Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In part (c), you need to take the value as an unknown value and move forward. You will get to the point that the only

In part (c), you need to take the value as an unknown value and move forward. You will get to the point that the only unknown in an equation is the retention rate (R). Solving that equation, you can find the R value. In part (d), I repeat the first part of the question. Part d is:

Calculate the maximum achievable growth rate if the company is allowed to borrow up to $2000 (new debt) but has to pay at least a 20% dividend (maximum retention rate of 80%).

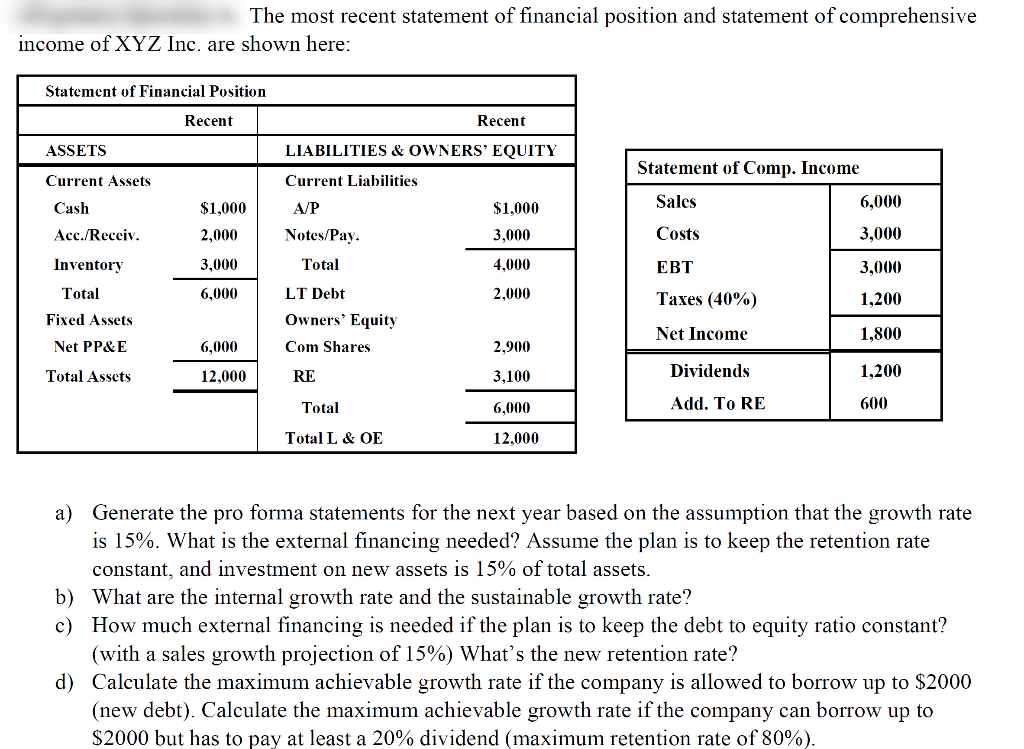

The most recent statement of financial position and statement of comprehensive income of XYZ Inc. are shown here: Statement of Financial Position Recent Recent ASSETS LIABILITIES & OWNERS' EQUITY Statement of Comp. Income Current Assets Current Liabilities Sales 6,000 $1,000 A/P Cash Acc./Receiv. $1.000 3,000 2,000 Costs 3,000 Notes/Pay. Total 3,000 4,000 EBT 3,000 Inventory Total 6,000 2,000 Taxes (40%) 1,200 Fixed Assets LT Debt Owners' Equity Com Shares Net Income 1,800 Net PP&E 6,000 2,900 Total Assets 12,000 RE 3,100 Dividends 1,200 Total 6,000 Add. To RE 600 Total L & OE 12.000 a) Generate the pro forma statements for the next year based on the assumption that the growth rate is 15%. What is the external financing needed? Assume the plan is to keep the retention rate constant, and investment on new assets is 15% of total assets. b) What are the internal growth rate and the sustainable growth rate? c) How much external financing is needed if the plan is to keep the debt to equity ratio constant? (with a sales growth projection of 15%) What's the new retention rate? d) Calculate the maximum achievable growth rate if the company is allowed to borrow up to $2000 (new debt). Calculate the maximum achievable growth rate if the company can borrow up to $2000 but has to pay at least a 20% dividend (maximum retention rate of 80%). The most recent statement of financial position and statement of comprehensive income of XYZ Inc. are shown here: Statement of Financial Position Recent Recent ASSETS LIABILITIES & OWNERS' EQUITY Statement of Comp. Income Current Assets Current Liabilities Sales 6,000 $1,000 A/P Cash Acc./Receiv. $1.000 3,000 2,000 Costs 3,000 Notes/Pay. Total 3,000 4,000 EBT 3,000 Inventory Total 6,000 2,000 Taxes (40%) 1,200 Fixed Assets LT Debt Owners' Equity Com Shares Net Income 1,800 Net PP&E 6,000 2,900 Total Assets 12,000 RE 3,100 Dividends 1,200 Total 6,000 Add. To RE 600 Total L & OE 12.000 a) Generate the pro forma statements for the next year based on the assumption that the growth rate is 15%. What is the external financing needed? Assume the plan is to keep the retention rate constant, and investment on new assets is 15% of total assets. b) What are the internal growth rate and the sustainable growth rate? c) How much external financing is needed if the plan is to keep the debt to equity ratio constant? (with a sales growth projection of 15%) What's the new retention rate? d) Calculate the maximum achievable growth rate if the company is allowed to borrow up to $2000 (new debt). Calculate the maximum achievable growth rate if the company can borrow up to $2000 but has to pay at least a 20% dividend (maximum retention rate of 80%)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started