Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In order to obtain the electric company car, rather than a cheaper petrol car, Bella was required to make a capital contribution of 8,400 towards

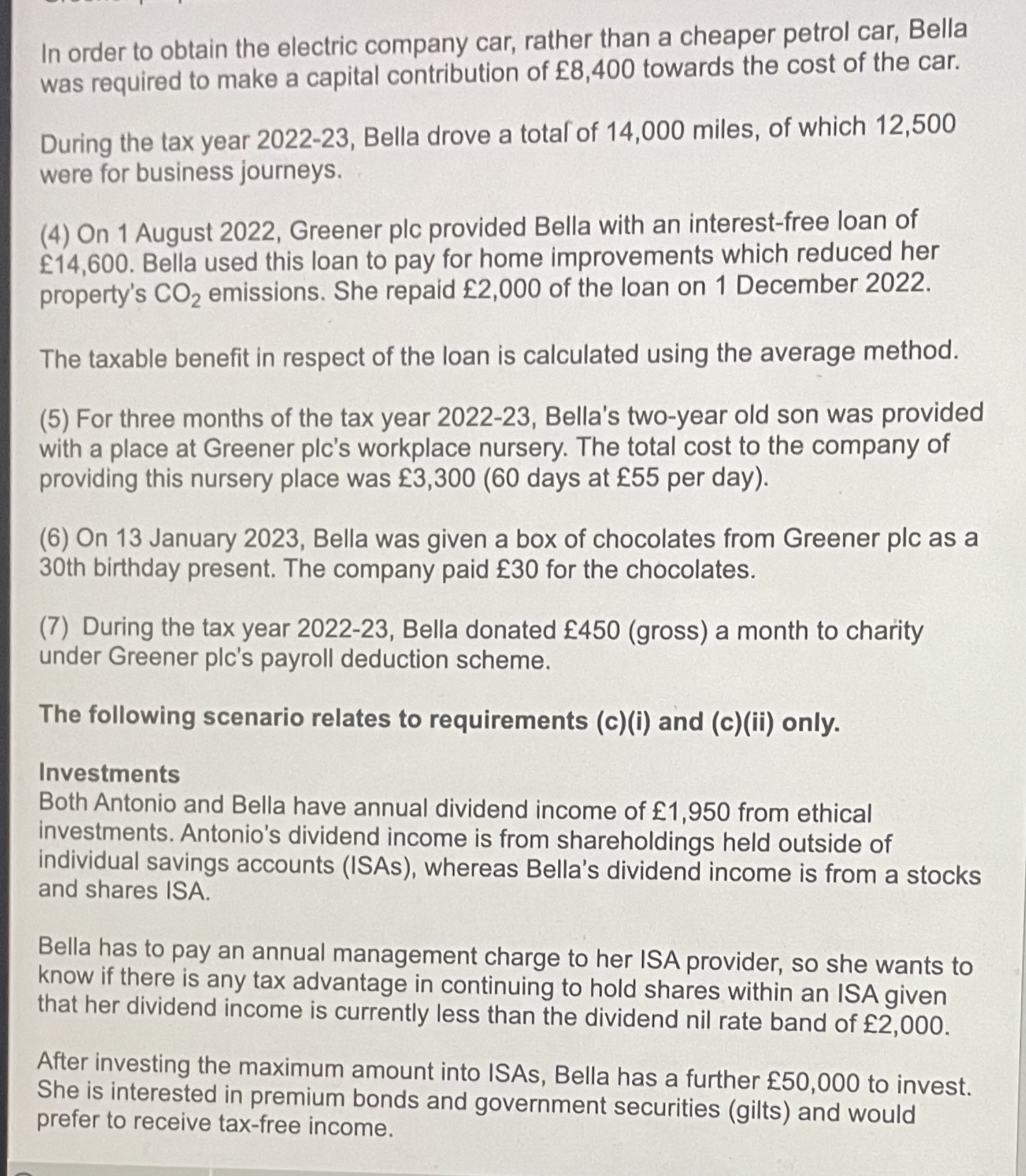

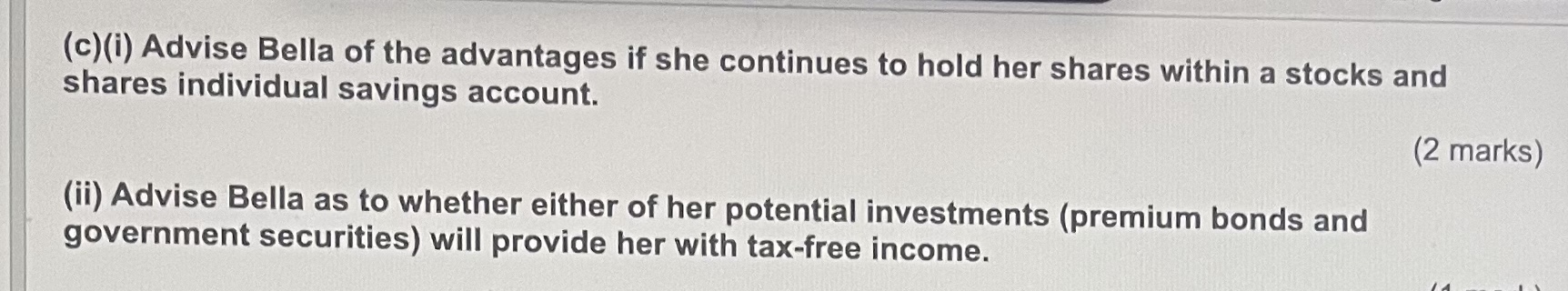

In order to obtain the electric company car, rather than a cheaper petrol car, Bella was required to make a capital contribution of 8,400 towards the cost of the car. During the tax year 2022-23, Bella drove a total of 14,000 miles, of which 12,500 were for business journeys. (4) On 1 August 2022, Greener plc provided Bella with an interest-free loan of 14,600. Bella used this loan to pay for home improvements which reduced her property's CO2 emissions. She repaid 2,000 of the loan on 1 December 2022. The taxable benefit in respect of the loan is calculated using the average method. (5) For three months of the tax year 2022-23, Bella's two-year old son was provided with a place at Greener plc's workplace nursery. The total cost to the company of providing this nursery place was 3,300 (60 days at 55 per day). (6) On 13 January 2023, Bella was given a box of chocolates from Greener plc as a 30 th birthday present. The company paid 30 for the chocolates. (7) During the tax year 2022-23, Bella donated 450 (gross) a month to charity under Greener plc's payroll deduction scheme. The following scenario relates to requirements (c)(i) and (c)(ii) only. Investments Both Antonio and Bella have annual dividend income of 1,950 from ethical investments. Antonio's dividend income is from shareholdings held outside of individual savings accounts (ISAs), whereas Bella's dividend income is from a stocks and shares ISA. Bella has to pay an annual management charge to her ISA provider, so she wants to know if there is any tax advantage in continuing to hold shares within an ISA given that her dividend income is currently less than the dividend nil rate band of 2,000. After investing the maximum amount into ISAs, Bella has a further 50,000 to invest. She is interested in premium bonds and government securities (gilts) and would prefer to receive tax-free income. (c)(i) Advise Bella of the advantages if she continues to hold her shares within a stocks and shares individual savings account. (2 marks) (ii) Advise Bella as to whether either of her potential investments (premium bonds and government securities) will provide her with tax-free income. In order to obtain the electric company car, rather than a cheaper petrol car, Bella was required to make a capital contribution of 8,400 towards the cost of the car. During the tax year 2022-23, Bella drove a total of 14,000 miles, of which 12,500 were for business journeys. (4) On 1 August 2022, Greener plc provided Bella with an interest-free loan of 14,600. Bella used this loan to pay for home improvements which reduced her property's CO2 emissions. She repaid 2,000 of the loan on 1 December 2022. The taxable benefit in respect of the loan