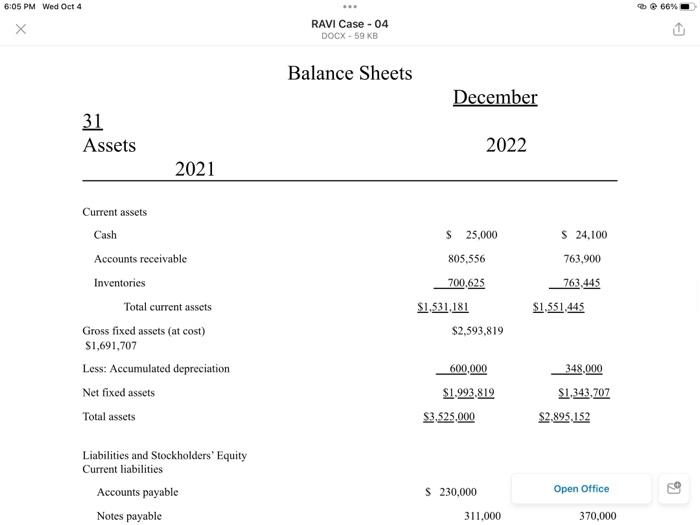

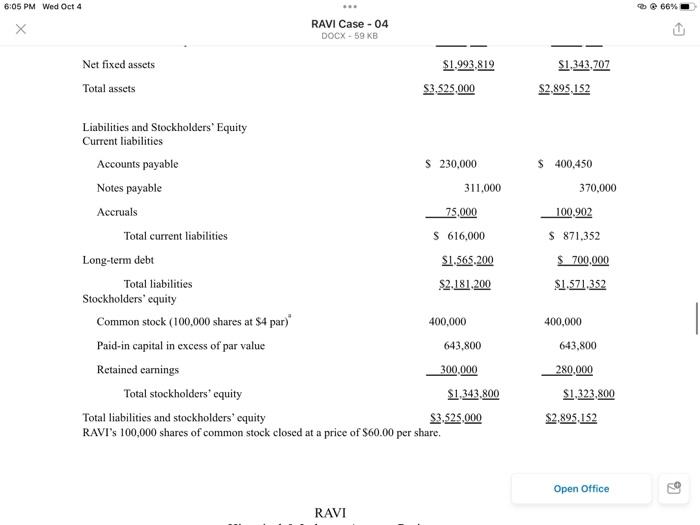

In order to bring you up to speed with RAVI's current situation, you have been asked to assess RAVI's financial performance during 2022 and its financial position at year-end 2022. To complete this assignment, you have gathered the firm's 2022 financial statements (below). In addition, your assistant obtained the firm's ratio values for 2020 and 2021, along with the 2022 industry average ratios. During the year, lease payments were $10,000, while sinking fund payments were $15,000.

To Do:

