Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In Part B, you need to provide a risk management consulting report to a client. In your report, please address the issues faced by the

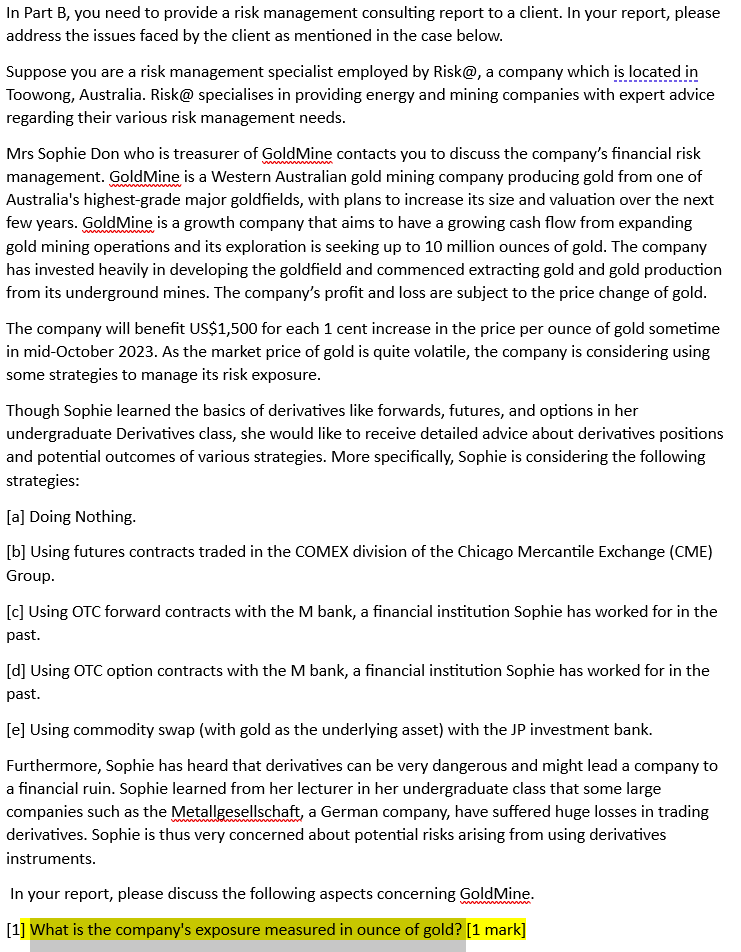

In Part B, you need to provide a risk management consulting report to a client. In your report, please address the issues faced by the client as mentioned in the case below. Suppose you are a risk management specialist employed by Risk@, a company which is located in Toowong, Australia. Risk@ specialises in providing energy and mining companies with expert advice regarding their various risk management needs. Mrs Sophie Don who is treasurer of GoldMine contacts you to discuss the company's financial risk management. GoldMine is a Western Australian gold mining company producing gold from one of Australia's highest-grade major goldfields, with plans to increase its size and valuation over the next few years. GoldMine is a growth company that aims to have a growing cash flow from expanding gold mining operations and its exploration is seeking up to 10 million ounces of gold. The company has invested heavily in developing the goldfield and commenced extracting gold and gold production from its underground mines. The company's profit and loss are subject to the price change of gold. The company will benefit US\$1,500 for each 1 cent increase in the price per ounce of gold sometime in mid-October 2023. As the market price of gold is quite volatile, the company is considering using some strategies to manage its risk exposure. Though Sophie learned the basics of derivatives like forwards, futures, and options in her undergraduate Derivatives class, she would like to receive detailed advice about derivatives positions and potential outcomes of various strategies. More specifically, Sophie is considering the following strategies: [a] Doing Nothing. [b] Using futures contracts traded in the COMEX division of the Chicago Mercantile Exchange (CME) Group. [c] Using OTC forward contracts with the M bank, a financial institution Sophie has worked for in the past. [d] Using OTC option contracts with the M bank, a financial institution Sophie has worked for in the past. [e] Using commodity swap (with gold as the underlying asset) with the JP investment bank. Furthermore, Sophie has heard that derivatives can be very dangerous and might lead a company to a financial ruin. Sophie learned from her lecturer in her undergraduate class that some large companies such as the Metallgesellschaft, a German company, have suffered huge losses in trading derivatives. Sophie is thus very concerned about potential risks arising from using derivatives instruments. In your report, please discuss the following aspects concerning GoldMine. [1] What is the company's exposure measured in ounce of gold? [1 mark]

In Part B, you need to provide a risk management consulting report to a client. In your report, please address the issues faced by the client as mentioned in the case below. Suppose you are a risk management specialist employed by Risk@, a company which is located in Toowong, Australia. Risk@ specialises in providing energy and mining companies with expert advice regarding their various risk management needs. Mrs Sophie Don who is treasurer of GoldMine contacts you to discuss the company's financial risk management. GoldMine is a Western Australian gold mining company producing gold from one of Australia's highest-grade major goldfields, with plans to increase its size and valuation over the next few years. GoldMine is a growth company that aims to have a growing cash flow from expanding gold mining operations and its exploration is seeking up to 10 million ounces of gold. The company has invested heavily in developing the goldfield and commenced extracting gold and gold production from its underground mines. The company's profit and loss are subject to the price change of gold. The company will benefit US\$1,500 for each 1 cent increase in the price per ounce of gold sometime in mid-October 2023. As the market price of gold is quite volatile, the company is considering using some strategies to manage its risk exposure. Though Sophie learned the basics of derivatives like forwards, futures, and options in her undergraduate Derivatives class, she would like to receive detailed advice about derivatives positions and potential outcomes of various strategies. More specifically, Sophie is considering the following strategies: [a] Doing Nothing. [b] Using futures contracts traded in the COMEX division of the Chicago Mercantile Exchange (CME) Group. [c] Using OTC forward contracts with the M bank, a financial institution Sophie has worked for in the past. [d] Using OTC option contracts with the M bank, a financial institution Sophie has worked for in the past. [e] Using commodity swap (with gold as the underlying asset) with the JP investment bank. Furthermore, Sophie has heard that derivatives can be very dangerous and might lead a company to a financial ruin. Sophie learned from her lecturer in her undergraduate class that some large companies such as the Metallgesellschaft, a German company, have suffered huge losses in trading derivatives. Sophie is thus very concerned about potential risks arising from using derivatives instruments. In your report, please discuss the following aspects concerning GoldMine. [1] What is the company's exposure measured in ounce of gold? [1 mark] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started