Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In Part 1 What is the Annual Debt Service in Year 1? In Part 1 What is the Annual Debt Service in Year 4? Your

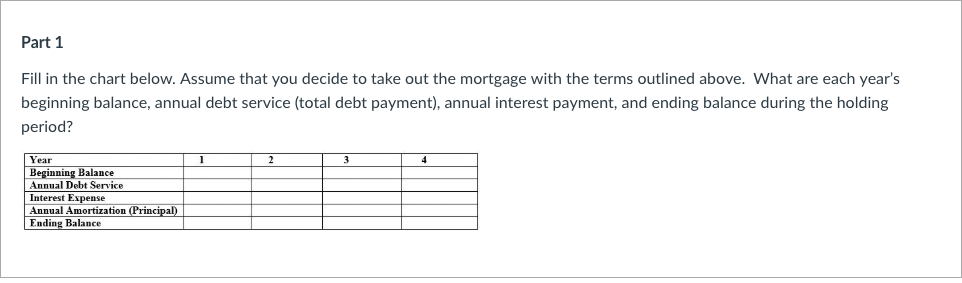

In Part 1

What is the Annual Debt Service in Year 1?

In Part 1

What is the Annual Debt Service in Year 4?

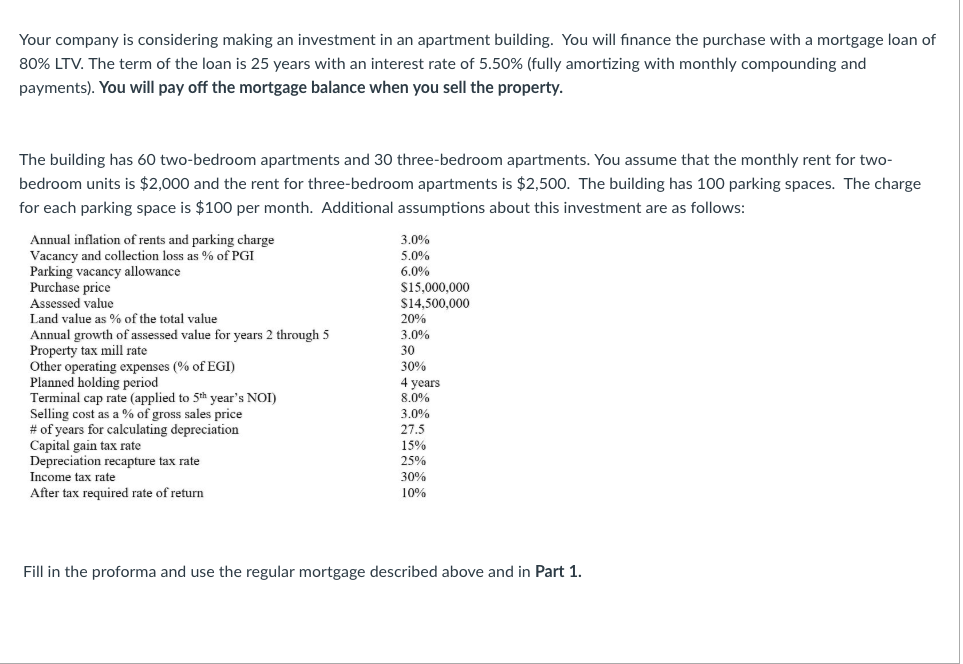

Your company is considering making an investment in an apartment building. You will finance the purchase with a mortgage loan of 80% LTV. The term of the loan is 25 years with an interest rate of 5.50% (fully amortizing with monthly compounding and payments). You will pay off the mortgage balance when you sell the property. The building has 60 two-bedroom apartments and 30 three-bedroom apartments. You assume that the monthly rent for two- bedroom units is $2,000 and the rent for three-bedroom apartments is $2,500. The building has 100 parking spaces. The charge for each parking space is $100 per month. Additional assumptions about this investment are as follows Annual inflation of rents and parking charge Vacancy and collection loss as % of PGI Parking vacancy allowance Purchase price Assessed valuc Land value as % of the total value Annual growth of assessed value for years 2 through 5 Property tax mill rate Other operating expenses of EGI) Planned holding period Terminal cap rate (applied to 5th year's NOI) Selling cost as a % of gross sales price # of years for calculating depreciation Capital gain tax rate Depreciation recapture tax rate Income tax rate After tax required rate of return 3.0% 5.0% 6.0% $15,000,000 S14,500,000 20% 3.0% 30 3090 4 years 8.000 3.0% 27.5 15% 2590 30% 10% Fill in the proforma and use the regular mortgage described above and inStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started