Answered step by step

Verified Expert Solution

Question

1 Approved Answer

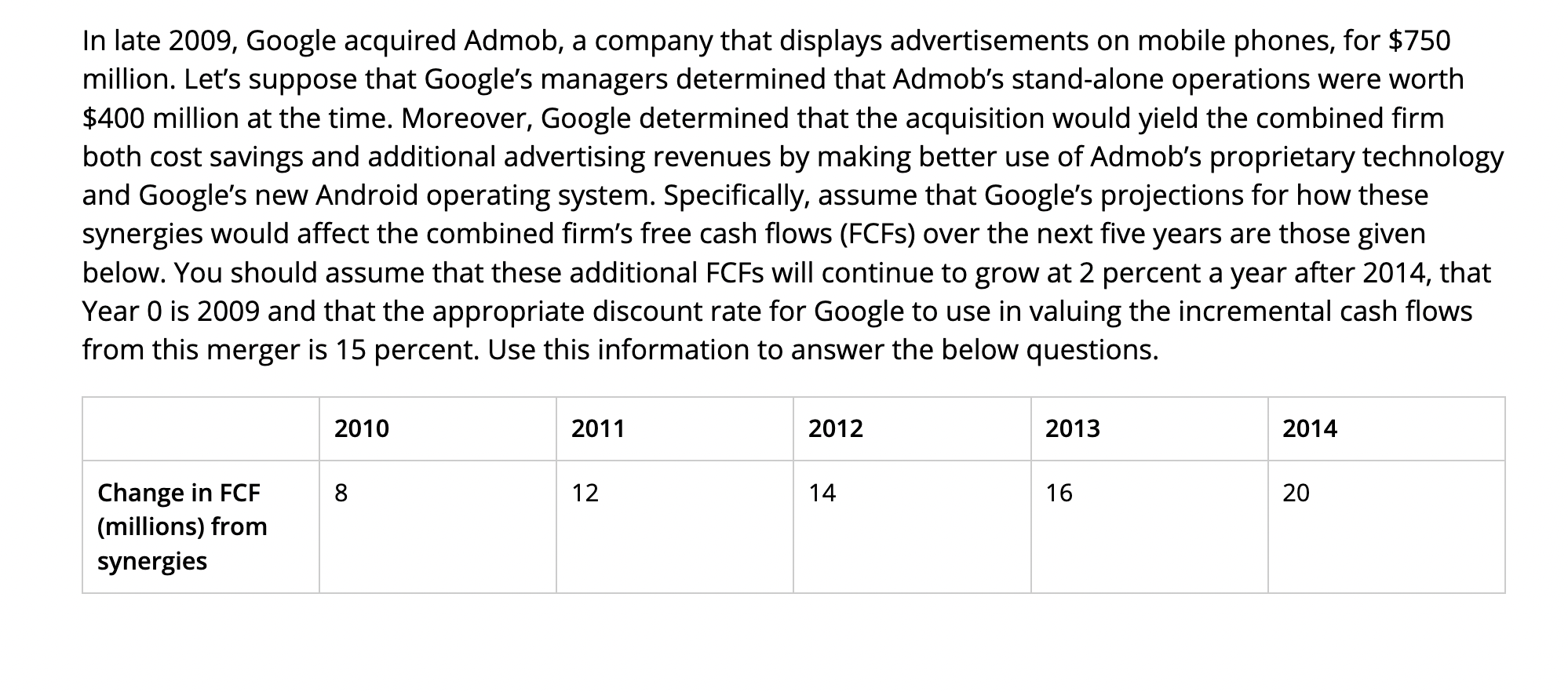

In late 2009, Google acquired Admob, a company that displays advertisements on mobile phones, for $750 million. Let's suppose that Google's managers determined that

In late 2009, Google acquired Admob, a company that displays advertisements on mobile phones, for $750 million. Let's suppose that Google's managers determined that Admob's stand-alone operations were worth $400 million at the time. Moreover, Google determined that the acquisition would yield the combined firm both cost savings and additional advertising revenues by making better use of Admob's proprietary technology and Google's new Android operating system. Specifically, assume that Google's projections for how these synergies would affect the combined firm's free cash flows (FCFS) over the next five years are those given below. You should assume that these additional FCFs will continue to grow at 2 percent a year after 2014, that Year 0 is 2009 and that the appropriate discount rate for Google to use in valuing the incremental cash flows from this merger is 15 percent. Use this information to answer the below questions. Change in FCF (millions) from synergies 2010 8 2011 12 2012 14 2013 16 2014 20 Given what we know so far, how much does it look like Google is overpaying? Your answer should be rounded to two decimal places.

Step by Step Solution

★★★★★

3.44 Rating (183 Votes )

There are 3 Steps involved in it

Step: 1

To determine how much Google appears to be overpaying for Admob we need to calculate the present val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started