Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In October 2019 a city levies property taxes of $520 million for the year beginning January 1, 2019. During 2019 it collects $415 million.

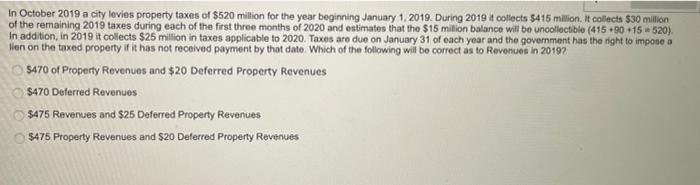

In October 2019 a city levies property taxes of $520 million for the year beginning January 1, 2019. During 2019 it collects $415 million. It collects $30 million of the remaining 2019 taxes during each of the first three months of 2020 and estimates that the $15 million balance will be uncollectible (415+90 +15=520). In addition, in 2019 it collects $25 million in taxes applicable to 2020. Taxes are due on January 31 of each year and the government has the right to impose a lien on the taxed property if it has not received payment by that date. Which of the following will be correct as to Revenues in 2019? $470 of Property Revenues and $20 Deferred Property Revenues $470 Deferred Revenues $475 Revenues and $25 Deferred Property Revenues $475 Property Revenues and $20 Deferred Property Revenues

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Step ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started