Answered step by step

Verified Expert Solution

Question

1 Approved Answer

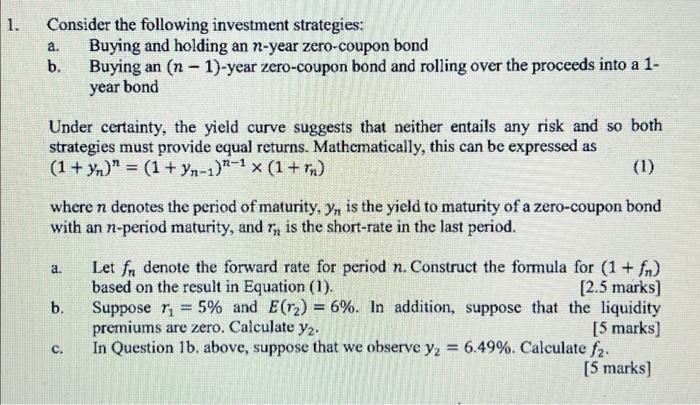

1. Consider the following investment strategies: a. b. Under certainty, the yield curve suggests that neither entails any risk and so both strategies must

1. Consider the following investment strategies: a. b. Under certainty, the yield curve suggests that neither entails any risk and so both strategies must provide equal returns. Mathematically, this can be expressed as (1 + y) = (1 + Yn-1)-1 x (1 + r) (1) where n denotes the period of maturity. Yn is the yield to maturity of a zero-coupon bond with an n-period maturity, and r,, is the short-rate in the last period. a. b. Buying and holding an n-year zero-coupon bond Buying an (n-1)-year zero-coupon bond and rolling over the proceeds into a 1- year bond C. Let fn denote the forward rate for period n. Construct the formula for (1 + fn) based on the result in Equation (1). [2.5 marks] Suppose = 5% and E(1) = 6%. In addition, suppose that the liquidity premiums are zero. Calculate y2. [5 marks] In Question 1b. above, suppose that we observe y = 6.49%. Calculate f. [5 marks]

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

b Buying Question Consider the following investment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e08454097a_180882.pdf

180 KBs PDF File

635e08454097a_180882.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started