In one of our worksheets, we found the minimum variance portfolio. This is not the optimal portfolio, so let's try that now. A fund

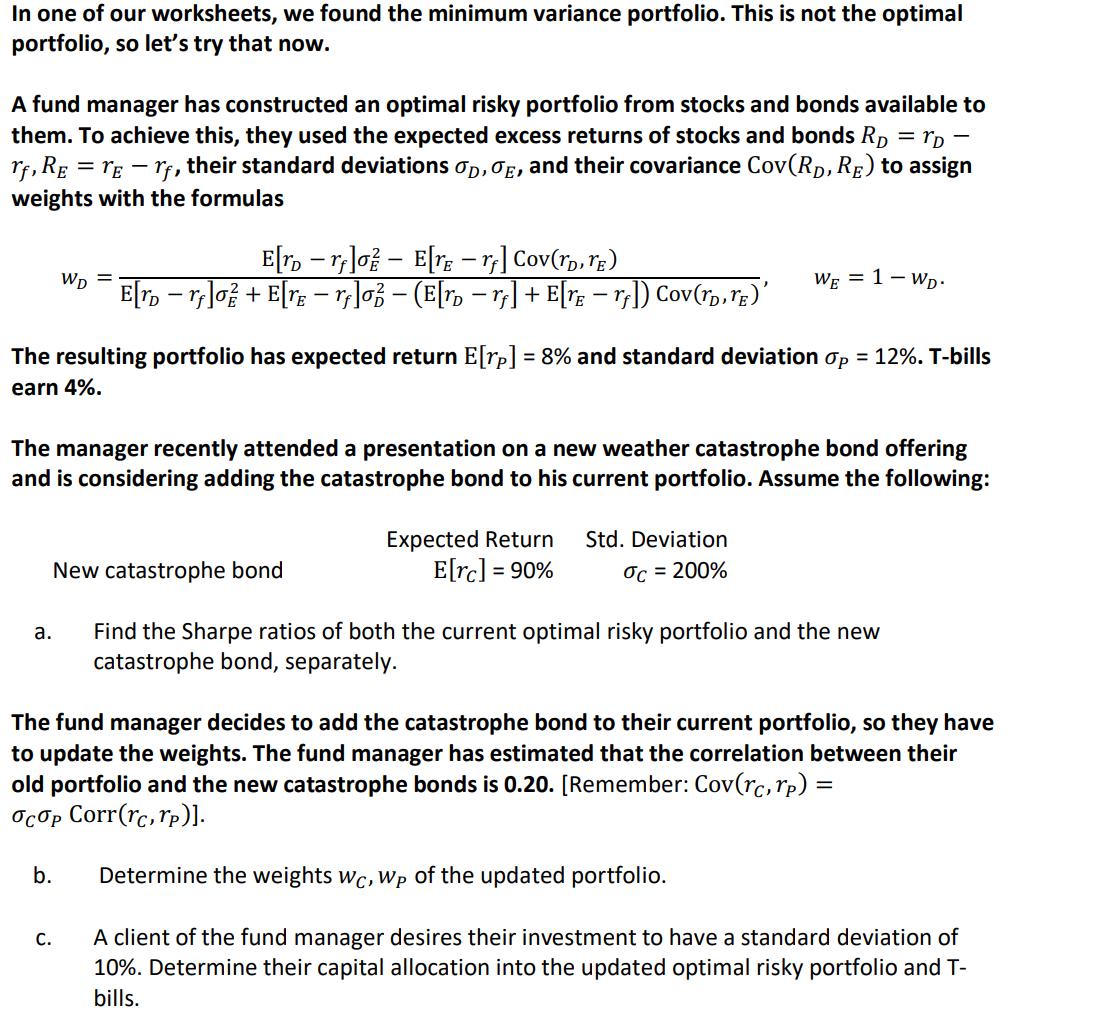

In one of our worksheets, we found the minimum variance portfolio. This is not the optimal portfolio, so let's try that now. A fund manager has constructed an optimal risky portfolio from stocks and bonds available to them. To achieve this, they used the expected excess returns of stocks and bonds Rp = rp - rf, RE = TE - rf, their standard deviations op, E, and their covariance Cov(RD, RE) to assign weights with the formulas The resulting portfolio has expected return E[rp] = 8% and standard deviation Op = 12%. T-bills earn 4%. E[r - ro E[re -rf] Cov(TD, TE) WD E[r r]0 + E[r r]0 (E[r r] + E[re r]) Cov(rd rE)' The manager recently attended a presentation on a new weather catastrophe bond offering and is considering adding the catastrophe bond to his current portfolio. Assume the following: a. New catastrophe bond b. C. WE = 1 - WD. Expected Return E[rc] = 90% Std. Deviation oc = 200% The fund manager decides to add the catastrophe bond to their current portfolio, so they have to update the weights. The fund manager has estimated that the correlation between their old portfolio and the new catastrophe bonds is 0.20. [Remember: Cov(rc, rp) = cp Corr(rc,rp)]. Determine the weights Wc, Wp of the updated portfolio. A client of the fund manager desires their investment to have a standard deviation of 10%. Determine their capital allocation into the updated optimal risky portfolio and T- bills. Find the Sharpe ratios of both the current optimal risky portfolio and the new catastrophe bond, separately.

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a The Sharpe ratio is calculated as the excess return of an assetportfolio divided by its standard d...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started