is calculated using the average method. (5) For three months of the tax year 2022-23, Bella's two-year old son was provided with a place at Greener plc's workplace nursery. The total cost to the company of providing this nursery place was 3,300 (60 days at 55 per day). (6) On 13 January 2023, Bella was given a box of chocolates from Greener plc as a 30 th birthday present. The company paid 30 for the chocolates. (7) During the tax year 2022-23, Bella donated 450 (gross) a month to charity under Greener plc's payroll deduction scheme. The following scenario relates to requirements (c)(i) and (c)(ii) only. Investments Both Antonio and Bella have annual dividend income of 1,950 from ethical investments. Antonio's dividend income is from shareholdings held outside of individual savings accounts (ISAs), whereas Bella's dividend income is from a stocks and shares ISA. Bella has to pay an annual management charge to her ISA provider, so she wants to know if there is any tax advantage in continuing to hold shares within an ISA given that her dividend income is currently less than the dividend nil rate band of 2,000. After investing the maximum amount into ISAs, Bella has a further 50,000 to invest. She is interested in premium bonds and government securities (gilts) and would prefer to receive tax-free income. (c)(i) Advise Bella of the advantages if she continues to hold her shares within a stocks and shares individual savings account. (2 marks) (ii) Advise Bella as to whether either of her potential investments (premium bonds and government securities) will provide her with tax-free income

In order to obtain the electric company car, rather than a cheaper petrol car, Bella was required to make a capital contribution of 8,400 towards the cost of the car. During the tax year 2022-23, Bella drove a total of 14,000 miles, of which 12,500 were for business journeys. (4) On 1 August 2022, Greener plc provided Bella with an interest-free loan of 14,600. Bella used this loan to pay for home improvements which reduced her property's CO2 emissions. She repaid 2,000 of the loan on 1 December 2022. The taxable benefit in respect of the loan is calculated using the average method. (5) For three months of the tax year 2022-23, Bella's two-year old son was provided with a place at Greener plc's workplace nursery. The total cost to the company of providing this nursery place was 3,300 (60 days at 55 per day). (6) On 13 January 2023, Bella was given a box of chocolates from Greener plc as a 30 th birthday present. The company paid 30 for the chocolates. (7) During the tax year 2022-23, Bella donated 450 (gross) a month to charity under Greener plc's payroll deduction scheme. The following scenario relates to requirements (c)(i) and (c)(ii) only. Investments Both Antonio and Bella have annual dividend income of 1,950 from ethical investments. Antonio's dividend income is from shareholdings held outside of individual savings accounts (ISAs), whereas Bella's dividend