In Parts IV, V, and VI of this case study, you were asked to apply concepts we have discussed in previous chapters related to the

In Parts IV, V, and VI of this case study, you were asked to apply concepts we have discussed in previous chapters related to the sales and collection cycle to the acquisition and cash disbursement cycle. Parts IV, V, and VI dealt with obtaining an understanding of internal control and assessing control risk for transactions affecting accounts payable of Pinnacle Manufacturing. In Part VII, you will design substantive analytical procedures and design and perform tests of details of balances for accounts payable.

Assume that your understanding of internal controls over acquisitions and cash disbursements and the related tests of controls and substantive tests of transactions support an assessment of low control risk. The listing of the 519 accounts making up the accounts payable balance of $12,969,686 at December 31, 2016, is available online.

Required

List those relationships, ratios, and trends that you believe will provide useful information about the overall reasonableness of accounts payable. You should consider income statement accounts that affect accounts payable in selecting the analytical procedures.

| Balance-Related Audit Objective | Common Tests of Details of Balances Procedures | Comments |

|---|---|---|

| Accounts payable in the accounts payable list agree with related master file, and the total is correctly added and agrees with the general ledger (detail tie-in). | Re-add or use the computer to total the accounts payable list. Trace the total to the general ledger. Trace individual vendor’s invoices to master file for names and amounts. | All pages need not ordinarily be footed if footing manually. Unless controls are deficient, tracing to master file should be limited. |

| Accounts payable in the accounts payable list exist (existence). | Trace from accounts payable list to vendors’ invoices and statements. Confirm accounts payable, emphasizing large and unusual amounts. | Ordinarily receives little attention because the primary concern is with understatements. |

| Existing accounts payable are included in the accounts payable list (completeness). | Perform out-of-period liability tests (see discussion). | These are essential audit tests for accounts payable. |

| Accounts payable in the accounts payable list are accurate (accuracy). | Perform same procedures as those used for existence objective and out-of-period liability tests. | Ordinarily, the emphasis in these procedures for accuracy is understatement rather than omission. |

| Accounts payable in the accounts payable list are correctly classified (classification). | Review the list and master file for related parties, notes or other interest-bearing liabilities, long-term payables, and debit balances. | Knowledge of the client’s business is essential for these tests. |

| Transactions in the acquisition and payment cycle are recorded in the proper period (cutoff). | Perform out-of-period liability tests (see discussion). Perform detailed tests as part of physical observation of inventory (see discussion). Test for inventory in transit (see discussion). | These are essential audit tests for accounts payable. These are called cutoff tests. |

| The company has an obligation to pay the liabilities included in accounts payable (obligations). | Examine vendors’ statements and confirm accounts payable. | Normally not a concern in the audit of accounts payable because all accounts payable are obligations. |

Table 16-5

Test of Details of Balances Audit Program for Hillsburg Hardware Co.—Sales and Collection Cycle (Performance Format)

| 1. Obtain the accounts receivable aged trial balance and trace the balance to the general ledger. |

| 2. Use audit software to foot and cross-foot the aged trial balance. |

| 3. Review aged trial balance for large and unusual receivables. |

| 4. Calculate analytical procedures indicated in carry-forward audit schedules (not included) and follow up on any significant changes from prior years. |

| 5. Review the receivables listed on the aged trial balance for notes and related party receivables. |

| 6. Inquire of management whether there are any related party notes or long-term receivables included in the trial balance. |

| 7. Review the minutes of the board of directors meetings and inquire of management to determine whether any receivables are pledged or factored. |

| 8. Trace 10 accounts from the aged trial balance to the accounts receivable master file to test for correctness of aging and the balance. |

| 9. Trace five accounts from the accounts receivable master file to the aged trial balance. |

| 10. Confirm accounts receivable, using positive confirmations. Confirm all amounts over $100,000 and select a statistical sample using audit software for the remaining accounts. |

