Madhu and Neha were partners in a firm sharing profits and losses in the ratio of 3 : 5. Their fixed capitals were Rs.4,

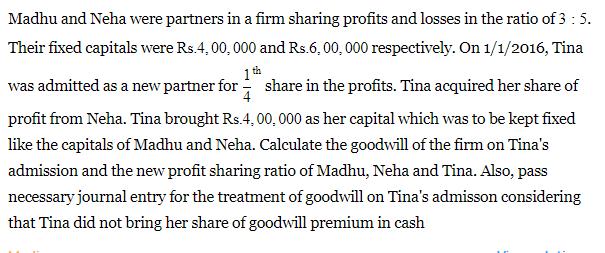

Madhu and Neha were partners in a firm sharing profits and losses in the ratio of 3 : 5. Their fixed capitals were Rs.4, 00, 000 and Rs.6, 00, 000 respectively. On 1/1/2016, Tina 1 th was admitted as a new partner for share in the profits. Tina acquired her share of 4 profit from Neha. Tina brought Rs.4, 00, 000 as her capital which was to be kept fixed like the capitals of Madhu and Neha. Calculate the goodwill of the firm on Tina's admission and the new profit sharing ratio of Madhu, Neha and Tina. Also, pass necessary journal entry for the treatment of goodwill on Tina's admisson considering that Tina did not bring her share of goodwill premium in cash

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Working Notes Calculation of Tinas Share of Goodwill Hidden T...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started