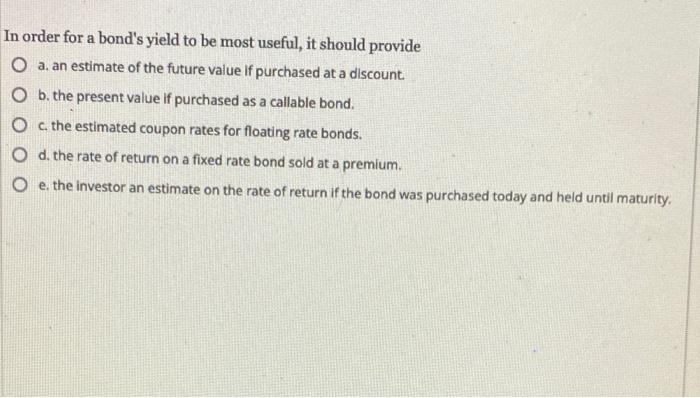

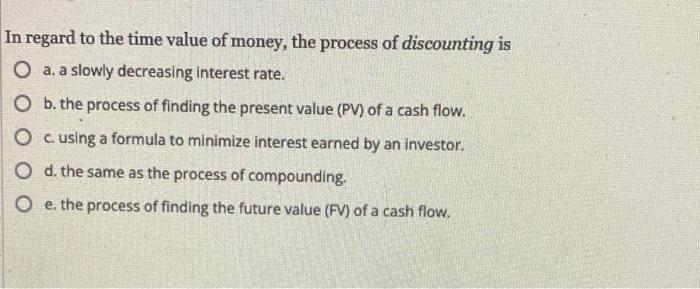

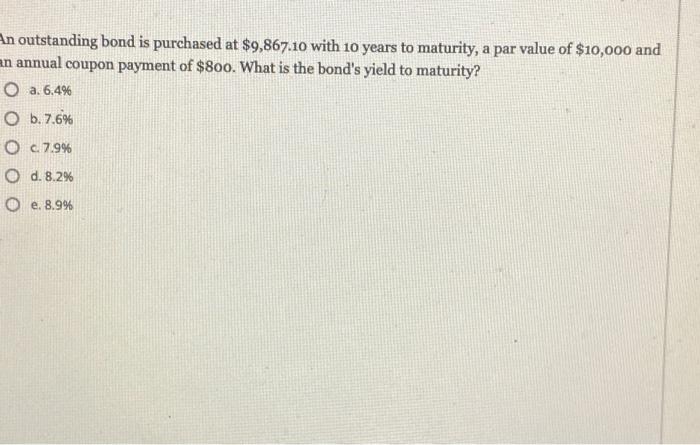

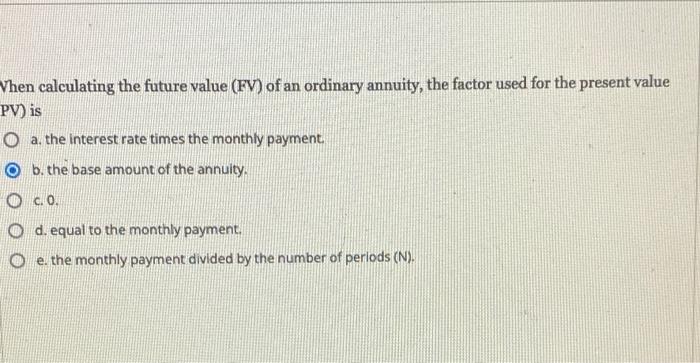

In order for a bond's yield to be most wel should provide O estimate of the few purchased at O the present or purchased and O c. the estimated cures for tong rate bones Od thereof return on the rate bond som o the western stimate on the truth and purchased In regard to the time value of money, the percen of discounting is a. a slowly decreasing interest rate Ob the process of finding the present value of a cash low Ocusing a formula to minimize rest earned by an inverte Od the same as the process of compounding e. the process of finding the future value of a cash from In outstanding bend is purchased at 9.867.10 with 20 years to po 10.000 and un coupon payment of oo. What is the bodyield to mais! O O O O. Vhen calculating the future value (FV) of an ordinary annuity, the fact wel sat the permet value PV) is the rest Metimes the monthly payment the base amount of the annuity 40 dequal to the money the moment divided by the number of In order for a bond's yield to be most useful, it should provide O a. an estimate of the future value of purchased at a discount O b. the present value if purchased as a callable bond. O c the estimated coupon rates for floating rate bonds. O d. the rate of return on a fixed rate bond sold at a premium. O e the investor an estimate on the rate of return if the bond was purchased today and held until maturity. In regard to the time value of money, the process of discounting is O a. a slowly decreasing interest rate. O b. the process of finding the present value (PV) of a cash flow. O c. using a formula to minimize interest earned by an investor. O d. the same as the process of compounding. O e. the process of finding the future value (FV) of a cash flow. An outstanding bond is purchased at $9,867.10 with 10 years to maturity, a par value of $10,000 and an annual coupon payment of $800. What is the bond's yield to maturity? O a. 6.4% O b.7.6% O c. 7.9% O d. 8.2% O e. 8.9% Vhen calculating the future value (FV) of an ordinary annuity, the factor used for the present value PV) is O a. the interest rate times the monthly payment O b. the base amount of the annuity O co. O d. equal to the monthly payment. @ e. the monthly payment divided by the number of periods (N)