Answered step by step

Verified Expert Solution

Question

1 Approved Answer

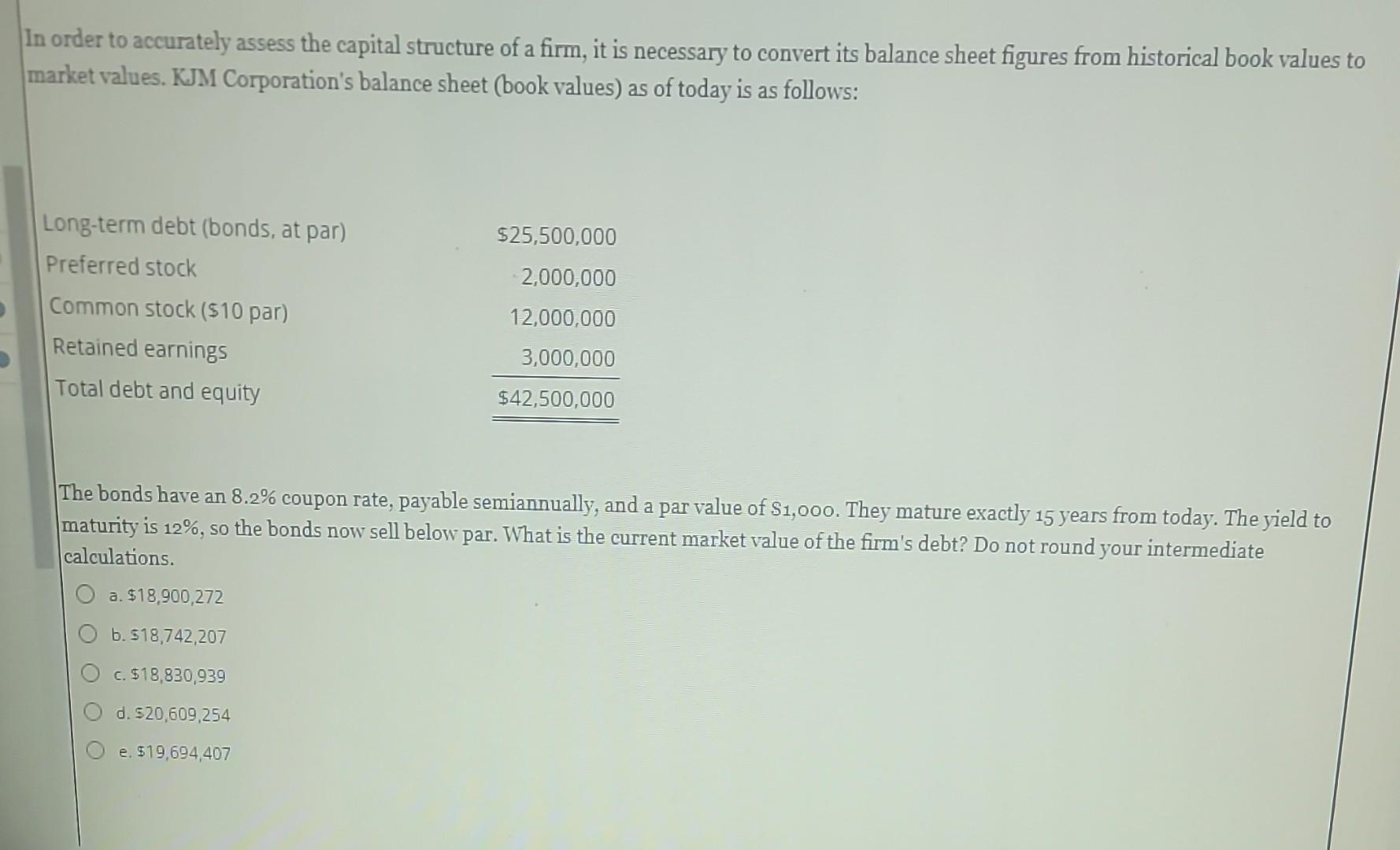

In order to accurately assess the capital structure of a firm, it is necessary to convert its balance sheet figures from historical book values to

