Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In November 2023, Kay followed her plans. She dropped out of college, created a business plan, and incorporated her business as Kay's Bakery, Inc.

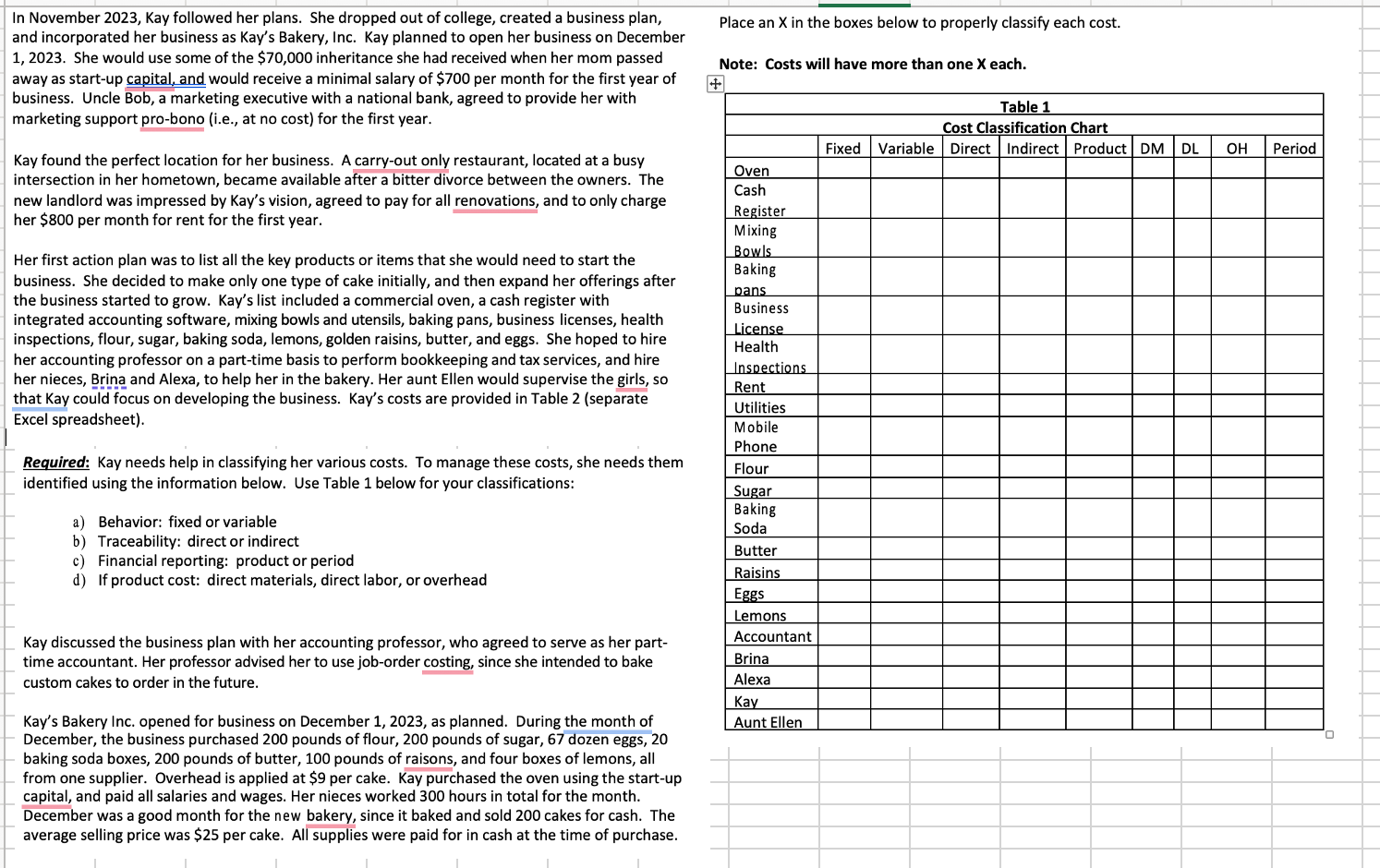

In November 2023, Kay followed her plans. She dropped out of college, created a business plan, and incorporated her business as Kay's Bakery, Inc. Kay planned to open her business on December 1, 2023. She would use some of the $70,000 inheritance she had received when her mom passed away as start-up capital, and would receive a minimal salary of $700 per month for the first year of business. Uncle Bob, a marketing executive with a national bank, agreed to provide her with marketing support pro-bono (i.e., at no cost) for the first year. Kay found the perfect location for her business. A carry-out only restaurant, located at a busy intersection in her hometown, became available after a bitter divorce between the owners. The new landlord was impressed by Kay's vision, agreed to pay for all renovations, and to only charge her $800 per month for rent for the first year. Her first action plan was to list all the key products or items that she would need to start the business. She decided to make only one type of cake initially, and then expand her offerings after the business started to grow. Kay's list included a commercial oven, a cash register with integrated accounting software, mixing bowls and utensils, baking pans, business licenses, health inspections, flour, sugar, baking soda, lemons, golden raisins, butter, and eggs. She hoped to hire her accounting professor on a part-time basis to perform bookkeeping and tax services, and hire her nieces, Brina and Alexa, to help her in the bakery. Her aunt Ellen would supervise the girls, so that Kay could focus on developing the business. Kay's costs are provided in Table 2 (separate Excel spreadsheet). Required: Kay needs help in classifying her various costs. To manage these costs, she needs them identified using the information below. Use Table 1 below for your classifications: a) Behavior: fixed or variable b) Traceability: direct or indirect c) Financial reporting: product or period d) If product cost: direct materials, direct labor, or overhead + Place an X in the boxes below to properly classify each cost. Note: Costs will have more than one X each. Oven Cash Register Mixing Bowls Baking pans Business License Health Inspections Rent Utilities Mobile Phone Flour Sugar Baking Soda Butter Raisins Table 1 Cost Classification Chart Fixed Variable Direct Indirect Product DM DL OH Period Kay discussed the business plan with her accounting professor, who agreed to serve as her part- time accountant. Her professor advised her to use job-order costing, since she intended to bake custom cakes to order in the future. Kay's Bakery Inc. opened for business on December 1, 2023, as planned. During the month of December, the business purchased 200 pounds of flour, 200 pounds of sugar, 67 dozen eggs, 20 baking soda boxes, 200 pounds of butter, 100 pounds of raisons, and four boxes of lemons, all from one supplier. Overhead is applied at $9 per cake. Kay purchased the oven using the start-up capital, and paid all salaries and wages. Her nieces worked 300 hours in total for the month. December was a good month for the new bakery, since it baked and sold 200 cakes for cash. The average selling price was $25 per cake. All supplies were paid for in cash at the time of purchase. Eggs Lemons Accountant Brina Alexa Kay Aunt Ellen

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started