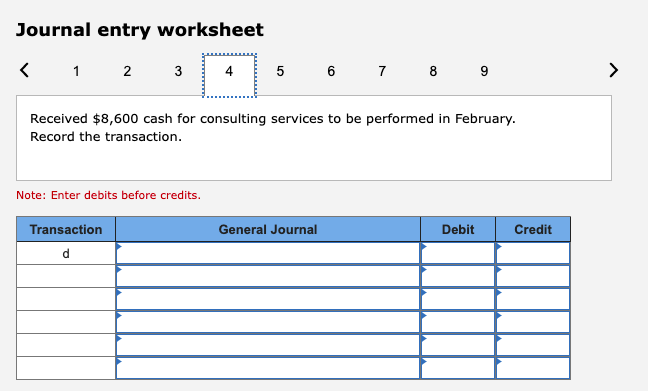

- Received $8,600 cash for consulting services to be performed in February.

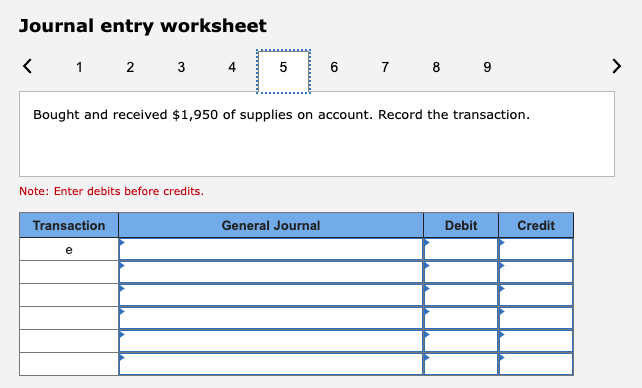

- Bought and received $1,950 of supplies on account.

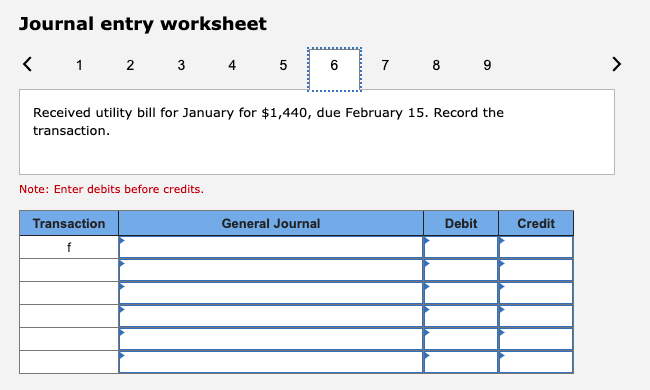

- Received utility bill for January for $1,440, due February 15.

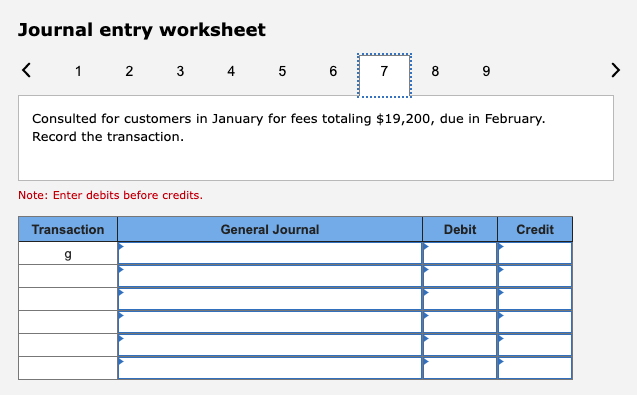

- Consulted for customers in January for fees totaling $19,200, due in February.

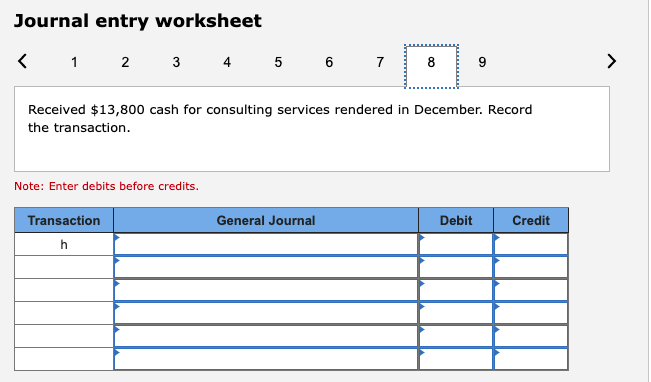

- Received $13,800 cash for consulting services rendered in December.

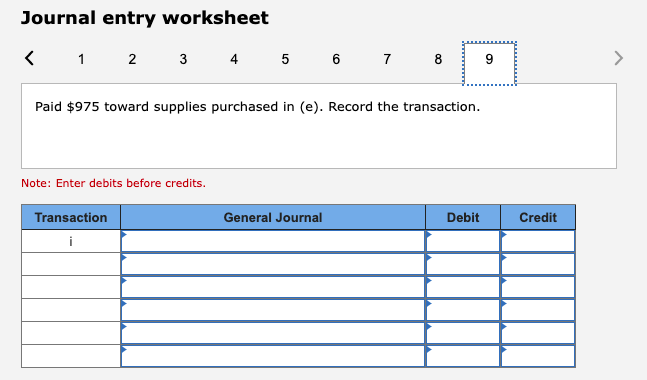

- Paid $975 toward supplies purchased in (e).

Required: Prepare the journal entry for each of the above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

OPTIONS FOR GENERAL JOURNAL SECTION:

- No Journal Entry Required

- Accounts Payable

- Accounts Receivable

- Accumulated Amortization

- Accumulated Depreciation

- Advertising Expense

- Amortization Expense

- Bad Debt Expense

- Bank Charges Expense

- Buildings

- Cash

- Common Stock

- Copyrights

- Cost of Goods Sold

- Deferred Revenue

- Delivery Expense

- Depreciation Expense

- Dividends

- Dividends Payable

- Donation Revenue

- Equipment

- Franchise Rights

- Goodwill

- Income Tax Expense

- Income Tax Payable

- Insurance Expense

- Interest Expense

- Interest Payable

- Interest Receivable

- Interest Revenue

- Inventory

- Land

- Legal Expense

- Licensing Rights

- Logo and Trademarks

- Notes Payable (long-term)

- Notes Payable (short-term)

- Notes Receivable (long-term)

- Notes Receivable (short-term)

- Office Expense

- Patents

- Prepaid Advertising

- Prepaid Insurance

- Prepaid Rent

- Rent Expense

- Rent Revenue

- Repairs and Maintenance Expense

- Retained Earnings

- Salaries and Wages Expense

- Salaries and Wages Payable

- Sales Revenue

- Selling, General, and Administrative Expense

- Service Revenue

- Short-term Investments

- Software

- Supplies

- Supplies Expense

- Travel Expense

- Utilities Expense

- Vehicles

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started