income is from a stocks and shares ISA. Bella has to pay an annual management charge to her ISA provider, so she wants to know if there is any tax advantage in continuing to hold shares within an ISA given that her dividend income is currently less than the dividend nil rate band of 2,000. After investing the maximum amount into ISAs, Bella has a further 50,000 to invest. She is interested in premium bonds and government securities (gilts) and would prefer to receive tax-free income. (c)(i) Advise Bella of the advantages if she continues to hold her shares within a stocks and shares individual savings account. (2 marks) (ii) Advise Bella as to whether either of her potential investments (premium bonds and government securities) will provide her with tax-free income. In order to obtain the electric company car, rather than a cheaper petrol car, Bella was required to make a capital contribution of 8,400 towards the cost of the car. During the tax year 2022-23, Bella drove a total of 14,000 miles, of which 12,500 were for business journeys. (4) On 1 August 2022, Greener plc provided Bella with an interest-free loan of 14,600. Bella used this loan to pay for home improvements which reduced her property's CO2 emissions. She repaid 2,000 of the loan on 1 December 2022. The taxable benefit in respect of the loan is calculated using the average method. (5) For three months of the tax year 2022-23, Bella's two-year old son was provided with a place at Greener plc's workplace nursery. The total cost to the company of providing this nursery place was 3,300 (60 days at 55 per day). (6) On 13 January 2023, Bella was given a box of chocolates from Greener plc as a 30 th birthday present. The company paid 30 for the chocolates. (7) During the tax year 2022-23, Bella donated 450 (gross) a month to charity under Greener plc's payroll deduction scheme. The following scenario relates to requirements (c)(i) and (c)(ii) only. Investments Both Antonio and Bella have annual dividend income of 1,950 from ethical investments. Antonio's dividend income is from shareholdings held outside of individual savings accounts (ISAs), whereas Bella's dividend income is from a stocks and shares ISA. Bella has to pay an annual management charge to her ISA provider, so she wants to know if there is any tax advantage in continuing to hold shares within an ISA given that her dividend income is currently less than the dividend nil rate band of 2,000. After investing the maximum amount into ISAs, Bella has a further 50,000 to invest. She is interested in premium bonds and government securities (gilts) and would prefer to receive tax-free income. (c)(i) Advise Bella of the advantages if she continues to hold her shares within a stocks and shares individual savings account. (2 marks) (ii) Advise Bella as to whether either of her potential investments (premium bonds and government securities) will provide her with tax-free income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started