Question

In part A, you will be accounting for a long-term bond issuance. Part A On January 1, 2017, Cheng Inc., issued $200,000 of 8%, 15

In part A, you will be accounting for a long-term bond issuance.

Part A On January 1, 2017, Cheng Inc., issued $200,000 of 8%, 15 year bonds, yielding an effective interest rate of 10%. Semiannual interest is payable on June 30 and December 31. The firm uses effective interest method to amortize any discount or premium.

Required:

1. Determine the issuance price of the bonds and provide the journal entry recorded (impact on the financial statement equation) on January 1, 2017.

2. Prepare the journal entry (impact on the financial statement equation) for the December 31, 2017 interest payment.

3. Determine the interest expense reported on the 2017 income statement.

4. Determine the carrying value of the bonds on the 12/31/2017 balance sheet.

Please also include the journal entry and dont copy and paste from other chegg answers because they are missing the info needed.

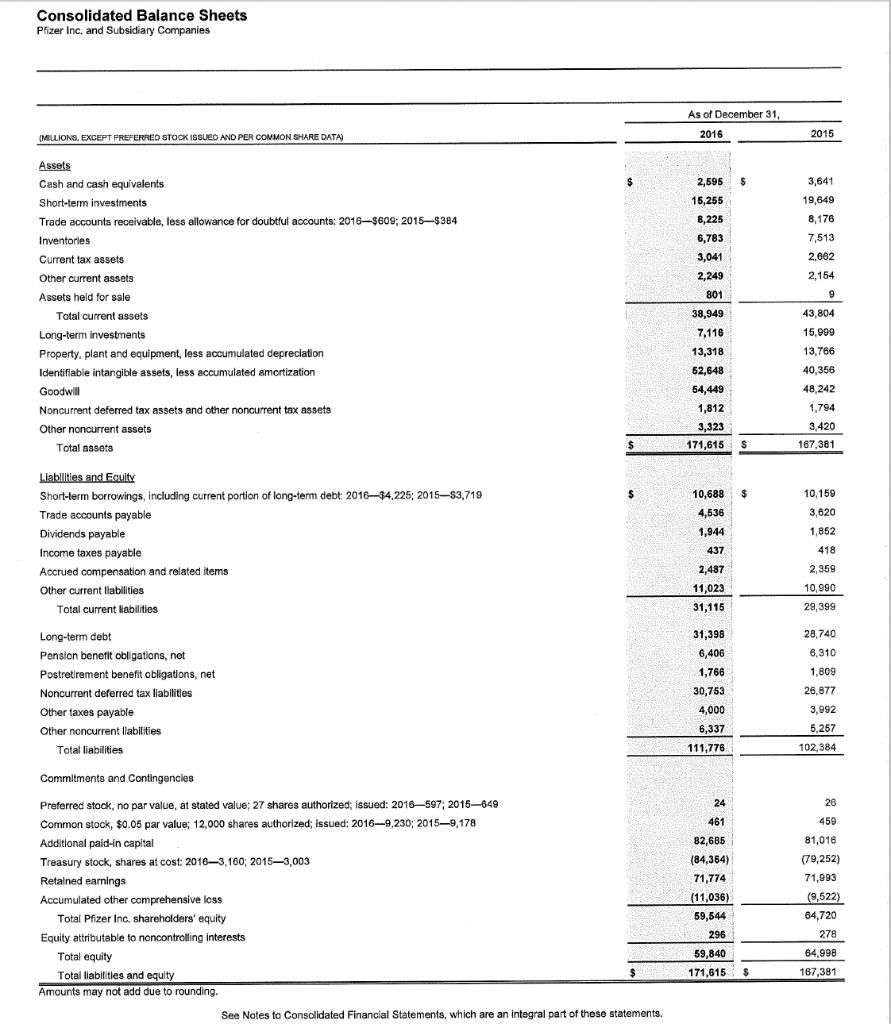

Consolidated Balance Sheets Pfizer Inc, and Subsidiary Companies As of December 31 2016 2015 (MELLIONS, EXCEPT PREFERRED STOCK ISSUED AND PER COMMON SHARE DATA) Assets Cash and cash equivalents $ 2,595 $ 3,641 Short-term investments 15,255 19,649 Trade accounts receivable, less allowance for doubtful accounts: 2016$609; 2015$384 8,225 8,176 Inventories 6,783 7,513 Current tax assets 3,041 2,082 Other current assets 2,249 2,154 Assets held for sale 801 9 Total current assets 38,949 43,804 Long-term investments 7,116 15,999 Property, plant and equipment, less accumulated depreciation 13,318 13.766 52,648 40,356 Identifiable intangible assets, less accumulated amortization Goodwill 54,449 48,242 Noncurrent deferred tax assets and other noncurrent tax assets 1,812 1,794 Other noncurrent assets 3,323 3,420 167.381 Total assets $ 171,615 $ $ 10,688 $ 10,159 Liabilities and Family Short-term borrowings, including current portion of long-term debt: 2016-14,225; 2015-S3,719 Trade accounts payable Dividends payable Income taxes payable 4,636 3,620 1,944 1,852 437 418 Accrued compensation and related items 2,487 2,359 Other current liabilities 11,023 10,990 Total current liabilities 31,115 29,399 Long-term debt 31,398 28.740 Pension benefit obligations, net 6,406 6,310 Postretirement benefit obligations, net 1,809 1,766 30,753 Noncurrent deferred tax liabilities 26,877 Other taxes payable 4,000 3,992 Other noncurrent liabilities 6,337 5,257 Total liabilities 111,776 102,384 Commitments and Contingencles 24 26 461 459 Preferred stock, no par value, at stated value: 27 shares authorized; issued: 2016-597; 2016---649 Common stock, $0.05 par value; 12,000 shares authorized; Issued: 2016-9,230; 20159,178 Additional pald-in capital - Treasury stock, shares at cost 20163,160; 20153,003 82,685 81,016 (84,364) (79,252) 71,774 71,093 Retained earnings Accumulated other comprehensive loss (11,036) (9,522) 64,720 Total Pfizer Inc. shareholders' equity 59,544 296 278 Equity attributable to noncontrolling interests 59,840 64,998 171,615 $ 167,381 Total equity $ Total liabilities and equity Amounts may not add due to rounding. See Notes to Consolidated Financial Statements, which are an integral part of those statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started