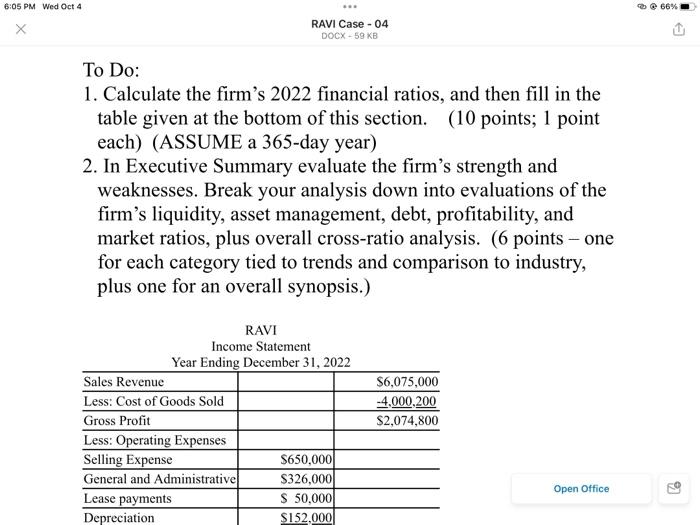

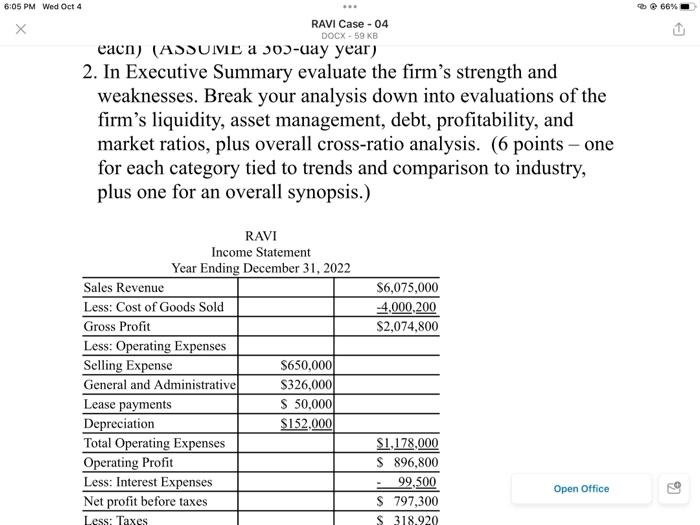

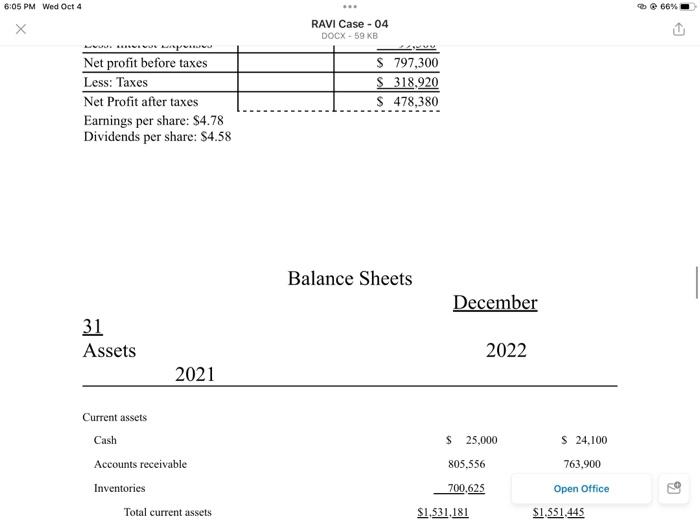

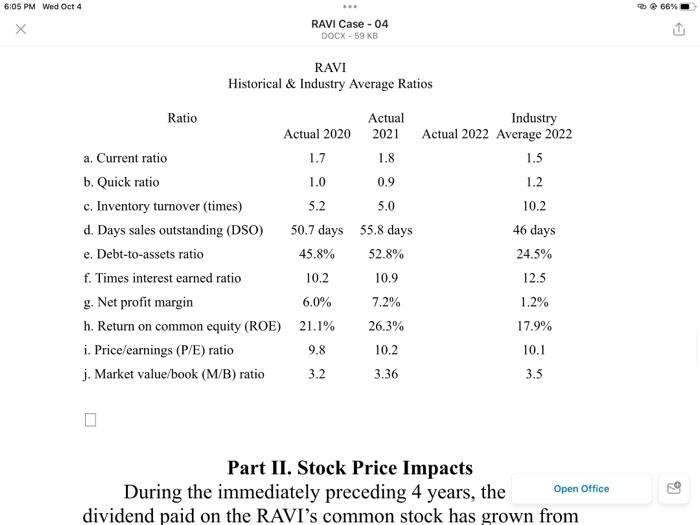

- Calculate the firm's 2022 financial ratios, and then fill in the table given at the bottom of this section. (10 points; 1 point each) (ASSUME a 365-day year)

- In Executive Summary evaluate the firm's strength and weaknesses. Break your analysis down into evaluations of the firm's liquidity, asset management, debt, profitabile market ratios, plus overall cross-ratio analysis.