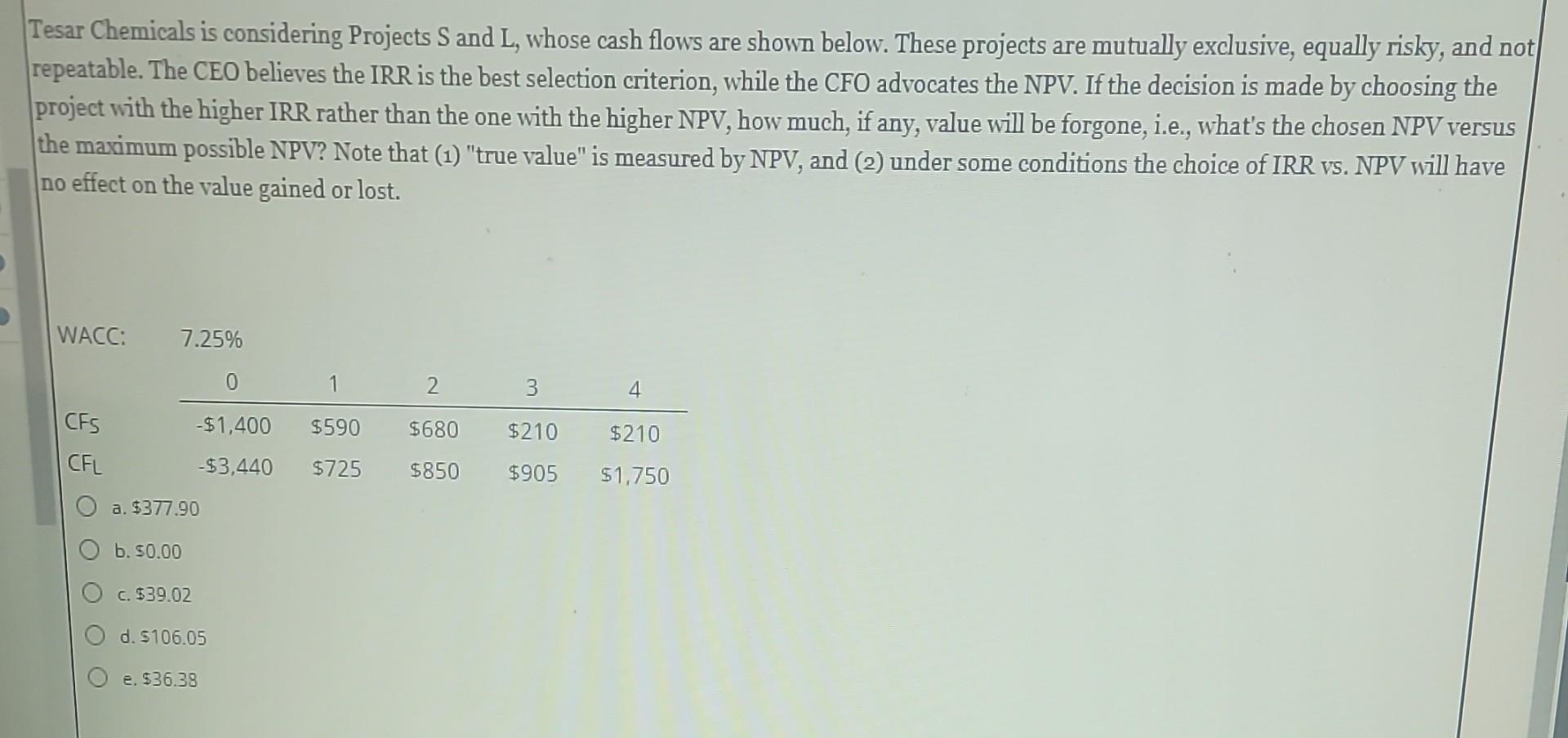

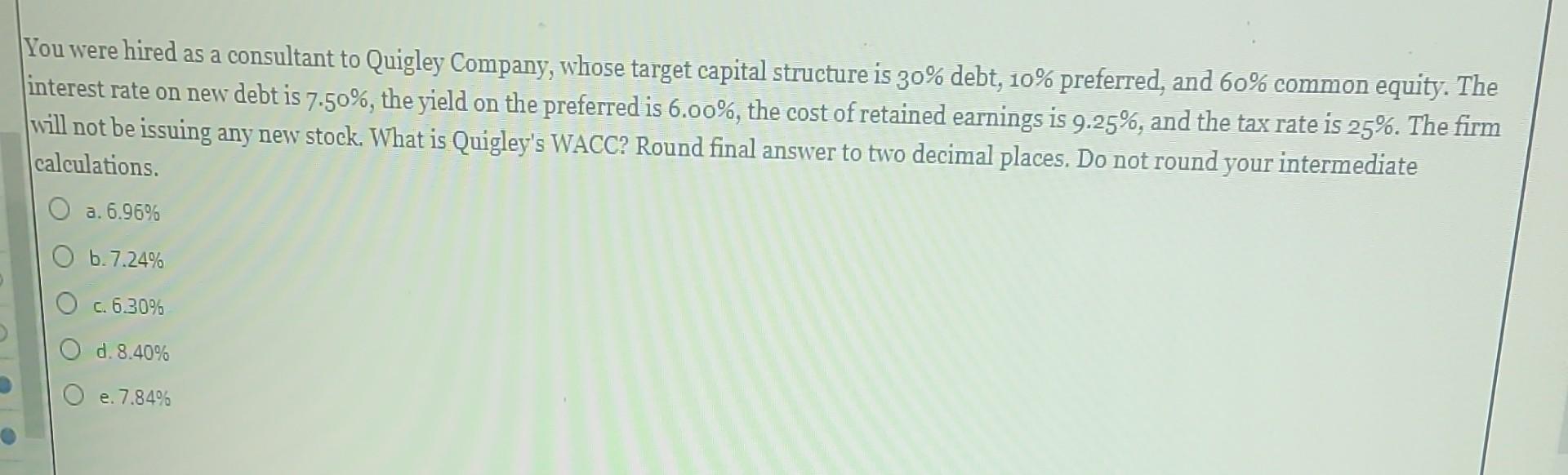

In order to accurately assess the capital structure of a firm, it is necessary to convert its balance sheet figures from historical book values to market values. KJM Corporation's balance sheet (book values) as of today is as follows: The bonds have an 8.2% coupon rate, payable semiannually, and a par value of $1,000. They mature exactly 15 years from today. The yield to maturity is 12%, so the bonds now sell below par. What is the current market value of the firm's debt? Do not round your intermediate calculations. a. $18,900,272 b. 518,742,207 c. $18,830,939 d. $20,609,254 e. $19,694,407 Tesar Chemicals is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates the NPV. If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV, how much, if any, value will be forgone, i.e., what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs. NPV will have no effect on the value gained or lost. WACC: 7.25% a. $377.90 b. 50.00 c. $39.02 d. 5106.05 You were hired as a consultant to Quigley Company, whose target capital structure is 30% debt, 10% preferred, and 60% common equity. The interest rate on new debt is 7.50%, the yield on the preferred is 6.00%, the cost of retained earnings is 9.25%, and the tax rate is 25%. The firm will not be issuing any new stock. What is Quigley's WACC? Round final answer to two decimal places. Do not round your intermediate calculations. a. 6.96% b. 7.24% c. 6.30% d. 8.40% e. 7.84%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started