Answered step by step

Verified Expert Solution

Question

1 Approved Answer

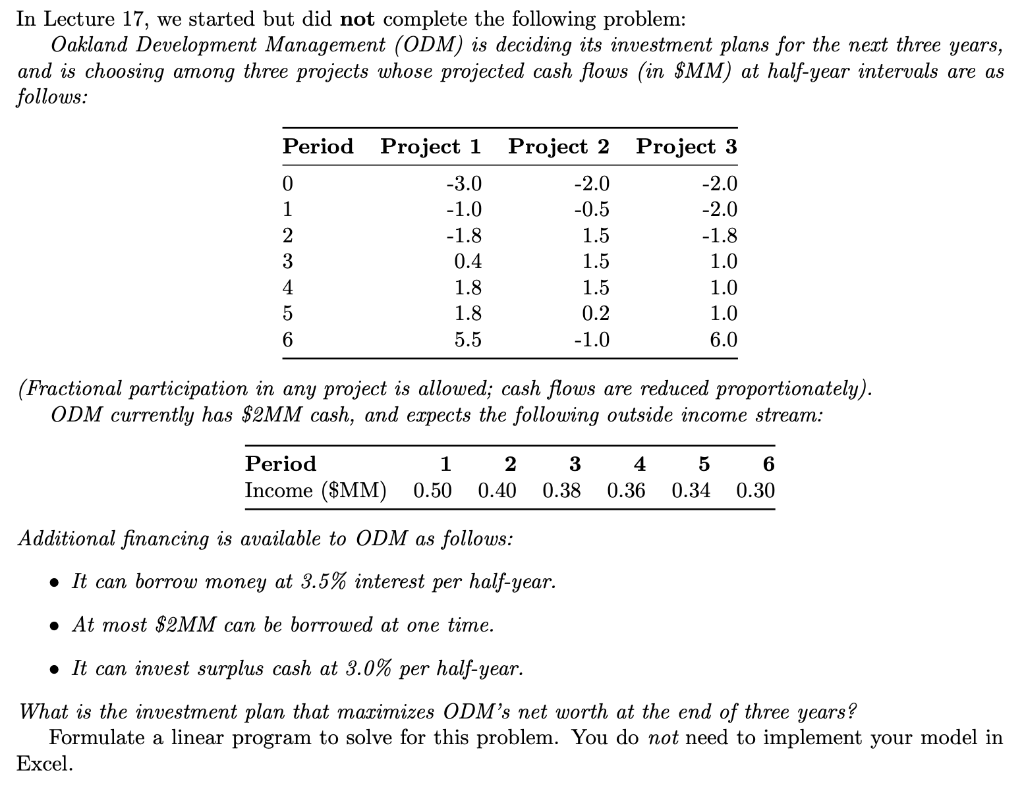

In Lecture 17, we started but did not complete the following problem: Oakland Development Management (ODM) is deciding its investment plans for the next three

In Lecture 17, we started but did not complete the following problem: Oakland Development Management (ODM) is deciding its investment plans for the next three years, and is choosing among three projects whose projected cash flows (in \$MM) at half-year intervals are as follows: (Fractional participation in any project is allowed; cash flows are reduced proportionately). ODM currently has \$2MM cash, and expects the following outside income stream: Additional financing is available to ODM as follows: - It can borrow money at 3.5\% interest per half-year. - At most \$2MM can be borrowed at one time. - It can invest surplus cash at 3.0\% per half-year. What is the investment plan that maximizes ODM's net worth at the end of three years? Formulate a linear program to solve for this problem. You do not need to implement your model in Excel. In Lecture 17, we started but did not complete the following problem: Oakland Development Management (ODM) is deciding its investment plans for the next three years, and is choosing among three projects whose projected cash flows (in \$MM) at half-year intervals are as follows: (Fractional participation in any project is allowed; cash flows are reduced proportionately). ODM currently has \$2MM cash, and expects the following outside income stream: Additional financing is available to ODM as follows: - It can borrow money at 3.5\% interest per half-year. - At most \$2MM can be borrowed at one time. - It can invest surplus cash at 3.0\% per half-year. What is the investment plan that maximizes ODM's net worth at the end of three years? Formulate a linear program to solve for this problem. You do not need to implement your model in Excel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started