Question

In March 2020, gross salary amounts to NOK 250,000. The tax deduction amounts to NOK 75,000. The holiday pay rate is 12% and the employer

In March 2020, gross salary amounts to NOK 250,000. The tax deduction amounts to NOK 75,000. The holiday pay rate is 12% and the employer rate is 14.1%. The salary is paid on the 12th of each month, and the payment is made from the company's bank account. The company has a bank account for tax deductions.

a) carry out the calculations necessary for you to post the wage cost

b) what is the companys wage cost for march 2020?

c) how much does the companys costs increase when the employers contribution for march is paid 15.05? ( 15th may)

d) view the accounting. Use attachments

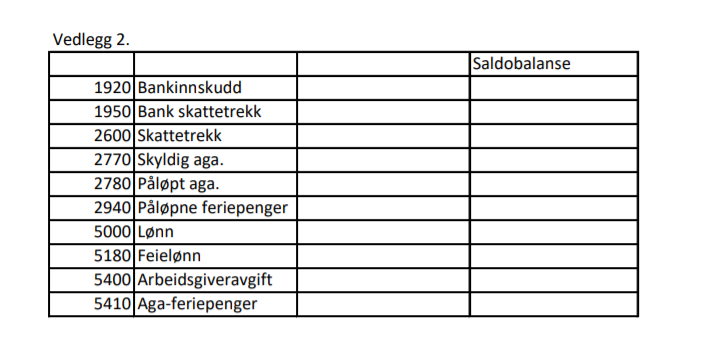

The attachment is in norwegian but it says:'

1920 bank deposits

1950 bank tax decuction

2600tax deductions

2770 guilty aga

2780 accrued aga

2940 ongoing vacaction money

5000 Salary

5180error pay

5400 employers tax

5410 aga vacation money

saldobalanse; balance

NOK is kr.

if task d is confusing, i appreciate a , b and c.

Vedlegg 2. Saldobalanse 1920 Bankinnskudd 1950 Bank skattetrekk 2600 Skattetrekk 2770 Skyldig aga. 2780 Plpt aga. 2940 Plpne feriepenger 5000 Lnn 5180 Feielnn 5400 Arbeidsgiveravgift 5410 Aga-feriepenger Vedlegg 2. Saldobalanse 1920 Bankinnskudd 1950 Bank skattetrekk 2600 Skattetrekk 2770 Skyldig aga. 2780 Plpt aga. 2940 Plpne feriepenger 5000 Lnn 5180 Feielnn 5400 Arbeidsgiveravgift 5410 Aga-feriepenger

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started