Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Moving Expenses) In May of the current year, following a dispute with her immediate superior, Ms. Elaine Fox resigned from her job in Halifax

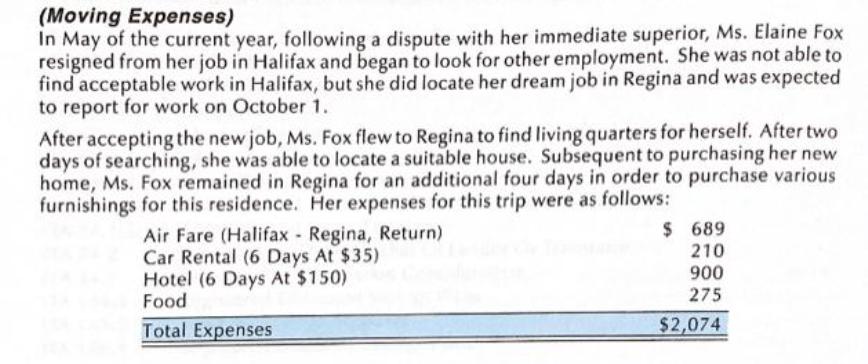

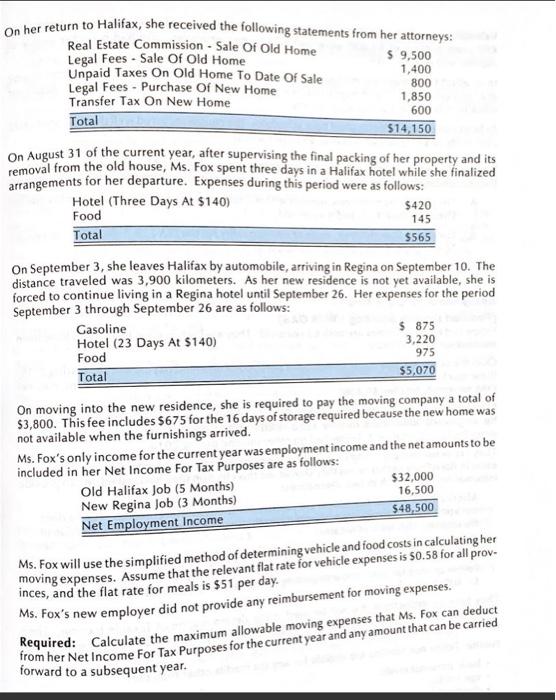

(Moving Expenses) In May of the current year, following a dispute with her immediate superior, Ms. Elaine Fox resigned from her job in Halifax and began to look for other employment. She was not able to find acceptable work in Halifax, but she did locate her dream job in Regina and was expected to report for work on October 1. After accepting the new job, Ms. Fox flew to Regina to find living quarters for herself. After two days of searching, she was able to locate a suitable house. Subsequent to purchasing her new home, Ms. Fox remained in Regina for an additional four days in order to purchase various furnishings for this residence. Her expenses for this trip were as follows: $ 689 Air Fare (Halifax Regina, Return) Car Rental (6 Days At $35) Hotel (6 Days At $150) Food 210 900 275 Total Expenses $2,074 ber return to Halifax, she received the following statements from her attorneys: Real Estate Commission - Sale Of Old Home Legal Fees - Sale Of Old Home Unpaid Taxes On Old Home To Date Of Sale Legal Fees - Purchase Of New Home Transfer Tax On New Home Total $ 9,500 1,400 800 1,850 600 $14,150 On August 31 of the current year, after supervising the final packing of her property and its removal from the old house, Ms. Fox spent three days in a Halifax hotel while she finalized arrangements for her departure. Expenses during this period were as follows: Hotel (Three Days At $140) Food $420 145 Total $565 On September 3, she leaves Halifax by automobile, arriving in Regina on September 10. The distance traveled was 3,900 kilometers. As her new residence is not yet available, she is forced to continue living in a Regina hotel until September 26. Her expenses for the period September 3 through September 26 are as follows: Gasoline Hotel (23 Days At $140) Food $ 875 3,220 975 Total $5,070 On moving into the new residence, she is required to pay the moving company a total of $3,800. This fee includes $675 for the 16 days of storage required because the new home was not available when the furnishings arrived. Ms. Fox's only income for the current year was employment income and the net amounts to be included in her Net Income For Tax Purposes are as follows: $32,000 16,500 Old Halifax Job (5 Months) New Regina Job (3 Months) Net Employment Income $48,500 Ms. Fox will use the simplified method of determining vehicle and food costs in calculating her moving expenses. Assume that the relevant flat rate for vehicle expenses is $0.58 for all prov- inces, and the flat rate for meals is $51 per day. Ms. Fox's new employer did not provide any reimbursement for moving expenses. fom her Net Income For Tax Purposes for the current year and any amount that can be carried forward to a subsequent year. Kequired: Calculate the maximum allowable moving expenses that Ms. Fox can deduct

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started