Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In June 2022, the Australian livestock industry production was valued at 35 billion AUD. The industry's value as a whole is expected to rise

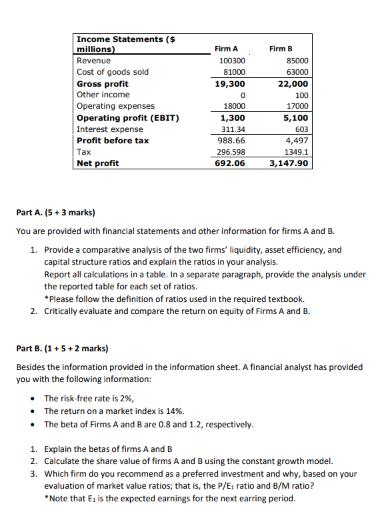

In June 2022, the Australian livestock industry production was valued at 35 billion AUD. The industry's value as a whole is expected to rise by 1.2 % during 2022-2023 while facing challenges such as falling prices, herding, and flock rebuilds. Firms A and B are medium-sized peer firms operating in this industry, raising livestock for meat production. You are part of the financial management team of Firm B. The CFO of the firm is interested in a comparative financial analysis, relative valuation, the potential to invest in another firm across the supply chain and managing risk. Each part of this assignment is dedicated to a particular task that requires analysis, problem- solving, evaluation, or recommendation. Below you will find the financial information required to solve Parts A and B. Parts C and D are self-contained. Balance Sheets ($ millions) Current assets Cash and marketable securities Accounts receivable Inventories Other current assets Total current assets Net property, plant, and equipment Other non-current assets Total assets Current liabilities Accounts payable Short-term debt Other current liabilities Total current liabilities. Long-term debt Other non-current liabilities Total liabilities Total shareholders' equity Total liabilities and shareholders' equity Additional information: No. of ordinary shares (millions) Share price Firm A 2390 5800 21000 1250 30,440 30000 69500 129,940 23000 4050 850 27,900 10378 4162 42,440 87500 129,940 2000 $2 Firm B 3800 2400 12700 2600 21,500 32000 26000 79,500 24400 2115 5700 32,215 20100 5200 57 21985 79,500 1450 $12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started