Answered step by step

Verified Expert Solution

Question

1 Approved Answer

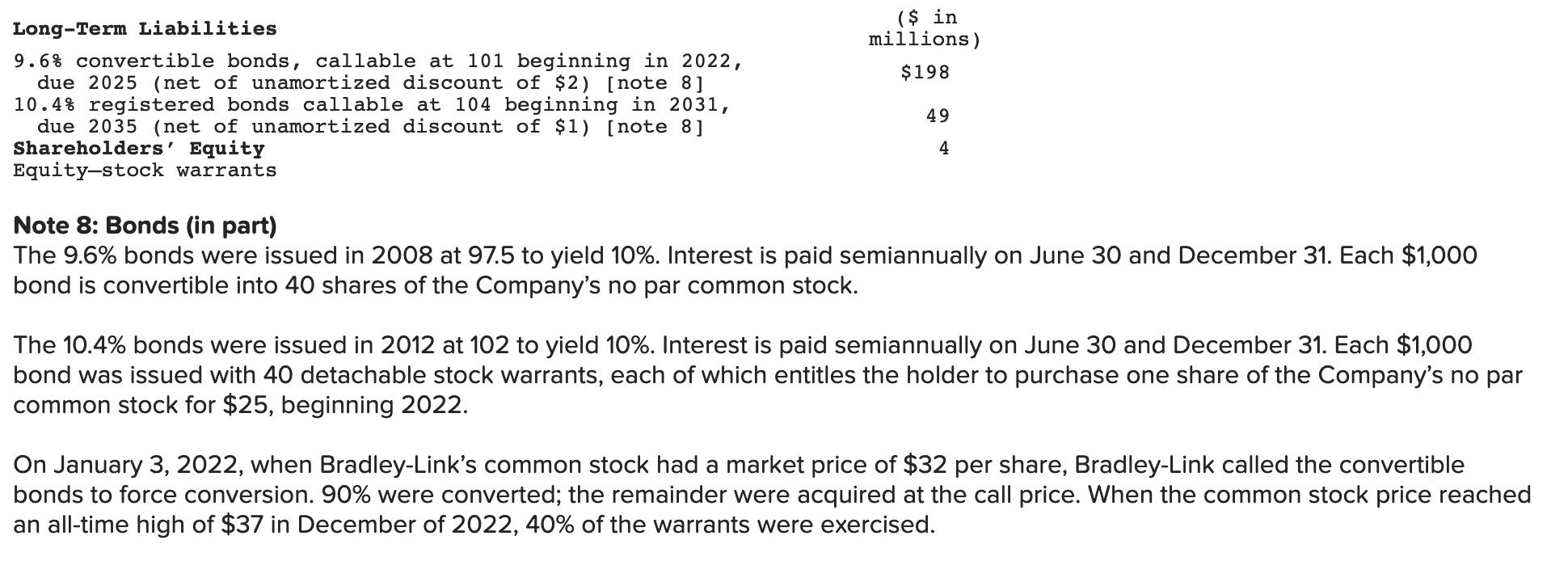

($ in millions) Long-Term Liabilities 9.6% convertible bonds, callable at 101 beginning in 2022, due 2025 (net of unamortized discount of $2) [note 8]

($ in millions) Long-Term Liabilities 9.6% convertible bonds, callable at 101 beginning in 2022, due 2025 (net of unamortized discount of $2) [note 8] 10.4% registered bonds callable at 104 beginning in 2031, due 2035 (net of unamortized discount of $1) [note 8] Shareholders' Equity Equity-stock warrants $198 49 4 Note 8: Bonds (in part) The 9.6% bonds were issued in 2008 at 97.5 to yield 10%. Interest is paid semiannually on June 30 and December 31. Each $1,O00 bond is convertible into 40 shares of the Company's no par common stock. The 10.4% bonds were issued in 2012 at 102 to yield 10%. Interest is paid semiannually on June 30 and December 31. Each $1,000 bond was issued with 40 detachable stock warrants, each of which entitles the holder to purchase one share of the Company's no par common stock for $25, beginning 2022. On January 3, 2022, when Bradley-Link's common stock had a market price of $32 per share, Bradley-Link called the convertible bonds to force conversion. 90% were converted; the remainder were acquired at the call price. When the common stock price reached an all-time high of $37 in December of 2022, 40% of the warrants were exercised.

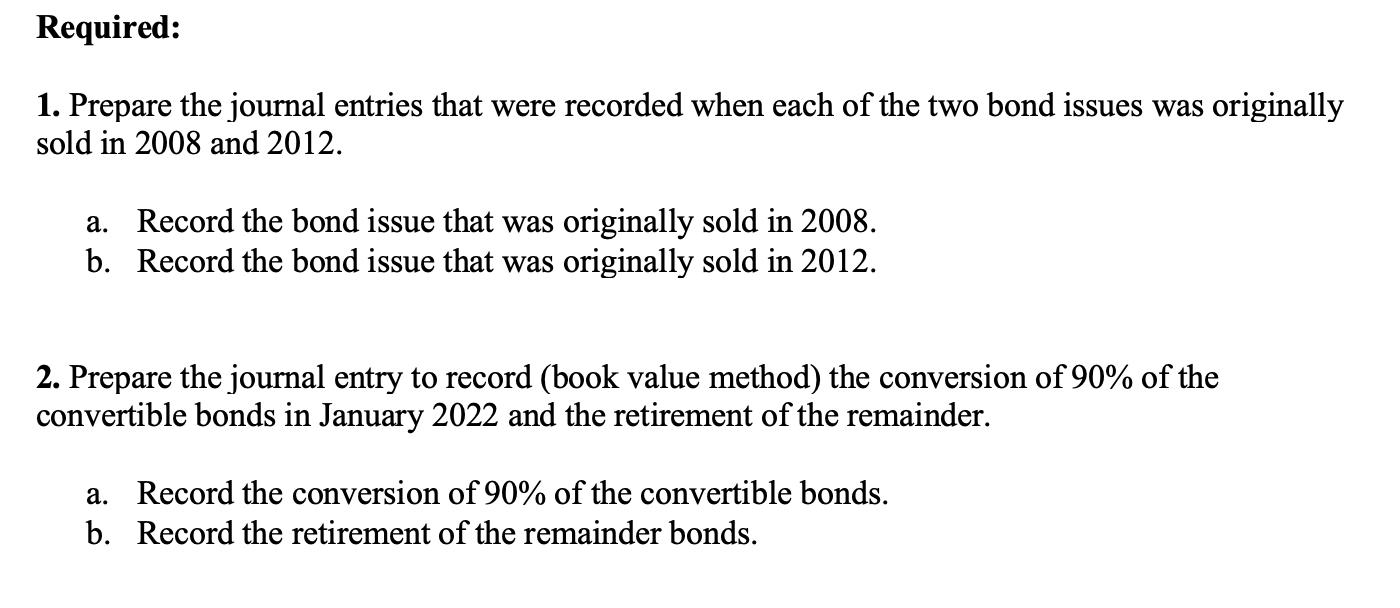

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 a Journal entry for the bonds issued in 2008 Date Account Title and Explanation Debit in million Credit in million 2008 Cash 200 million ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started