Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In looking at the information below in the balance sheet and income statement for quarter ending 10/3/2021 (3rd quarter), how do I determine the Price

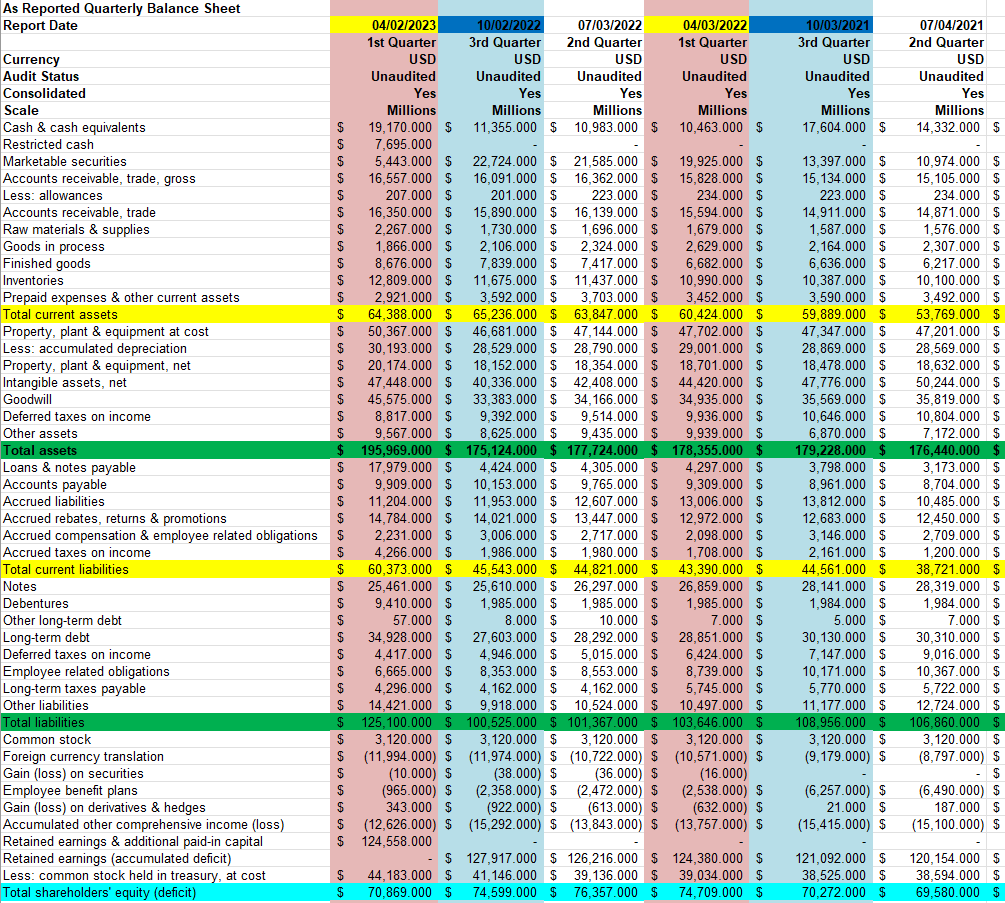

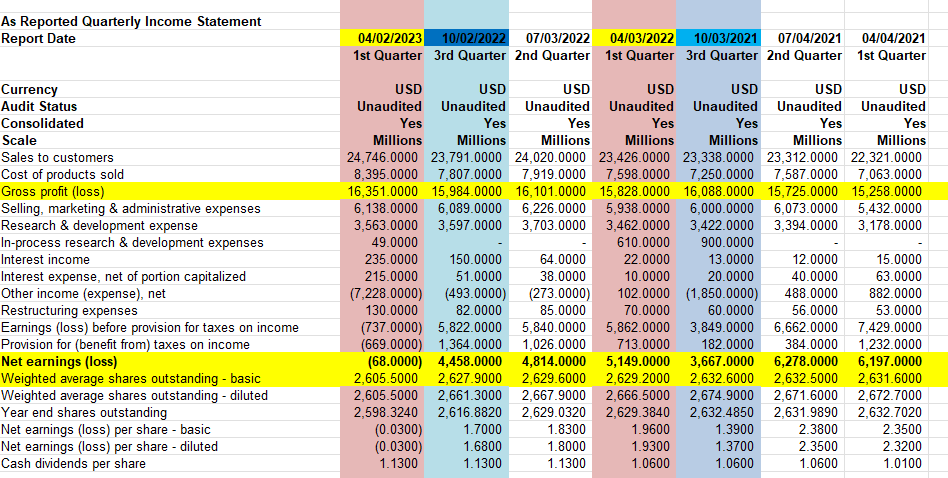

In looking at the information below in the balance sheet and income statement for quarter ending 10/3/2021 (3rd quarter), how do I determine the Price Earnings Ratio and Return on Equity?

