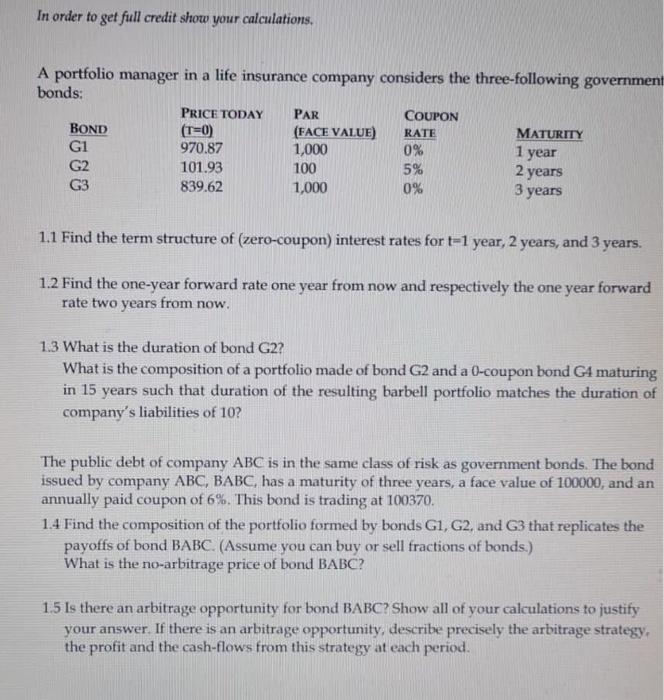

In order to get full credit show your calculations, A portfolio manager in a life insurance company considers the three-following government bonds: PRICE TODAY PAR COUPON BOND (T=0) (FACE VALUE) MATURITY G1 970.87 1,000 0% G2 101.93 100 5% 839.62 1,000 3 years RATE 1 year 2 years 0% 1.1 Find the term structure of (zero-coupon) interest rates for t-1 year, 2 years, and 3 years. 1.2 Find the one-year forward rate one year from now and respectively the one year forward rate two years from now. 1.3 What is the duration of bond G2? What is the composition of a portfolio made of bond G2 and a 0-coupon bond G4 maturing in 15 years such that duration of the resulting barbell portfolio matches the duration of company's liabilities of 10? The public debt of company ABC is in the same class of risk as government bonds. The bond issued by company ABC, BABC, has a maturity of three years, a face value of 100000, and an annually paid coupon of 6%. This bond is trading at 100370. 1.4 Find the composition of the portfolio formed by bonds G1, G2, and G3 that replicates the payoffs of bond BABC. (Assume you can buy or sell fractions of bonds.) What is the no-arbitrage price of bond BABC? 1.5 Is there an arbitrage opportunity for bond BABC? Show all of your calculations to justify your answer. If there is an arbitrage opportunity, describe precisely the arbitrage strategy, the profit and the cash-flows from this strategy at each period. In order to get full credit show your calculations, A portfolio manager in a life insurance company considers the three-following government bonds: PRICE TODAY PAR COUPON BOND (T=0) (FACE VALUE) MATURITY G1 970.87 1,000 0% G2 101.93 100 5% 839.62 1,000 3 years RATE 1 year 2 years 0% 1.1 Find the term structure of (zero-coupon) interest rates for t-1 year, 2 years, and 3 years. 1.2 Find the one-year forward rate one year from now and respectively the one year forward rate two years from now. 1.3 What is the duration of bond G2? What is the composition of a portfolio made of bond G2 and a 0-coupon bond G4 maturing in 15 years such that duration of the resulting barbell portfolio matches the duration of company's liabilities of 10? The public debt of company ABC is in the same class of risk as government bonds. The bond issued by company ABC, BABC, has a maturity of three years, a face value of 100000, and an annually paid coupon of 6%. This bond is trading at 100370. 1.4 Find the composition of the portfolio formed by bonds G1, G2, and G3 that replicates the payoffs of bond BABC. (Assume you can buy or sell fractions of bonds.) What is the no-arbitrage price of bond BABC? 1.5 Is there an arbitrage opportunity for bond BABC? Show all of your calculations to justify your answer. If there is an arbitrage opportunity, describe precisely the arbitrage strategy, the profit and the cash-flows from this strategy at each period