| 11. Perform alternative procedures for all confirmations not returned on the first or second request. |

| 12. Discuss with the credit manager the likelihood of collecting older accounts. Examine subsequent cash receipts and the credit file on all larger accounts over 90 days and evaluate whether the receivables are collected. |

| 13. Evaluate whether the allowance is adequate after performing other audit procedures for collectibility of receivables. |

| 14. Select the last 20 sales transactions from the current year’s sales journal and the first 20 from the subsequent year’s and trace each to the related shipping documents, checking for the date of actual shipment and the correct recording. |

| 15. Review large sales returns and allowances before and after the balance sheet date to determine whether they are recorded in the correct period. |

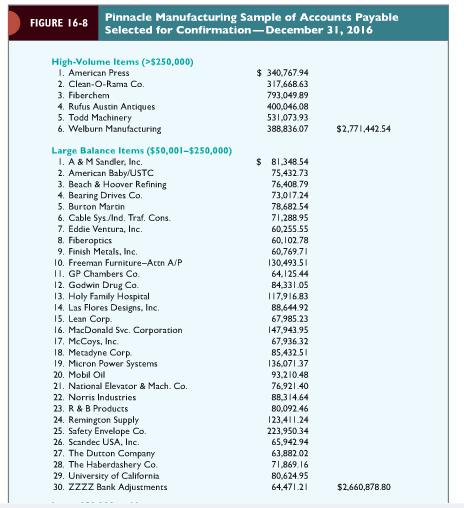

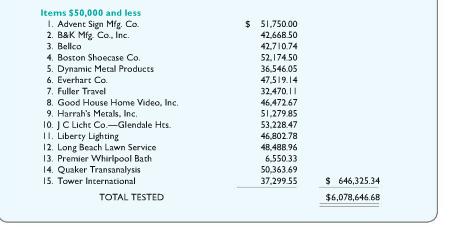

Pinnacle Manufacturing Sample of Accounts Payable Selected for Confirmation-December 31, 2016 FIGURE 16-8 High-Volume Items (>5250,000) 1. American Press 2. Clean-O-Rama Co. 3. Fiberchem 4. Rufus Austin Antiques 5. Todd Machinery 6. Welburn Manufacturing $ 340,767.94 317,668.63 793.049 89 400,046.08 531.073.93 388,836.07 $2,771442.54 Large Balance Items ($50,001-$250,000) 1. A & M Sandler, Inc. 2. American Baby/USTC 3. Beach & Hoover Refining 4. Bearing Drives Co. 5. Burton Martin 6. Cable Sys./Ind. Traf. Cons. 7. Eddie Ventura, Inc. 8. Fiberoptics $ 81.348.54 75,432.73 76,408.79 73,017.24 78,682 54 71.288.95 60,255 55 60, 102.78 60,769.71 9. Finish Metals, Inc. 10. Freeman Furniture-Acen A/P II. GP Chambers Co. 12. Godwin Drug Co. 13. Holy Family Hospital 14. Las Flores Designs, Inc. 15. Lean Corp. 16. MacDonald Sve. Corporation 17. McCoys, Inc. 18. Metadyne Corp. 19. Micron Power Systems 130,493 51 64,125.44 84.331.05 117,916 83 B8,644.92 67.985.23 147,943.95 67,936 32 85,43251 136,071 37 20. Mobil Oil 93.210.48 21. National Elevator & Mach. Co. 76,921.40 22. Norris Industries BB,314.64 23. R& B Products 80.092 46 24. Remington Supply 25. Safety Envelope Co. 26. Scandec USA, Inc. 27. The Dutton Company 28. The Haberdashery Co. 29. University of California 30. ZzzZ Bank Adjustments 123,411.24 223,950 34 65,942.94 63,882.02 71,869 16 B0,624.95 64,471.21 $2660,878.80

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Relationships ratios and trends that can provide useful information about the overall reasonableness of accounts payable include 1 Comparing the accou...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started