As Reported Quarterly Balance Sheet Report Date Currency Audit Status Consolidated Scale Cash & cash equivalents Restricted cash Marketable securities Accounts receivable, trade, gross Less: allowances Accounts receivable, trade Raw materials & supplies Goods in process Finished goods Inventories Prepaid expenses & other current assets Total current assets Property, plant & equipment at cost Less: accumulated depreciation Property, plant & equipment, net Intangible assets, net Goodwill Deferred taxes on income Other assets Total assets Loans & notes payable Accounts payable Accrued liabilities Accrued rebates, returns & promotions Accrued compensation & employee related obligations Accrued taxes on income Total current liabilities Notes Debentures Other long-term debt Long-term debt Deferred taxes on income Employee related obligations Long-term taxes payable Other liabilities Total liabilities Common stock Foreign currency translation Gain (loss) on securities Employee benefit plans Gain (loss) on derivatives & hedges Accumulated other comprehensive income (loss) Retained earnings & additional paid-in capital Retained earnings (accumulated deficit) Less: common stock held in treasury, at cost Total shareholders' equity (deficit) $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 04/02/2023 1st Quarter USD Unaudited Yes Millions 19,170.000 $ 7,695.000 5,443.000 $ 16,557.000 $ 207.000 $ 16,350.000 $ 2,267.000 $ 1,866.000 $ 8,676.000 $ 12,809.000 $ 2,921.000 $ 64,388.000 $ 50,367.000 $ 30,193.000 $ 20,174.000 $ 47,448.000 $ 45,575.000 $ 8,817.000 9,567.000 $ 195,969.000 $ 17,979.000 $ 9,909.000 $ 11,204.000 $ 14,784.000 $ 2,231.000 $ 4,266.000 $ 60,373.000 $ 25,461.000 $ 9,410.000 $ 57.000 $ 34,928.000 $ 4,417.000 $ 6.665.000 $ 4,296.000 $ 14.421.000 $ 125,100.000 $ 3,120.000 $ (11,994.000) $ (10.000) $ (965.000) $ 343.000 $ (12,626.000) $ 124,558.000 $ $ 44,183.000 $ $ 70,869.000 $ 10/02/2022 3rd Quarter USD Unaudited Yes Millions 11,355.000 $ 21,585.000 $ 22,724.000 $ 16,091.000 $ 16,362.000 $ 201.000 $ 15,890.000 $ 1,730.000 $ 2,106.000 $ 7,839.000 $ 223.000 $ 16,139.000 1,696.000 2,324.000 $ 11,675.000 $ 3,592.000 $ 65,236.000 $ 46,681.000 $ 7,417.000 $ 11,437.000 $ 3,703.000 $ 63,847.000 $ 47,144.000 $ 28,529.000 $ 28,790.000 $ 18,152.000 $ 18,354.000 $ 40,336.000 $ 42,408.000 $ 33,383.000 $ 34,166.000 $ 9,392.000 $ 8,625.000 $ 9,514.000 $ 9,435.000 $ 175,124.000 $177,724.000 $ 4,424.000 $ 4,305.000 $ 10,153.000 $ 11,953.000 $ 07/03/2022 2nd Quarter USD Unaudited Yes Millions 10,983.000 $ 14,021.000 $ 