Answered step by step

Verified Expert Solution

Question

1 Approved Answer

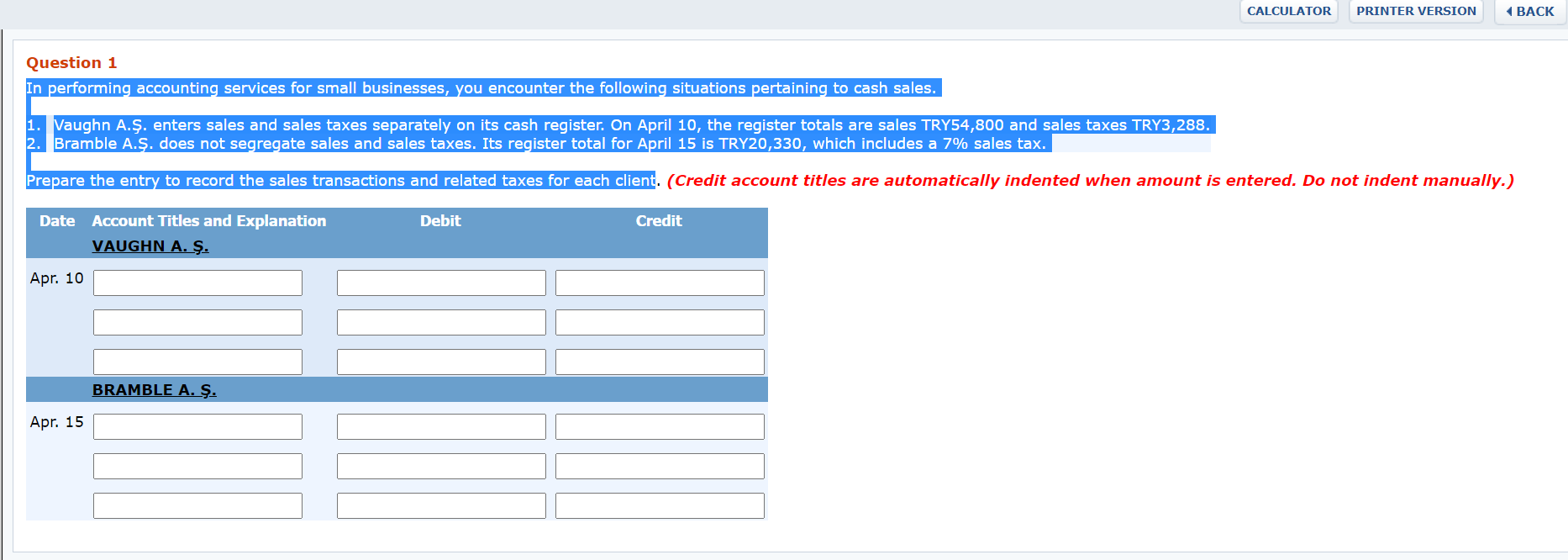

In performing accounting services for small businesses, you encounter the following situations pertaining to cash sales. 1. Vaughn A.. enters sales and sales taxes separately

In performing accounting services for small businesses, you encounter the following situations pertaining to cash sales.

| 1. | Vaughn A.. enters sales and sales taxes separately on its cash register. On April 10, the register totals are sales TRY54,800 and sales taxes TRY3,288. | |

| 2. | Bramble A.. does not segregate sales and sales taxes. Its register total for April 15 is TRY20,330, which includes a 7% sales tax. |

Prepare the entry to record the sales transactions and related taxes for each client

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started