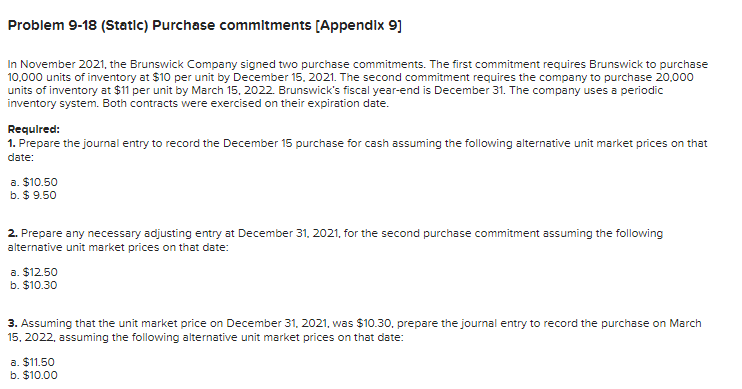

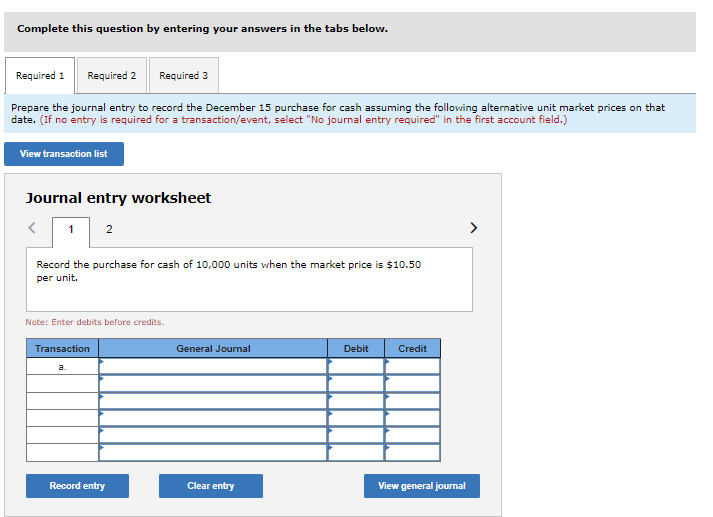

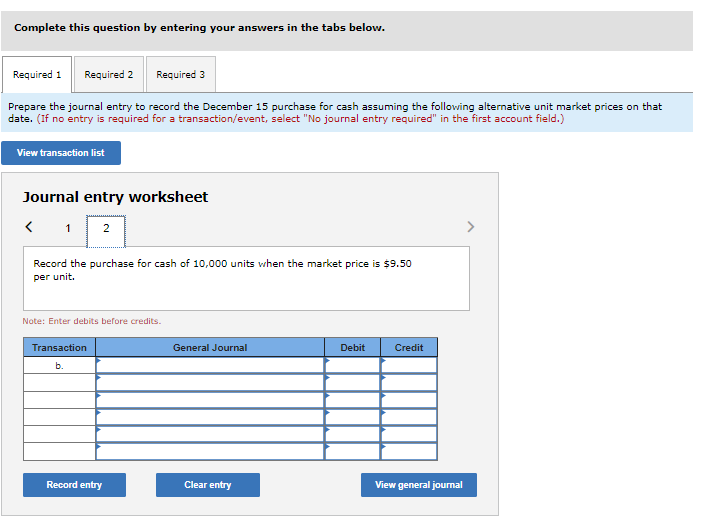

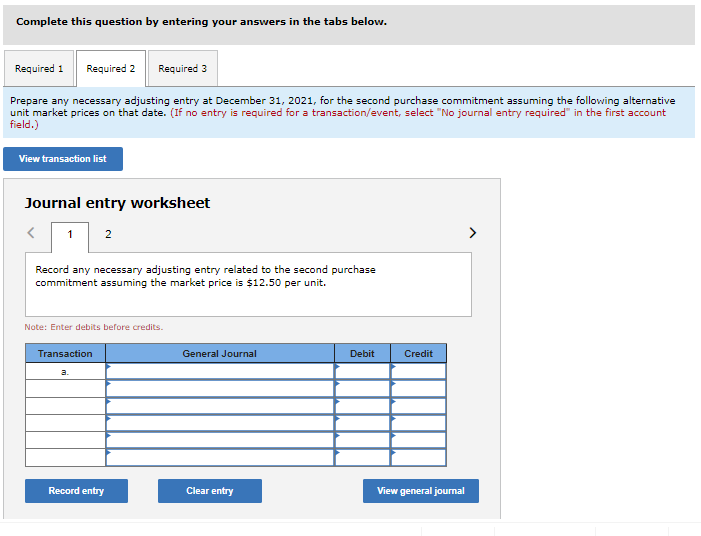

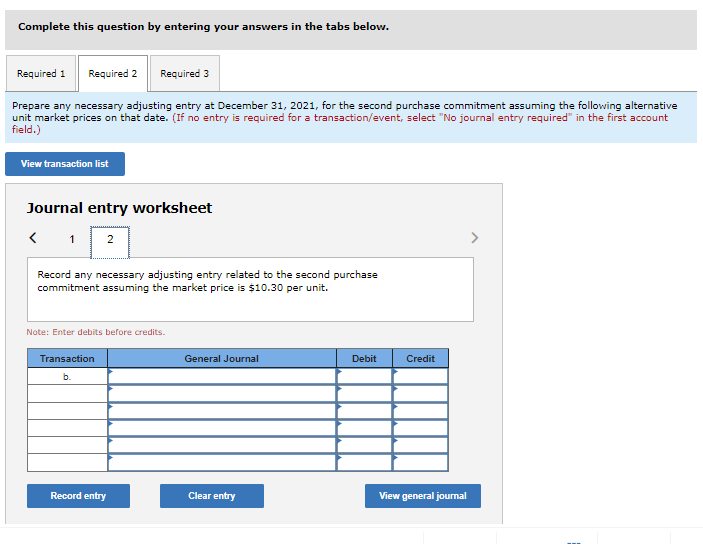

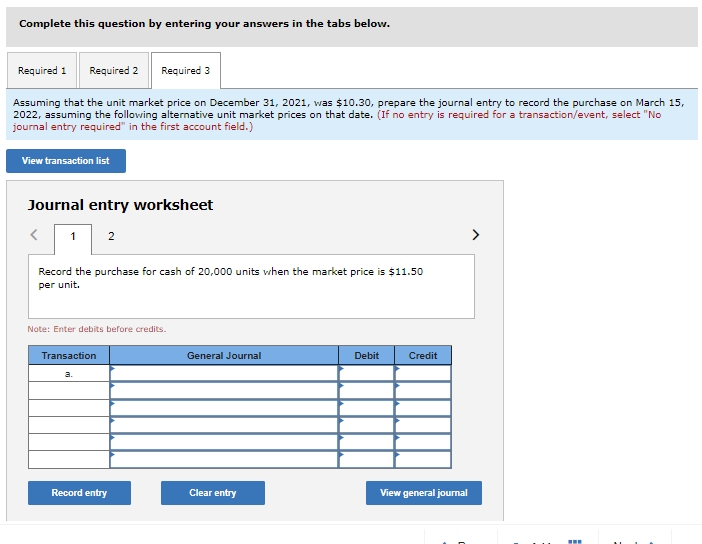

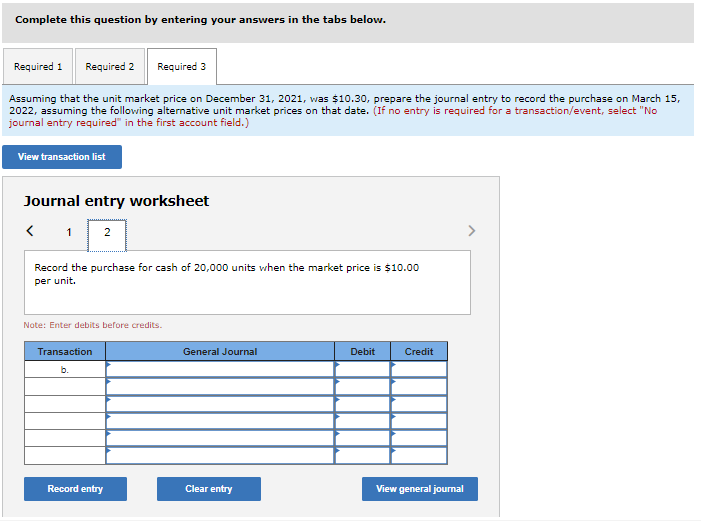

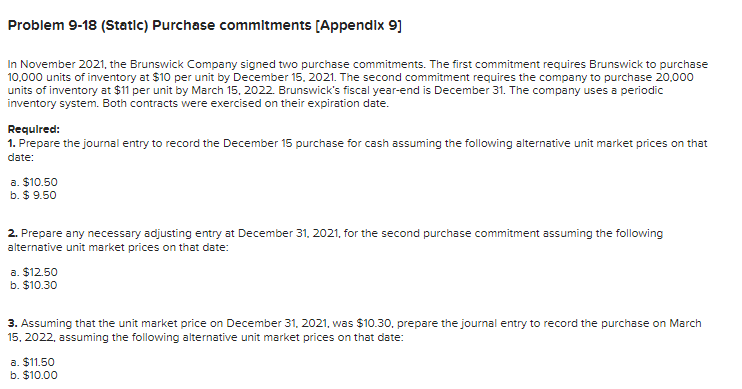

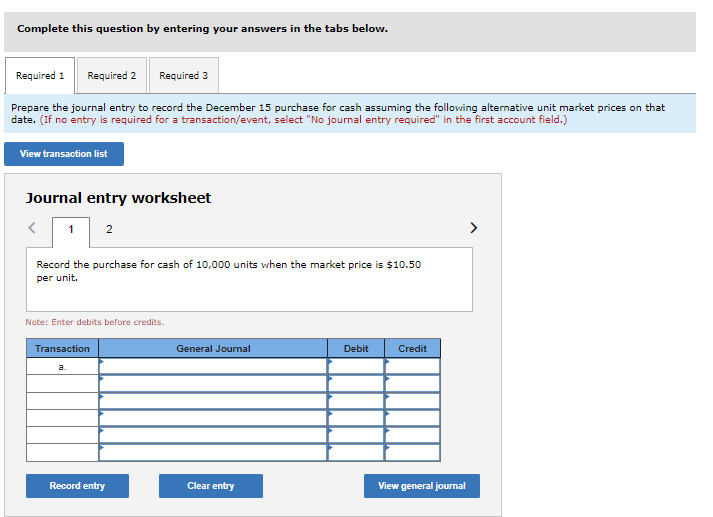

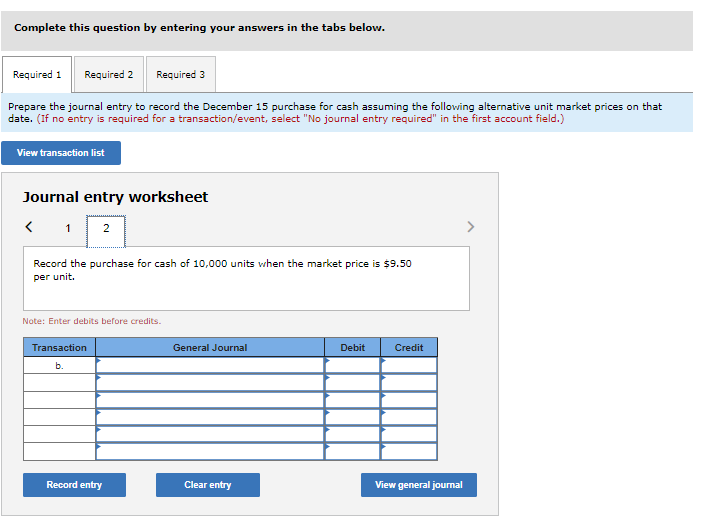

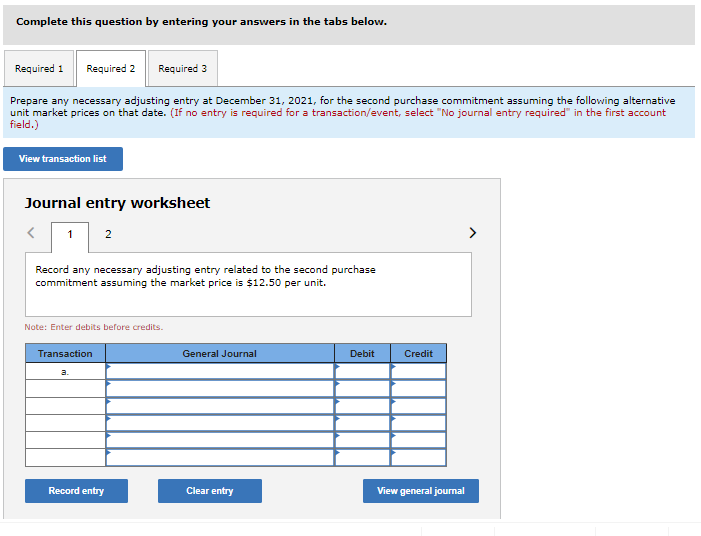

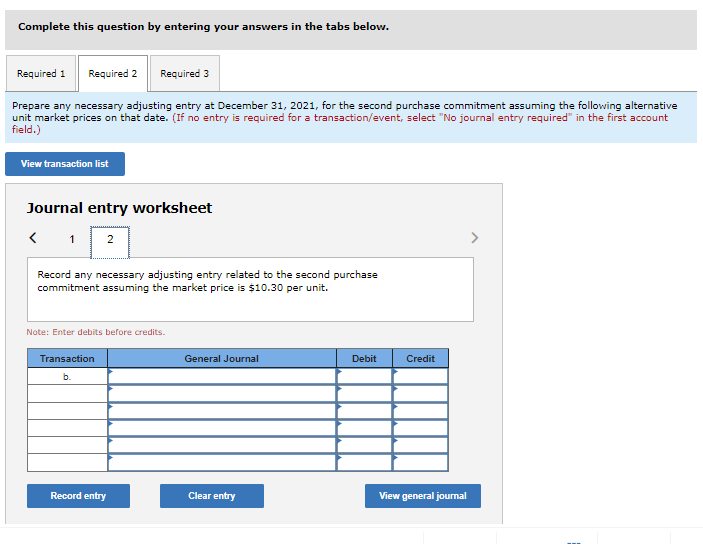

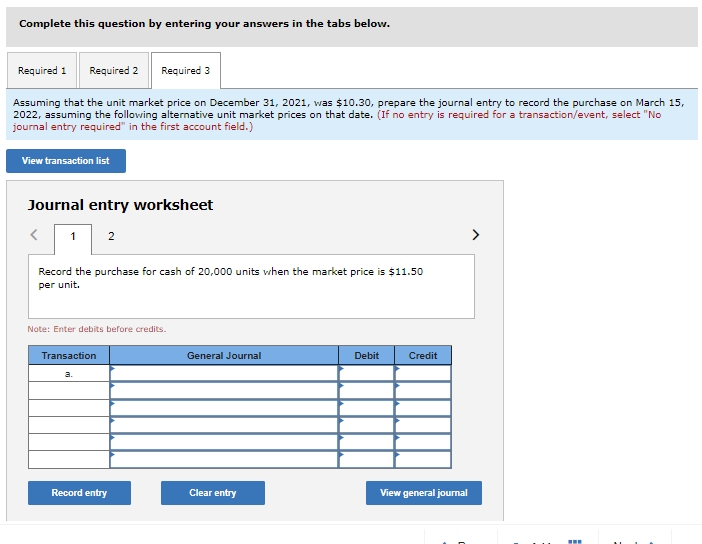

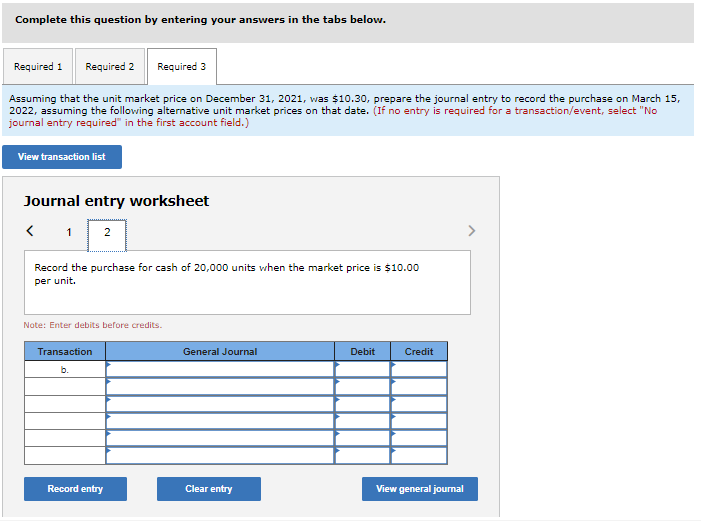

In November 2021, the Brunswick Company signed two purchase commitments. The first commitment requires Brunswick to purchase 10,000 units of inventory at $10 per unit by December 15,2021 . The second commitment requires the company to purchase 20,000 units of inventory at $11 per unit by March 15, 2022. Brunswick's fiscal year-end is December 31 . The company uses a periodic inventory system. Both contracts were exercised on their expiration date. Required: 1. Prepare the journal entry to record the December 15 purchase for cash assuming the following alternative unit market prices on that date: a. $10.50 b. $9.50 2. Prepare any necessary adjusting entry at December 31,2021 , for the second purchase commitment assuming the following alternative unit market prices on that date: a. $12.50 b. $10.30 3. Assuming that the unit market price on December 31,2021 , was $10.30, prepare the journal entry to record the purchase on March 15, 2022, assuming the following alternative unit market prices on that date: a. $11.50 b. $10.00 Complete this question by entering your answers in the tabs below. Prepare the journal entry to record the December 15 purchase for cash assuming the following alternative unit market prices on that Uate. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the purchase for cash of 10,000 units when the market price is $10.50 per unit. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare the journal entry to record the December 15 purchase for cash assuming the following alternative unit market prices on that date. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the purchase for cash of 10,000 units when the market price is $9.50 per unit. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare any necessary adjusting entry at December 31,2021, for the second purchase commitment assuming the following alternative unit market prices on that date. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record any necessary adjusting entry related to the second purchase commitment assuming the market price is $12.50 per unit. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare any necessary adjusting entry at December 31,2021, for the second purchase commitment assuming the following alternative unit market prices on that date. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record any necessary adjusting entry related to the second purchase commitment assuming the market price is $10.30 per unit. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Assuming that the unit market price on December 31,2021 , was $10.30, prepare the journal entry to record the purchase on March 15, 2022 , assuming the following alternative unit market prices on that date. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the purchase for cash of 20,000 units when the market price is $11.50 per unit. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Assuming that the unit market price on December 31,2021 , was $10.30, prepare the journal entry to record the purchase on March 15, 2022 , assuming the following alternative unit market prices on that date. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the purchase for cash of 20,000 units when the market price is $10.00 per unit. Note: Enter debits before credits