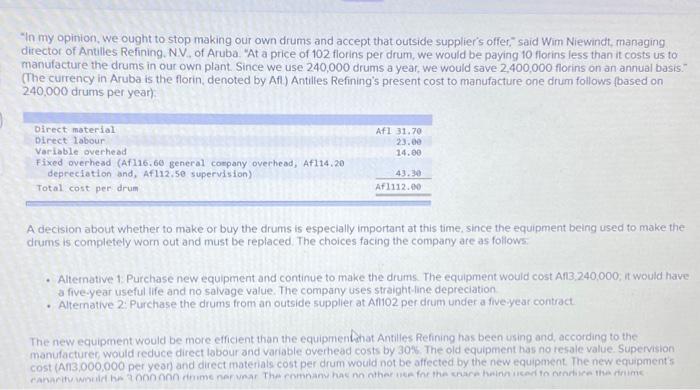

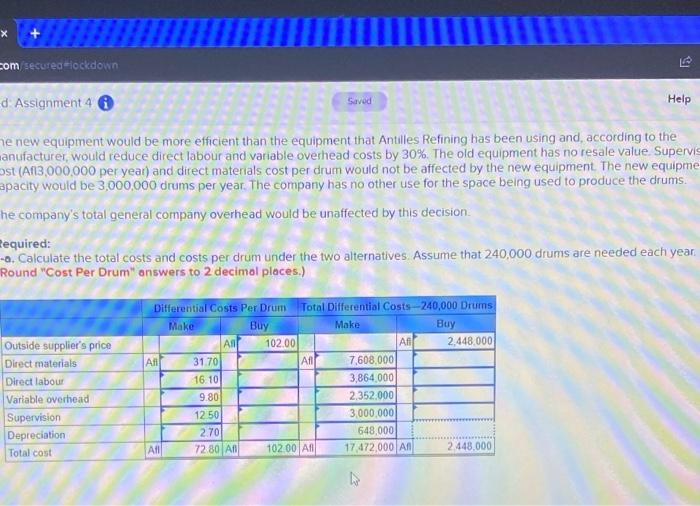

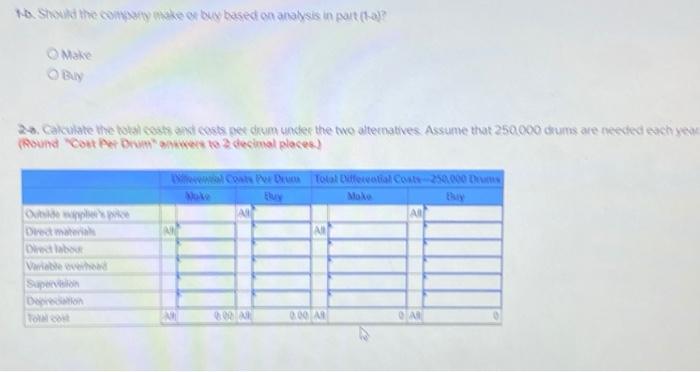

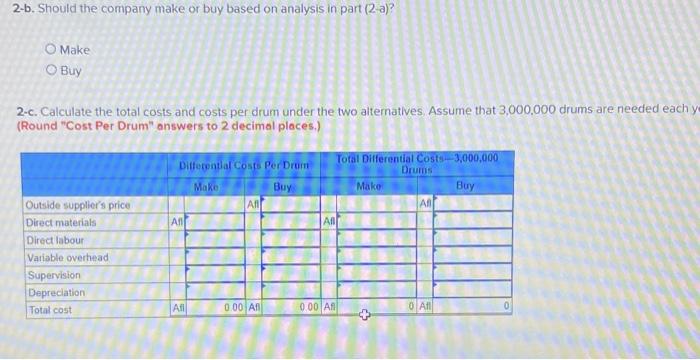

"In my opinion, we ought to stop making our own drums and accept that outside supplier's offer," said Wim Niewindt, managing director of Antiles Refining. N. ., of Aruba, "At a price of 102 florins per drum, we would be paying 10 florins less than it costs us to manufacture the drums in our own plant. Since we use 240,000 drums a year, we would save 2,400,000 florins on an annual basis. (The currency in Aruba is the florin, denoted by Afl.) Antilles Refining's present cost to manufacture one drum follows foased on 240,000 drums per year) A decision about whether to make or buy the drums is especially important at this time. since the equipment being used to make the drums is completely worn out and must be replaced. The choices facing the company are as follows: - Alternative 1: Purchase new equipment and continue to make the drums. The equipment would cost Afl3,240,000, it would have a five-year useful life and no salvage value. The company uses straight-line depreciation. - Altemative ?' Purchase the drums from an outside supplier at Aflo2 per drum under a five:year contract The new equipment would be more efficient than the equipmenhidat Antilles Refining has been using and, according to the manufacturer, would reduce direct labour and variable overhead costs by 30%. The old equipment has no resale value. Supervion enst iAfl3 000000 per yean and direct materials cost per drum would not be affected by the new equipment. The new equipments he new equipment would be more efficient than the equipment that Antilles Refining has been using and, according to the anufacturer, would reduce direct labour and variable overhead costs by 30%. The old equipment has no resale value Supervis st (Afl3,000,000 per year) and direct materials cost per drum would not be affected by the new equipment. The new equipme apacity would be 3,000,000 drums per year. The company has no other use for the space being used to produce the drums. he company's total general company overhead would be unaffected by this decision. equired: - Calculate the total costs and costs per drum under the two alternatives. Assume that 240,000 drums are needed each year. Round "Cost Per Drum" answers to 2 decimal places.) 16. Showhd the comphry nake or buy based on analysis in part (ha)? Make Bur (Aound "Cout Pet Bum" ankwers to 2 decimal places.) 2-b. Should the company make or buy based on analysis in part (2a)? Make Bur 2-c. Calculate the total costs and costs per drum under the two alternatives, Assume that 3,000,000 drums are needed each y (Round "Cost Per Drum" answers to 2 decimal places.) 2-d. Should the company make or buy based on analysis in part (2-c)? Make Buy