3,006.000 $ 1,986.000 $ 45,543.000 $ 25,610.000 $ 1,985.000 $ 8.000 $ 27,603.000 $ 4,946.000 $ 8,353.000 $ (2,358.000) $ (922.000) $ (15,292.000) $ 9,765.000 $ 12,607.000 $ 13,447.000 $ 2,717.000 $ 1,980.000 $ 44,821.000 $ 26,297.000 $ 1,985.000 $ 10.000 $ 28,292.000 $ 5,015.000 8,553.000 4,162.000 $ 4,162.000 9,918.000 $ 100,525.000 $ 3,120.000 $ (11,974.000) $ 10,524.000 101,367.000 3,120.000 $ (10,722.000) $ (38.000) $ (36.000) $ (2,472.000) $ (613.000) $ (13,843.000) $ 127,917.000 $ 126,216.000 $ 41,146.000 $ 39,136.000 $ 74,599.000 $ 76,357.000 $ 04/03/2022 1st Quarter USD Unaudited Yes Millions 10,463.000 $ 19,925.000 $ 15,828.000 $ 234.000 $ 15,594.000 $ 1,679.000 $ 2,629.000 $ 6,682.000 $ 10,990.000 $ 3,452.000 $ 60,424.000 $ 47,702.000 $ 29,001.000 $ 18,701.000 $ 44,420.000 $ 34,935.000 $ 9,936.000 $ 9,939.000 $ 178,355.000 $ 4,297.000 $ 9,309.000 $ 13,006.000 $ 12,972.000 $ 2,098.000 $ 1,708.000 $ 43,390.000 $ 26,859.000 $ 1,985.000 $ 7.000 $ 28,851.000 $ 6,424.000 $ 8,739.000 $ 5,745.000 $ 10,497.000 $ 103,646.000 $ 3,120.000 $ (10,571.000) $ (16.000) (2,538.000) $ (632.000) $ (13,757.000) $ 124,380.000 $ 39,034.000 $ 74,709.000 $ 10/03/2021 3rd Quarter USD Unaudited Yes Millions 17,604.000 $ 13,397.000 $ 15,134.000 $ 223.000 $ 14,911.000 $ 1,587.000 $ 2,164.000 $ 6,636.000 $ 10,387.000 $ 3,590.000 $ 59,889.000 $ 47,347.000 $ 28,869.000 $ 18,478.000 $ 47,776.000 $ 35,569.000 $ 10,646.000 $ 6,870.000 $ 179,228.000 $ 3,798.000 $ 8,961.000 $ 13,812.000 $ 12,683.000 $ 3,146.000 $ 2,161.000 $ 44,561.000 $ 28,141.000 $ 1,984.000 $ 5.000 $ 30,130.000 $ 7,147.000 $ 10,171.000 $ 5.770.000 $ 11,177.000 $ 108,956.000 $ 3,120.000 $ (9,179.000) $ (6,257.000) $ 21.000 $ (15,415.000) $ 121,092.000 $ 38,525.000 $ 70,272.000 $ 07/04/2021 2nd Quarter USD Unaudited Yes Millions 14,332.000 $ 10,974.000 $ 15,105.000 $ 234.000 $ 14,871.000 $ 1,576.000 $ 2,307.000 $ 6,217.000 $ 10,100.000 $ 3,492.000 $ 53,769.000 $ 47,201.000 $ 28,569.000 $ 18,632.000 $ 50,244.000 $ 35,819.000 $ 10,804.000 $ 7,172.000 $ 176,440.000 3,173.000 $ 8,704.000 $ 10,485.000 $ 12.450.000 $ 2,709.000 $ 1,200.000 $ 38,721.000 $ 28,319.000 $ 1,984.000 $ 7.000 $ 30,310.000 $ 9,016.000 $ 10,367.000 $ 5,722.000 $ 12,724.000 $ 106,860.000 3,120.000 $ (8,797.000) $ $ (6,490.000) $ 187.000 $ (15,100.000) $ 120,154.000 $ 38,594.000 $ 69,580.000 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 PriceEarnings PE Ratio The PE ratio is calculated as the market price per share divided by the ear...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started