Answered step by step

Verified Expert Solution

Question

1 Approved Answer

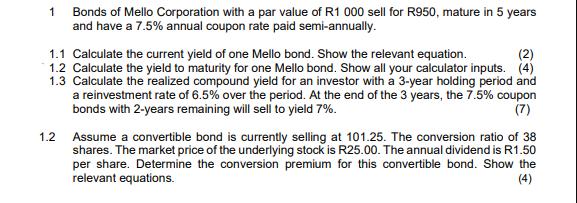

1 Bonds of Mello Corporation with a par value of R1 000 sell for R950, mature in 5 years and have a 7.5% annual

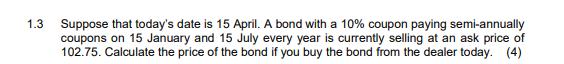

1 Bonds of Mello Corporation with a par value of R1 000 sell for R950, mature in 5 years and have a 7.5% annual coupon rate paid semi-annually. (2) 1.1 Calculate the current yield of one Mello bond. Show the relevant equation. 1.2 Calculate the yield to maturity for one Mello bond. Show all your calculator inputs. (4) 1.3 Calculate the realized compound yield for an investor with a 3-year holding period and a reinvestment rate of 6.5% over the period. At the end of the 3 years, the 7.5% coupon bonds with 2-years remaining will sell to yield 7%. (7) 1.2 Assume a convertible bond is currently selling at 101.25. The conversion ratio of 38 shares. The market price of the underlying stock is R25.00. The annual dividend is R1.50 per share. Determine the conversion premium for this convertible bond. Show the relevant equations. 1.3 Suppose that today's date is 15 April. A bond with a 10% coupon paying semi-annually coupons on 15 January and 15 July every year is currently selling at an ask price of 102.75. Calculate the price of the bond if you buy the bond from the dealer today. (4)

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

11 Current yield Annual coupon Current price R75 R950 789 12 Yield to maturity F PP CP R1000 R95...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started