Answered step by step

Verified Expert Solution

Question

1 Approved Answer

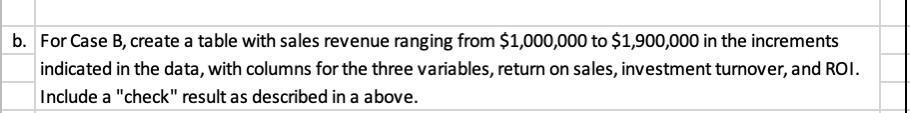

Write a conditional statement (=IF) that checks your computation of ROI to the number that would be computed using the Du-Pont method. This should be

Write a conditional statement (=IF) that checks your computation of ROI to the number that would be computed using the Du-Pont method. This should be included in the "Check" column and say "CORRECT" if the Du Pont method equals your calculated ROI and "ERROR" if the results do not match.

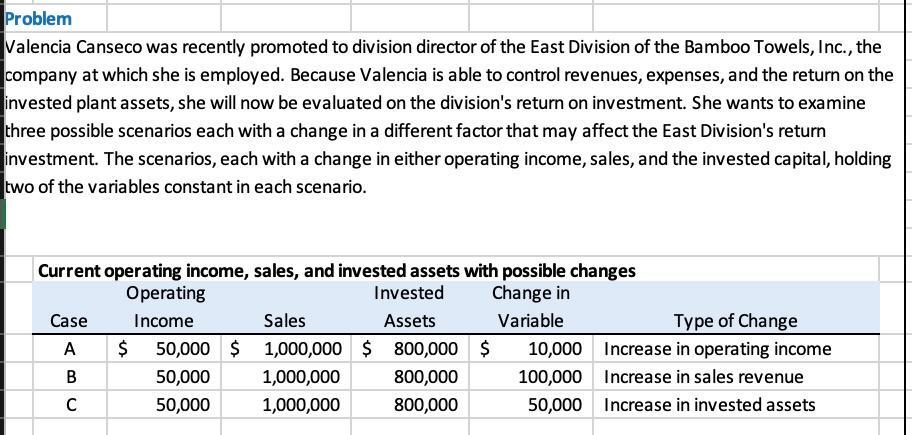

Problem Valencia Canseco was recently promoted to division director of the East Division of the Bamboo Towels, Inc., the company at which she is employed. Because Valencia is able to control revenues, expenses, and the return on the invested plant assets, she will now be evaluated on the division's return on investment. She wants to examine three possible scenarios each with a change in a different factor that may affect the East Division's return investment. The scenarios, each with a change in either operating income, sales, and the invested capital, holding two of the variables constant in each scenario. Current operating income, sales, and invested assets with possible changes Invested Change in Assets Variable Case A B C Operating Income Sales $ 50,000 $ 1,000,000 $ 800,000 $ 50,000 1,000,000 800,000 50,000 1,000,000 800,000 10,000 Type of Change Increase in operating income Increase in sales revenue 100,000 50,000 Increase in invested assets

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

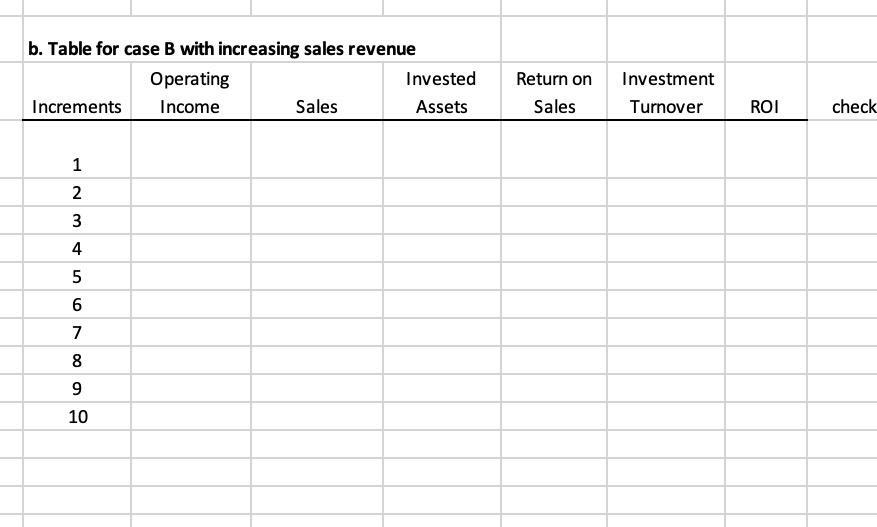

Increments Operating Income 1 2 WN 3 4 5 6 7 56 00 9 10 A 5000000 5500000 6000000 6...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started