Answered step by step

Verified Expert Solution

Question

1 Approved Answer

in order left to right and up and down for drop down options it is higher/lower senior/junior are/are not agency/municiple are noncallable/carry a deferred call/are

in order left to right and up and down for drop down options it is

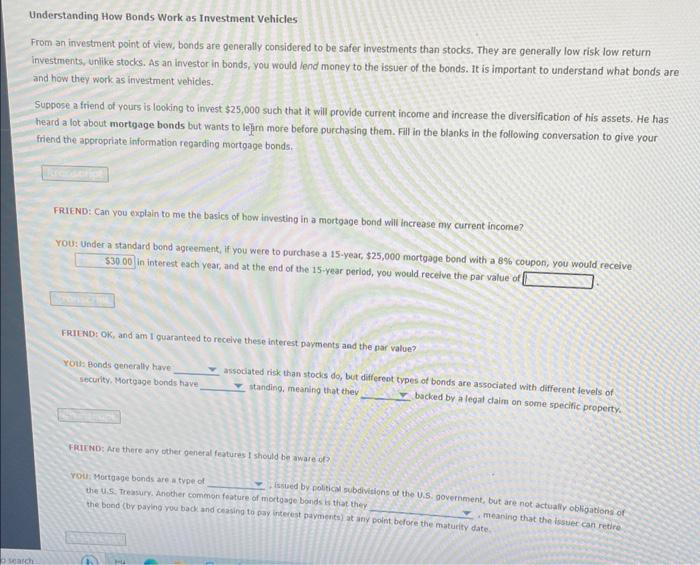

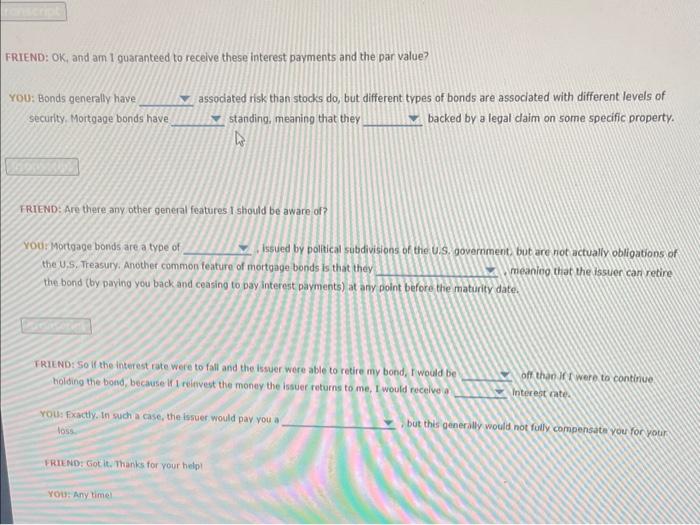

rom an investment point of view, bonds are generally considered to be safer investments than stocks. They are generally low risk low return ivestments, unilike stocks. As an investor in bonds, you would lend money to the issuer of the bonds. it is important to understand what bonds ar ind how they work as investment vehicles. Suppose a friend of yours is looking to invest $25,000 such that it will provide current income and increase the diversification of his assets. He has heard a lot about mortgage bonds but wants to lejm more before purchasing them. Fill in the blanks in the following conversation to give your firiend the appropriate information regarding mortgage bonds. FRIEND: Can you explain to me the basics of bow investing in a mortgage bond will increase my current income? You: Under a standard bond agreement, if you were to purchase a 15-year, $25,000 mortgage bond with a 8% coupon, you would receive in interest each year, and at the end of the 15-year period, you would receive the par value of FRIEN: OK, and am 1 guaranteed to recelve these interest payments and the par value? Yous Bonds generally have security, Mortgage bonds have arsociated risk than stochs 0, but differeot types of bonds are associated with different levels of standing, meaning that they bucked by a legal claim on some specific property. Firno: Are there any ther general features 1 should be aware ot? You: Hortgage bonds are a tvoe-of the tis. Freasury. Another commen feature of mortgage bonds by that the y the bood (by paying you bach and ciasing to pay interest paymente) at any FRIEND: OK, and am 1 quaranteed to receive these interest payments and the par value? You: Bonds generally have assodated risk than stocks do, but different types of bonds are associated with different levels of secuitity, Mortgage bonds have standing, meaning that they backed by a legal claim on some specific property. FRIEND: Are there any other geneal features I should be aware of? You: Mortgage bonds are a type of Issued by political subdivisions of the U.S. government but are not actually obligations of the U.S. Treasury. Another common feafure of mortqage bonds is that they meaniog that theissuen car retire the bond (by paying you back and ceasing to pay interest payments) at any point before the maturity date. FRIEND: So if the interest rate were to fall and the issuer were able to retire my bond, I would be holding the bond, because if 1 reifivest the money the issuer returns to me, 1 would recelve a off then ir were ta continue interent cate. rou: Fxactly, in such a case, the issuer would pay you a 105s: but this generilly would not folly compensate vou for yout FRIEND: Gotit. Thanks for your helpi higher/lower

senior/junior

are/are not

agency/municiple

are noncallable/carry a deferred call/are freely callable

better/worse

higher/lower

call premium/call fee/recall fee/ repayment premium

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started