Answered step by step

Verified Expert Solution

Question

1 Approved Answer

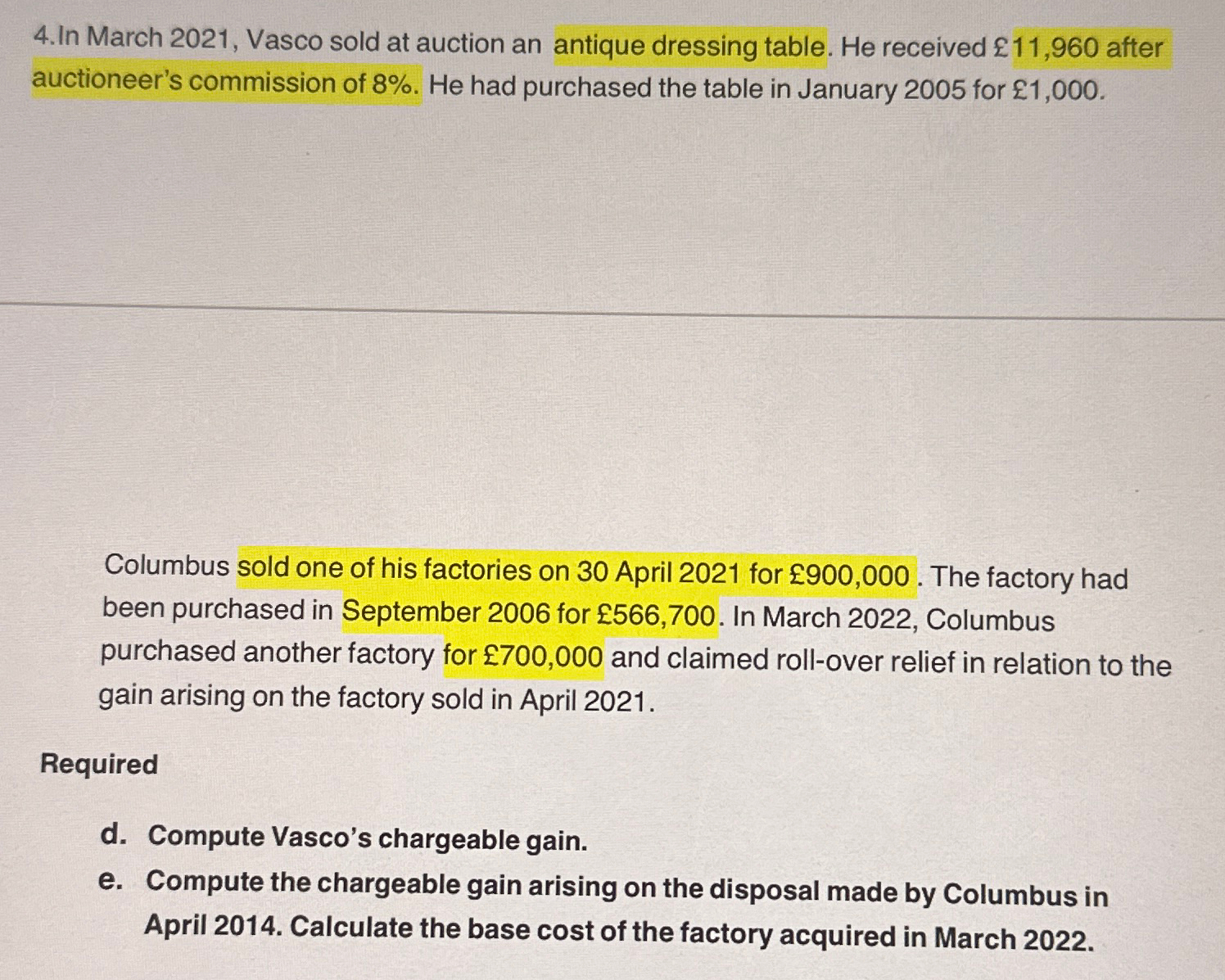

In March 2 0 2 1 , Vasco sold at auction an antique dressing table. He received 1 1 , 9 6 0 after auctioneer's

In March Vasco sold at auction an antique dressing table. He received after auctioneer's commission of He had purchased the table in January for

Columbus sold one of his factories on April for The factory had been purchased in September for In March Columbus purchased another factory for and claimed rollover relief in relation to the gain arising on the factory sold in April

Required

d Compute Vasco's chargeable gain.

e Compute the chargeable gain arising on the disposal made by Columbus in April Calculate the base cost of the factory acquired in March

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started