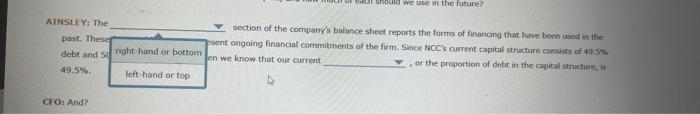

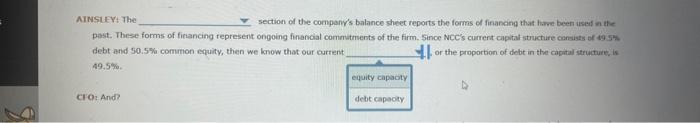

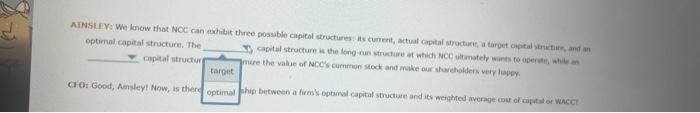

In nis private office, just down the hall from his conterence room, the Chef Financial Officer (CFO) of Nale Coristnaction Compony (NcC) is meeting with his newly hired assistant, Aindey. CFO: Before our next mecting with the bankers, let's take a second and make sure that we have a common understanding about the compsny's capital structure. We get to choose the form of money used to finance WeCs activities. We can use borrowed (debe) money or retained earnings, we can sell new shares of common stock, or we can sell new preferred wheros, 5o, my question to you, Ainsiey, is how do we know what sources of financing have been used in the past, and how much of each should we oie in the future? AustiY: The rection of the companys botance shect reports the fotris of financing that have becn used in the Dast. These forms of financing represent ongoing financial comnstments of the firm. Sence kcCs aurrent captid structure consests of 49.5\% debt and 50.5% common equity, then we know that our current. 49.54% Croi And? AWWSI EYI We know that FEC can exhibit three possible caphtal structures: its current, actuat cagital structure, a target capital structure, and an eptimhal capital structure. The capital stoscture is the long run structure at which NcC uhenately wants to ogerate, while an capital structure will maximize the value of NCCS common stock and make cur sharcholders vrry haper. CFO: Good, Aindifyl Now, is there a felatiomhip between a firmis optimal copital structure and its weiphted ayeraye cost of capetal or Whcci? AINSt EY; Yes, there is a relationship; not only will an optimal caputal structute maximite the value of a cocporaton, it will abo the company's WACC. However, the exact value of the that comreponds to an orpanization's. optimal capital stracture depends on its industry and the characteristics of the firm. CFOA Excellent overview, Ansleyt Youve phssed my fant test wath flying colorst With thas understanding of the theory and some real world expenence, youl be earning your bohus in no time. ATNSLFY; The past. Thes. section of the company's balance sheet reports the forms of financing that hatve been asod in the debt and 5 sent ongoing finBnicial cornmitments of the firm. Since NCC's current capital structure consists of 49.5%5 in we know that our current 49,5% AINSLEYt. The section of the company's balance sheet reports the forms of finaneing that have been ised at ule past. These fomms of ficiancing represent ongoing financial commitments of the firm. Since NCC's current capital stuucture cansists of 49 S-i. debt and 30.5% commion equity, then we lmow that our current or the proportion of debt in the capital structure, is 49,5% CIO:And? optimal capital structure. The cepital structui mite the value of NCCls cummon soct and make our shaveholders very hapcy CrOri Good, Ansleyl Now, is there thip between a fiems optimal capital structure and itw werghred average cour al mbit ad or whces ArmsirY: We know that NCC can exhibit three possible capital structuresi its current, actual capital structure, a tirget capral structure, aeid ai optimal capital structure, The capital structure is the lang-run structure at which NCC, ulimately wants to operate, while an ciapital structure will maximize the value of NCCis common stock and make our shareholders very hapoy. Sleyl Now, is there a relationship between a firm's optimal capatal structure and its weighted average cost of capirat or Whcc? AIT there is a rekationship; not only will an optimal capital structure maximize the value of a corperation, it will also the company's WACC. However the exact valua of the AINSi.F: Yes, there is a relationship; not only will an optimal capital structure maximize the value of a corporation, it will also the company's WACC, However, the exact volue of the that corresponds to an organizabion's opitinal capital ands on its industry and the characteristics of the firm. rerview, Ainsley! Yourve paissed my first test with fying colonit With this understanding of the theory and some rmat andid ou'll be earnifig your bohus in no time. NINStEY: We know that NCC can exhibit three possible capital structures: its current, actual capital structure, a farget capital strictige, and an optimal capital structure. The capital structure is the long-run structure at which NoC altimately wants in operate, whill an: capital struchure will maximize the value of NCC's common stock and make our sharcholders very happy CFO: Good, Ainsleyl Now, is there a relationship between a firm's optimal capital structure and its weighted averaige cost of capetal or Wace? AINStry: Yes, there is a relationship; not only will an optimal capital structure maximize the value of a corporation, it will also the company's WACC. However, the exact value of the , optimal copital structure depends on its industry and the characteristic that corresponds to an organimation CrO: Excellent overview, Ainsleyt You've passed my first test with