RAVI Case - 04 DOCX 59XE Balance Sheets December Assets31 2022 2021 \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Current assets } \\ \hline Cash & \$ 25,000 & S 24,100 \\ \hline Accounts receivable & 805,556 & 763,900 \\ \hline Inventories & 700,625 & 763,445 \\ \hline Total current assets & $1,531,181 & $1.551.445 \\ \hline Grossfixedassets(atcost)$1,691,707 & $2,593,819 & \\ \hline Less: Accumulated depreciation & 600,000 & 348,000 \\ \hline Net fixed assets & $1,993,819 & $1,343,707 \\ \hline Total assets & $3,525,000 & $2,895,152 \\ \hline \end{tabular} Liabilities and Stockholders' Equity Current liabilities Accounts payable \$ 230,000 Open Office Notes payable 311,000 370,000 6 6:05 PM Wed Oct 4 RAVI Case -04 DOCX -59 KB Net fixed assets Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Notes payable Accruals Total current liabilities Long-term debt Total liabilities Stockholders' equity Common stock ( (100,000 shares at \$4 par) 7 Paid-in capital in excess of par value Retained earnings Total stockholders' equity Total liabilities and stockholders' equity RAVI's 100,000 shares of common stock closed at a price of $60.00 per share. $1,993,819 \( \lcm{\$ 3}, \underline{525}, \underline{000} \) \$ 230,000 311,000 75,000 \$ 616,000 \$1 .565.200 $2.181.200 400,000 643,800 300,000 $1,343,800 $3,525,000 \$1 ,343,707 $2,895,152 66% RAVI Historical \& Industry Average Ratios Part II. Stock Price Impacts During the immediately preceding 4 years, the dividend paid on the RAVI's common stock has grown from Part I. Financial Statement Analysis In order to bring you up to speed with RAVI's current situation, you have been asked to assess RAVI's financial performance during 2022 and its financial position at year-end 2022. To complete this assignment, you have gathered the firm's 2022 financial statements (below). In addition, your assistant obtained the firm's ratio values for 2020 and 2021, along with the 2022 industry average ratios. During the year, lease payments were $10,000, while sinking fund payments were $15,000. To Do: 1. Calculate the firm's 2022 financial ratios, and then fill in the table given at the bottom of this section. (10 points; 1 point each) (ASSUME a 365-day year) 2. In Executive Summary evaluate the firm's strength and weaknesses. Break your analysis down into evaluations of the firm's liquidity, asset management, debt, profitabil open office market ratios, plus overall cross-ratio analysis. ( 6 points - one 6:05 PM Wed Oct 4 RAVI Case - 04 Earnings per share: $4.78 Dividends per share: $4.58 Balance Sheets December Assets31 2022 2021 Current assets Cash Accounts receivable Inventories Total current assets $25,000 805,556 700,625 $1,531,181 S 24,100 763,900 Open Office $1.,51,445 2. In Executive Summary evaluate the firm's strength and weaknesses. Break your analysis down into evaluations of the firm's liquidity, asset management, debt, profitability, and market ratios, plus overall cross-ratio analysis. (6 points - one for each category tied to trends and comparison to industry, plus one for an overall synopsis.) RAVI Income Statement Year Fndino Decemher 31,907 ? To Do: 1. Calculate the firm's 2022 financial ratios, and then fill in the table given at the bottom of this section. (10 points; 1 point each) (ASSUME a 365-day year) 2. In Executive Summary evaluate the firm's strength and weaknesses. Break your analysis down into evaluations of the firm's liquidity, asset management, debt, profitability, and market ratios, plus overall cross-ratio analysis. (6 points - one for each category tied to trends and comparison to industry, plus one for an overall synopsis.) RAVI Income Statement Year Ending December 31. 2022