In November 2017, a company issued an initial public offering (IPO) on the Toronto Stock Exchange. Shares purchased under the IPO were sold at $20.50

In November 2017, a company issued an initial public offering (IPO) on the Toronto Stock Exchange. Shares purchased under the IPO were sold at $20.50 per share. A shareholder purchased 1,000 of the company's shares in January 2018, and paid $24 per share at that time. Identify which of the following statements about the impact of the shares sold on the company's financial position are correct.

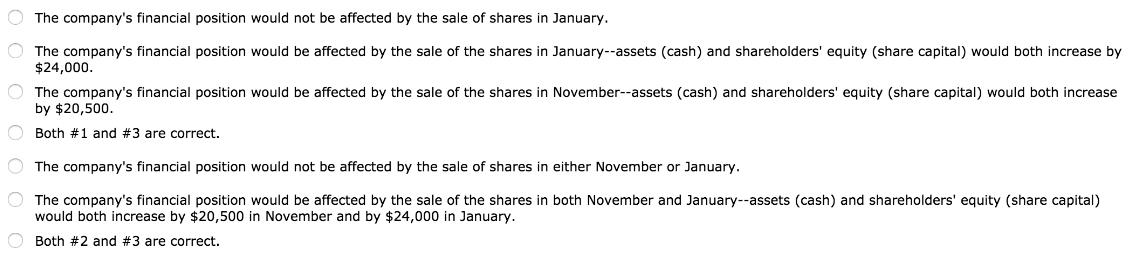

The company s financial position would not be affected by the sale of shares in January. The company s financial position would be affected by the sale of the shares in January--assets (cash) and shareholders equity (share capital) would both increase by $24,000. The company s financial position would be affected by the sale of the shares in November--assets (cash) and shareholders equity (share capital) would both increase by $20,500. Both #1 and #3 are correct. The company s financial position would not be affected by the sale of shares in either November or January. The company s financial position would be affected by the sale of the shares in both November and January--assets (cash) and shareholders equity (share capital) would both increase by $20,500 in November and by $24,000 in January. Both #2 and #3 are correct.

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer with explanation is given below 4th option is correct that 1 and 3 are cor...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started