fying col experience, you'll be earning your bonus in no tirne. In nis private office, just down the hall from his conterence room, the Chef Financial Officer (CFO) of Nale Coristnaction Compony (NcC) is meeting with his newly hired assistant, Aindey. CFO: Before our next mecting with the bankers, let's take a second and make sure that we have a common understanding about the compsny's capital structure. We get to choose the form of money used to finance WeCs activities. We can use borrowed (debe) money or retained earnings, we can sell new shares of common stock, or we can sell new preferred wheros, 5o, my question to you, Ainsiey, is how do we know what sources of financing have been used in the past, and how much of each should we oie in the future? AustiY: The rection of the companys botance shect reports the fotris of financing that have becn used in the Dast. These forms of financing represent ongoing financial comnstments of the firm. Sence kcCs aurrent captid structure consests of 49.5\% debt and 50.5% common equity, then we know that our current. 49.54% Croi And? AWWSI EYI We know that FEC can exhibit three possible caphtal structures: its current, actuat cagital structure, a target capital structure, and an eptimhal capital structure. The capital stoscture is the long run structure at which NcC uhenately wants to ogerate, while an capital structure will maximize the value of NCCS common stock and make cur sharcholders vrry haper. CFO: Good, Aindifyl Now, is there a felatiomhip between a firmis optimal copital structure and its weiphted ayeraye cost of capetal or Whcci? AINSt EY; Yes, there is a relationship; not only will an optimal caputal structute maximite the value of a cocporaton, it will abo the company's WACC. However, the exact value of the that comreponds to an orpanization's. optimal capital stracture depends on its industry and the characteristics of the firm. CFOA Excellent overview, Ansleyt Youve phssed my fant test wath flying colorst With thas understanding of the theory and some real world expenence, youl be earning your bohus in no time. ATNSLFY; The past. Thes. section of the company's balance sheet reports the forms of financing that hatve been asod in the debt and 5 sent ongoing finBnicial cornmitments of the firm. Since NCC's current capital structure consists of 49.5%5 in we know that our current 49,5% AINSLEYt. The section of the company's balance sheet reports the forms of finaneing that have been ised at ule past. These fomms of ficiancing represent ongoing financial commitments of the firm. Since NCC's current capital stuucture cansists of 49 S-i. debt and 30.5% commion equity, then we lmow that our current or the proportion of debt in the capital structure, is 49,5% CIO:And? optimal capital structure. The cepital structui mite the value of NCCls cummon soct and make our shaveholders very hapcy CrOri Good, Ansleyl Now, is there thip between a fiems optimal capital structure and itw werghred average cour al mbit ad or whces ArmsirY: We know that NCC can exhibit three possible capital structuresi its current, actual capital structure, a tirget capral structure, aeid ai optimal capital structure, The capital structure is the lang-run structure at which NCC, ulimately wants to operate, while an ciapital structure will maximize the value of NCCis common stock and make our shareholders very hapoy. Sleyl Now, is there a relationship between a firm's optimal capatal structure and its weighted average cost of capirat or Whcc? AIT there is a rekationship; not only will an optimal capital structure maximize the value of a corperation, it will also the company's WACC. However the exact valua of the AINSi.F: Yes, there is a relationship; not only will an optimal capital structure maximize the value of a corporation, it will also the company's WACC, However, the exact volue of the that corresponds to an organizabion's opitinal capital ands on its industry and the characteristics of the firm. rerview, Ainsley! Yourve paissed my first test with fying colonit With this understanding of the theory and some rmat andid ou'll be earnifig your bohus in no time. NINStEY: We know that NCC can exhibit three possible capital structures: its current, actual capital structure, a farget capital strictige, and an optimal capital structure. The capital structure is the long-run structure at which NoC altimately wants in operate, whill an: capital struchure will maximize the value of NCC's common stock and make our sharcholders very happy CFO: Good, Ainsleyl Now, is there a relationship between a firm's optimal capital structure and its weighted averaige cost of capetal or Wace? AINStry: Yes, there is a relationship; not only will an optimal capital structure maximize the value of a corporation, it will also the company's WACC. However, the exact value of the , optimal copital structure depends on its industry and the characteristic that corresponds to an organimation CrO: Excellent overview, Ainsleyt You've passed my first test with fying col experience, you'll be earning your bonus in no tirne