In order to answer the question above you will need the data from the previous question. The previous question and answer are below:

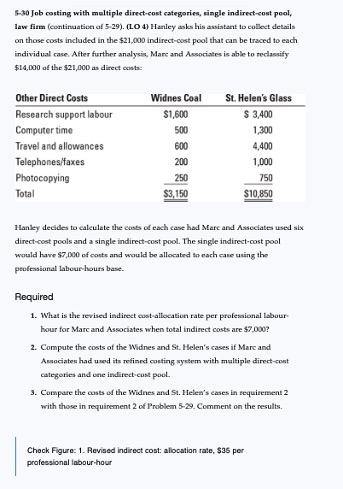

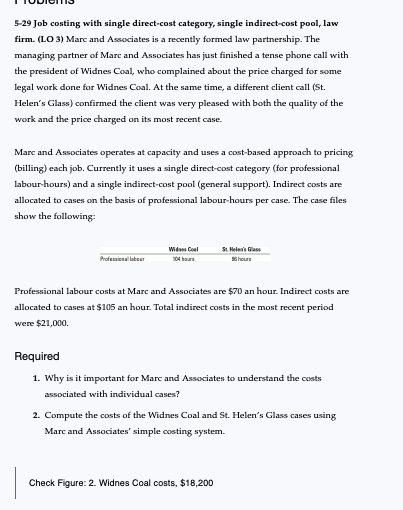

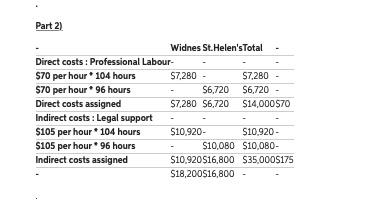

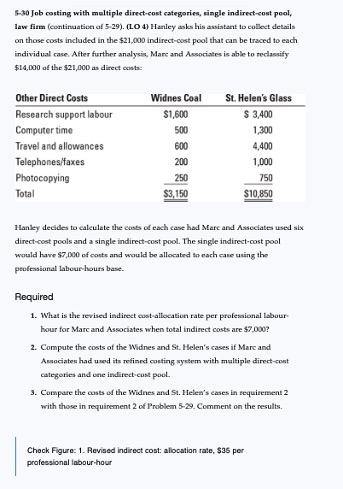

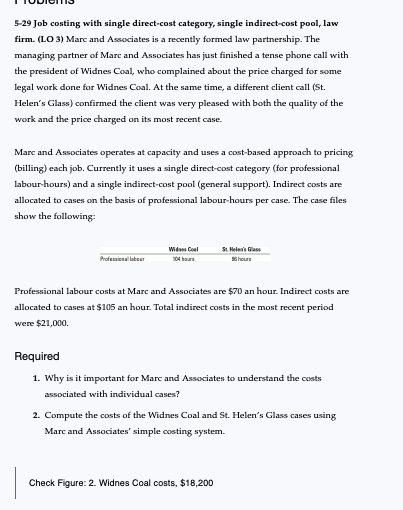

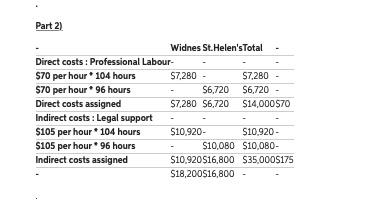

F-30 Job costing with meltiple direct-cost eategories, siagle indirect-cost peol. lave fiam (continaation al 5.29). (LO 4) Marley asks his assiatant to calect delails on those costs included in the $21,000 indirect-cost pool that can be traced to each individual case. After further analyeis, Mare and Avsoriates is able to reclasuify \$14,000 of the \$21,000 as direct ecista: 1hanley decides to caleulate the cass of each case had Marc and Assceiates used six direct-cost pools and a single indirect-cost pool. The single indirect-cost pool would have 57,DCO ef eots and wauld be allocated to each case uning the peufersanal labeuc-hours base. Required 1. What is the serised ind irect custallocation rate per profesaional labourhour for Marc and Associates when total indirect costs are $7,000? 2. Compute the costs of the Whdnes and St. Helen's cases if Mare and Aesaciates had uned its retined coeting syetem with maltiple direct-cont caterones and one indirect cust pool. 3. Compare the custs of the Widnes and St. Helea's cases in equaizenent 2 with those in requirement 2 of Problem 520. Comment on the results, Chack Figure: 1. Revised indirect cost: alocation rate, $35 per professional inbour thour 5-29 Job costing with single direct-cost category, single indirect-cost pool, law firm. (LO 3) Marc and Associates is a recently formed law partnership. The managing partner of Marc and Associates has just finished a tense phone call with the president of Widnes Coal, who complained about the price charged for some legal work done for Widnes Coal. At the same time, a different client call (St. Helen's Glass) confirmed the client was very pleased with both the quality of the work and the price charged on its most recent case. Marc and Associates operates at capacity and uses a cost-based approach to pricing (billing) each job. Currently it uses a single direct-cost category (for professional labour-hours) and a single indirect-cost pool (general support). Indirect costs are allocated to cases on the basis of profensional labour-hours per case. The case files show the following: Professional labour costs at Marc and Associates are $70 an hour. Indirect costs are allocated to cases at $105 an hour. Total indirect costs in the most recent period were $21,000. Required 1. Why is it important for Mare and Associates to understand the costs associated with individual cases? 2. Compute the costs of the Widnes Coal and St. Helen's Glass cases using Marc and Associates' simple costing system. Part 21. F-30 Job costing with meltiple direct-cost eategories, siagle indirect-cost peol. lave fiam (continaation al 5.29). (LO 4) Marley asks his assiatant to calect delails on those costs included in the $21,000 indirect-cost pool that can be traced to each individual case. After further analyeis, Mare and Avsoriates is able to reclasuify \$14,000 of the \$21,000 as direct ecista: 1hanley decides to caleulate the cass of each case had Marc and Assceiates used six direct-cost pools and a single indirect-cost pool. The single indirect-cost pool would have 57,DCO ef eots and wauld be allocated to each case uning the peufersanal labeuc-hours base. Required 1. What is the serised ind irect custallocation rate per profesaional labourhour for Marc and Associates when total indirect costs are $7,000? 2. Compute the costs of the Whdnes and St. Helen's cases if Mare and Aesaciates had uned its retined coeting syetem with maltiple direct-cont caterones and one indirect cust pool. 3. Compare the custs of the Widnes and St. Helea's cases in equaizenent 2 with those in requirement 2 of Problem 520. Comment on the results, Chack Figure: 1. Revised indirect cost: alocation rate, $35 per professional inbour thour 5-29 Job costing with single direct-cost category, single indirect-cost pool, law firm. (LO 3) Marc and Associates is a recently formed law partnership. The managing partner of Marc and Associates has just finished a tense phone call with the president of Widnes Coal, who complained about the price charged for some legal work done for Widnes Coal. At the same time, a different client call (St. Helen's Glass) confirmed the client was very pleased with both the quality of the work and the price charged on its most recent case. Marc and Associates operates at capacity and uses a cost-based approach to pricing (billing) each job. Currently it uses a single direct-cost category (for professional labour-hours) and a single indirect-cost pool (general support). Indirect costs are allocated to cases on the basis of profensional labour-hours per case. The case files show the following: Professional labour costs at Marc and Associates are $70 an hour. Indirect costs are allocated to cases at $105 an hour. Total indirect costs in the most recent period were $21,000. Required 1. Why is it important for Mare and Associates to understand the costs associated with individual cases? 2. Compute the costs of the Widnes Coal and St. Helen's Glass cases using Marc and Associates' simple costing system. Part 21